According to Ernest Haskins “Save a little money each month and at the end of the year, you’ll be surprised at how little you have.” Saving money is an important financial skill that can help you achieve long-term stability and reach your financial goals. Whether you’re saving for a rainy day, a major purchase, or retirement, having a structured approach can make a significant difference.

Saving money is essential for financial security and achieving goals. It prepares you for unexpected expenses and significant investments. Whether for emergencies, buying a home, starting a business, or retirement, a disciplined approach ensures readiness.

Effective saving involves clear goals, budgeting, and consistent adherence, managing expenses efficiently, maximizing savings, and reducing reliance on credit or debt.

Importance Of Saving Money

When thinking about why you should save money, focus on how it can impact your life specifically. Research from the American Psychological Association suggests finding a reason to save that fits your personality and priorities, rather than following generic advice. Here are some common reasons to consider.

1. Achieve Life Goals

Saving money is very important for reaching big life goals like buying a home, getting your dream car, or paying for your children’s education. These goals usually need many years of saving money, but it lets you achieve your dreams without stressing about money or borrowing too much.

2. Handle Unexpected Expenses

Not having savings can be stressful when unexpected expenses come up. Whether it’s a small cost like fixing a flat tire or a broken appliance, or a big one like needing a new roof or moving, having savings lets you concentrate on fixing the problem without worrying about money.

Savings are like a safety net that helps you handle surprise bills without borrowing money and paying extra interest. By saving money regularly, you get ready to deal with unexpected problems calmly and keep your finances stable.

3. Reduce Stress

Having savings lets you enjoy life more because you don’t have to constantly worry about paying bills, covering your kids’ activities, or going out with friends. It gives you peace of mind for unexpected costs and planned events, so you can stay relaxed and focused on the moment.

Saving money also helps you build good habits with your finances, making sure you stay stable and feel better overall.

4. Prepare for the Future

Having savings gives you flexibility for the future when things are uncertain. It brings peace of mind and more options in life. Savings act like a safety net for unexpected situations, like emergencies or job changes.

This helps you handle these challenges without needing to borrow money and worry about debt. Being financially prepared like this gives you confidence and makes you feel secure about what’s to come.

5. Career Flexibility

Saving money gives you options in your career, no matter how you feel about your current job. It lets you retire early, work fewer hours, take breaks, or switch jobs when you need to. Having savings is like having a safety net, so you can make these career choices without worrying about money.

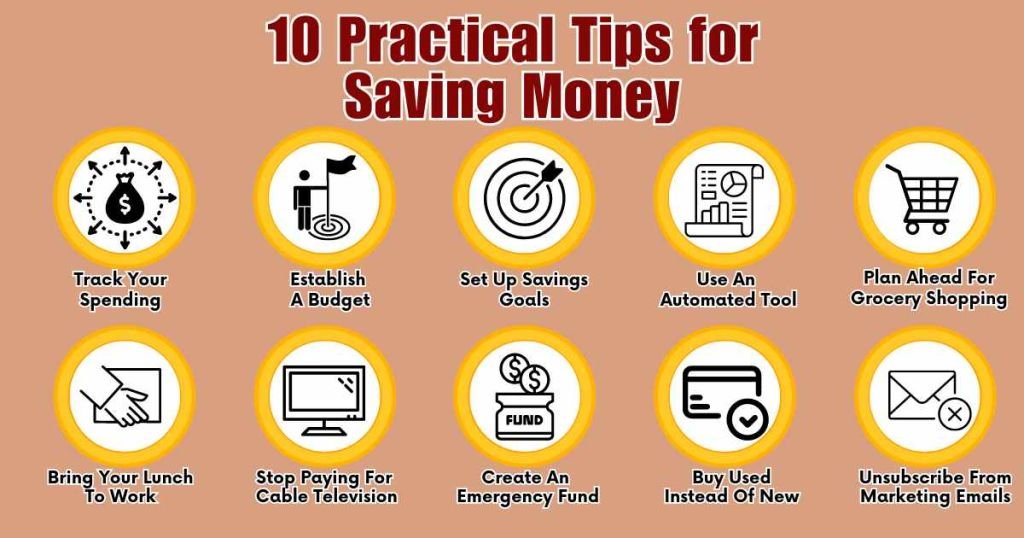

10 Practical Tips for Saving Money

1. Track Your Spending

Credit cards often lead to overspending due to their convenience. It’s simple to swipe the card and lose track of how much you’re spending. This ease of use can cause people to spend more than they would with cash.

A study by the Federal Reserve found that credit card holders tend to overspend by 23% compared to those who use cash. The “pain of paying” is less noticeable with a card swipe, leading to higher spending.

