AI significantly improves how companies handle risks, marking a major shift in Enterprise Risk Management (ERM). AI algorithms continuously monitor for potential risks. They analyze vast amounts of data, identify patterns, and predict future risks, allowing companies to address issues early and minimize emerging problems.

AI automates many tasks, freeing up time for risk managers. This allows them to focus more on planning and proactively preventing issues. Additionally, AI can quickly detect anomalies and alert the company, enhancing the ability to manage risks effectively. This is particularly valuable in today’s uncertain environment, making AI an essential tool for businesses in managing risks.

What is ERM?

Enterprise Risk Management (ERM) is the organized process of planning, overseeing, and controlling a company’s activities to minimize the negative effects of risks on its finances and earnings. This comprehensive approach includes managing financial, strategic, operational, and accidental loss-related risks.

The growing focus on ERM is driven by external factors. Regulatory bodies in industry and government, as well as investors, are closely examining the risk management strategies and practices of businesses. In many sectors, boards of directors are now required to evaluate and report on how effectively their organizations manage risks.

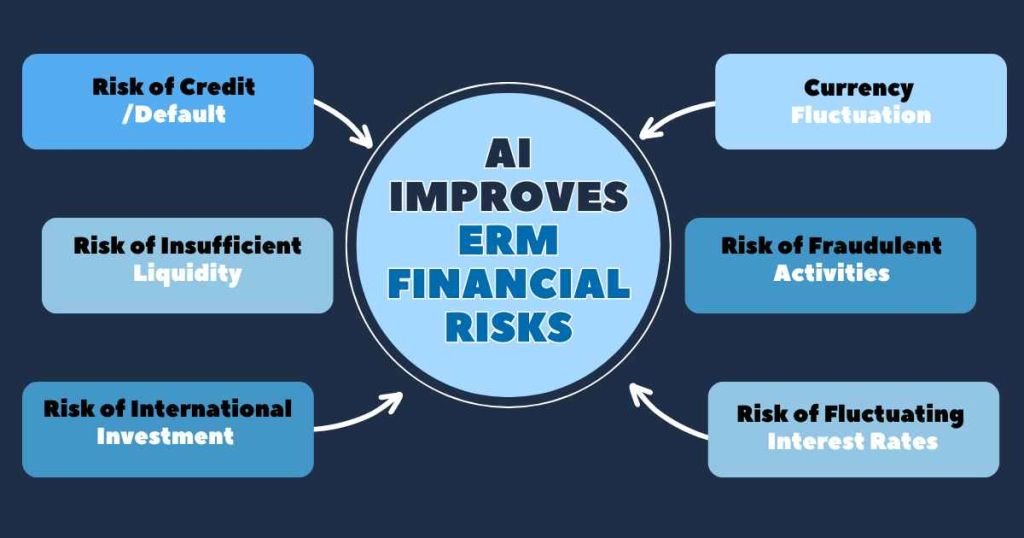

AI Improves ERM Financial Risks

Businesses face a wide range of financial risks. In the next section, we will describe the six most common financial risks and show how businesses effectively manage and reduce their impact. We will also explain how AI is used to enhance the management of financial risks in Enterprise Risk Management (ERM).

1. Risk of Credit/Default

The risk of credit/default involves the chance that borrowers won’t be able to pay back the principal and interest on their loans. AI helps by continuously monitoring in real-time, increasing business alertness and warning when limits are exceeded.

For instance, AI manages borrower’s credit data and detects early financial warning signs, allowing lenders to proactively address credit risks.

Additionally, AI’s predictive analysis can forecast when borrowers might default and assess their risk levels using data. This helps in making loan decisions by evaluating individual risk profiles to determine loan approvals and set interest rates.

AI also automates the monitoring of loan terms, quickly alerting both lenders and borrowers if terms are violated. This AI-driven method enhances risk management by providing timely insights and making informed decisions based on real-time data analysis and predictive modeling.

2. Risk of Insufficient Liquidity

The first part of managing liquidity risk is ensuring businesses have enough cash to pay their bills. The second part, market liquidity risk, happens when a company struggles to sell assets quickly in a volatile or declining market.