2. Establish A Budget

Creating a budget is a great way to control how you spend money. It doesn’t have to be hard. A budget helps you understand where your money is going, making it easier to identify areas where you can cut back and save. By setting spending limits for different categories, such as groceries, entertainment, and transportation, you can ensure that you live within your means and avoid unnecessary debt.

According to a survey conducted by Mint, about 93% of people who use a budget feel more in control of their money compared to 67% who do not budget.

3. Set Up Savings Goals

Having clear goals, whether they’re big or small, can make saving money simpler. When you know what you’re saving for, like a family trip or gifts, it’s easier to spend less on other things. This clarity allows you to prioritize your spending and make informed financial decisions.

For example, if you’re saving for a vacation, every time you’re tempted to spend on non-essential items, you can remind yourself of the future reward.

4. Use An Automated Tool

A smart way to save money is by using automatic savings tools. You can arrange with your bank to automatically transfer a set amount from your paycheck to your savings before you have a chance to spend it.

You’ll be surprised how quickly you get used to saving this way. Many banks, like Huntington, offer features where you can schedule regular transfers from your checking to your savings account, making saving easier.

5. Plan Ahead For Grocery Shopping

Another easy way to overspend is to shop for groceries without a list. Making a list before you go grocery shopping is one of the best tips to save money. Begin by planning your meals for the week.

Check what you already have in your pantry and fridge, and look for coupons or discounts from loyalty programs. Then, make your shopping list based on what you need. This simple step can help you stick to your budget and avoid unnecessary purchases.

6. Bring Your Lunch To Work

Making your own lunch instead of buying it daily is a smart way to save money. Eating out for lunch is more expensive than cooking at home. It doesn’t have to take a lot of time either; there are many quick recipes on cooking websites and in cookbooks.

Prepare enough food to bring lunch to work all week, and you’ll save a significant amount of money.

7. Stop Paying For Cable Television

Before you panic, consider that many subscription services provide access to a lot of content for a fraction of what you pay for cable TV. It might feel overwhelming initially, but once you switch, you probably won’t want to go back. Your savings will benefit from the change!

8. Create An Emergency Fund

Saving money for unexpected expenses is crucial for financial stability. An emergency fund can cover sudden costs like medical bills, car repairs, or home maintenance without needing to borrow money and pay interest.

This reduces stress and avoids debt. Experts suggest saving three to six months’ worth of living expenses in an easily accessible account to ensure you are prepared for life’s surprises.

9. Buy Used Instead Of New

Another excellent way to save money is by purchasing used items, which can save you money each year. Do you really need a brand-new car, or could you manage with one that’s a few years old? It’s a well-known fact that cars lose value as soon as they’re driven off the lot.

What about furniture? Check out thrift stores, yard sales, and consignment shops before buying new, as you can often find great deals. Research before buying can help you make your money go further and find ways to save.

10. Unsubscribe From Marketing Emails

Avoid the urge to spend money by staying away from things that make you want to shop. For example, limit your time at malls or browsing online stores. Unsubscribe from promotional emails that tempt you with sales and special offers.

Avoid social media pages that showcase products and deals. Instead, focus on activities that don’t involve spending money, like going for a walk, reading a book, or spending time with friends and family. This can help you stick to your savings goals and make better financial choices.

Final Thoughts

Saving money is a continuous process that requires discipline, planning, and regular review. By understanding your financial landscape, implementing practical savings strategies, managing debt effectively, and automating your savings, you can build a robust financial foundation for the future. Start today, and watch your savings grow, bringing you closer to financial security and freedom.

FAQs

What are some easy ways to start saving money?

To save money, first track your spending to find where you can cut back, like dining out less or canceling subscriptions. Set up automatic deposits into a savings account to save regularly. Use cashback or rewards programs when you shop to get money back on things you buy anyway.

How can I save money on groceries and everyday expenses?

To save on groceries and daily expenses, plan your meals ahead and make a shopping list to avoid spontaneous purchases and stay within your budget. Use coupons, store discounts, and loyalty programs to reduce costs on groceries and household items. Choosing generic or store-brand products instead of name brands can save money without sacrificing quality.

What strategies can help me save on utilities and energy bills?

To lower utility bills, use energy-efficient appliances and lights to save electricity. Install programmable thermostats to adjust heating and cooling based on your schedule, which saves energy. Seal gaps and insulate windows to keep heat in during winter and cool air in during summer, reducing the need for a lot of heating or air conditioning.

How can I save money on entertainment and leisure activities?

To save money on entertainment, try free or cheap options like local parks, community events, or discounted museum days. Switching from cable TV to streaming services can also save you money. Look for discounts for students, seniors, or groups when going to movies or concerts. These tips help you manage expenses and save money in different parts of your life.