AI helps by continuously monitoring and simplifying reports on cash management across bank accounts. It uses both past and present data, along with insights from AI-driven financial planning tools, to predict when a business might need extra financing to manage cash flow risks. AI supports decision-making by providing accurate reports on current and future cash levels.

For example, if a business is considering a purchase, AI can precisely evaluate available funds. This helps in deciding whether to seek external funding, like loans or selling shares. AI enables businesses to make informed decisions that are supported by reliable financial data.

3. Risk of International Investment

AI offers major benefits in various business operations. It’s particularly good at monitoring online reputation and quickly alerting businesses about suspicious transactions or irregularities in financial data. AI also simplifies decision-making, especially concerning foreign investments and their likely results.

By swiftly pinpointing key risks in different countries, AI aids businesses in understanding potential hazards. Predictive models forecast important financial metrics like cash flow and EBITDA. Armed with this information, businesses can make smarter decisions about whether to maintain or withdraw their international operations, leading to more strategic choices.

4. Currency Fluctuation

The risk of running into cash shortages during currency exchange in different countries where a company operates is significant. This problem occurs because of changes in exchange rates, which can cause one currency to lose value against another.

These fluctuations can lead to losses during currency exchanges, as businesses might end up with less money than expected. This affects their financial health and profits. Therefore, businesses need to manage these currency exchange risks effectively to stay financially stable and succeed internationally.

AI plays an important role by keeping track of changes in exchange rates and quickly alerting businesses about important shifts. It also helps in decision-making by predicting potential gains or losses from currency exchanges and by assessing options for currency hedges to ensure accurate outcomes.

5. Risk of Fraudulent Activities

Fraud can appear in different ways but usually involves people or businesses illegally trying to make money in dishonest ways.

AI can look through vast amounts of transaction data to find unusual patterns that may indicate fraud. By identifying potential fraud quickly, businesses can act early to minimize the risk and reduce any financial losses.

6. Risk of Fluctuating Interest Rates

This risk means you might have to pay more interest on your current debts. In early to mid-2022, this became a big problem because many countries raised their lending rates to control inflation. This risk is still a concern today.

AI helps by keeping an eye on interest rates and making reports easier to understand. It quickly warns businesses about changes in interest rates and predicts cost increases. With this information, companies can make smart choices to reduce risks from changing interest rates. They might sell assets to lower debt or change how they get money, like by selling company shares.

Why is Enterprise Risk Management Important?

In recent years, Enterprise Risk Management (ERM) has become more important. This is because the world is getting more complicated, and there’s a need to handle and reduce new risks. Luckily, artificial intelligence (AI) can help businesses deal with these new risks better. AI does this by automating difficult tasks, making things more accurate, and giving useful insights for better decisions.

An ERM initiative can make everyone in the organization more aware of business risks, build confidence in strategic goals, improve compliance with regulations and internal rules, and increase operational efficiency by ensuring procedures and controls are followed more consistently.

Final Thoughts

Organizations can benefit by shifting their focus from just meeting IT compliance requirements to fully addressing risk management. This change relies on having a clear understanding of the organization’s overall security situation.

Moving beyond basic compliance helps identify potential threats and vulnerabilities, preventing costly breaches and data loss. A strong risk management strategy also enhances business continuity and fosters a culture of security awareness among employees, leading to better security practices and a more resilient organization.

FAQs

What role does AI play in Enterprise Risk Management?

AI enhances ERM by analyzing large volumes of data quickly and identifying potential risks more efficiently than traditional methods. It can detect patterns and trends that might be missed by human analysts, helping organizations anticipate and mitigate risks before they escalate.

How does AI contribute to risk assessment in enterprises?

AI tools use advanced algorithms to assess risks by processing and analyzing data from various sources. These tools can predict potential risks and their impacts, allowing businesses to prioritize and address the most significant threats proactively.

Can AI help in monitoring risk in real-time?

Yes, AI can monitor various risk factors continuously and in real-time. It provides ongoing assessments and updates, enabling businesses to respond quickly to changes in risk status and make informed decisions on how to handle emerging threats.

What are the benefits of using AI in ERM?

Incorporating AI into ERM systems brings several benefits, including improved accuracy in risk identification, enhanced efficiency in risk analysis, and quicker response times to potential threats. Additionally, AI can handle complex data analysis tasks, freeing up human resources for strategic decision-making and risk management planning.