A cash flow statement is one of the key financial documents for any business, providing a detailed overview of a company’s cash transactions over a specific period, usually an accounting cycle.

This statement demonstrates the organization’s competency to operate successfully in both the short and long term by highlighting the inflows and outflows of cash.

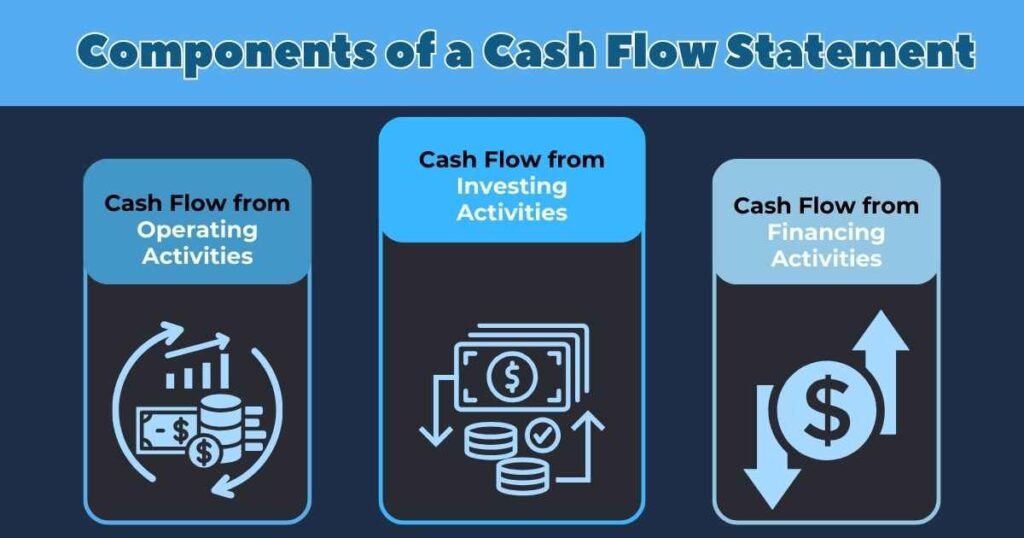

Components of a Cash Flow Statement

Examining a cash flow statement enables you to trace the cash generated by different activities, which aids in making well-informed business decisions. It’s important to understand that cash flow is distinct from profit, which is why it’s essential to analyze a cash flow statement alongside other financial documents.

The cash flow statement is divided into three major sections:

- Cash Flow from Operating Activities

- Cash Flow from Investing Activities

- Cash Flow from Financing Activities

Operating activities cover the cash generated from the company’s core business activities, including both revenue and expenses.

Investing activities depict the cash flow linked to the purchase or sale of assets using cash, not borrowed funds. This encompasses tangible assets like property or vehicles and intangible assets like patents.

Financing activities illustrate the cash flow resulting from both debt and equity financing.

Cash generated from operating income should consistently exceed net income. A positive cash flow indicates a company’s financial stability and its potential for growth.

Methods to Compute Cash Flow

Two common methods are used to compute and organize the operating activities section of cash flow statements.

Direct Method

The first approach is the direct method, which depends on the transactional details affecting cash within a specific period. To compute the operation section using the direct method, sum up all cash received from operating activities and subtract all cash payments made for operating activities.

Indirect Method

The indirect method is another way to prepare the operating section. This method relies on accrual accounting, recording revenues and expenses at different times from when cash is actually paid or received. This results in variances between cash flow from operating activities and net income.

Unlike the direct method that organizes transactional data, the indirect method starts with the net income from the income statement and then adjusts this amount for the impact of accruals during the period. In simpler terms, the accountant converts net income into actual cash flow by identifying and removing non-cash expenses, such as depreciation and amortization.

Interpreting a Cash Flow Statement

Cash flow statements can reveal a business’s current phase, whether it’s a rapidly expanding startup, a stable and profitable business, going through changes, or experiencing a downturn. Managers can use these statements to evaluate their department’s impact on the company and adjust team activities accordingly. Cash flow also influences internal decisions like budgeting and staffing.

2 Types of Cash Flow

Cash flow is typically classified as either positive or negative. Let’s look at what these terms mean.

1. Positive Cash Flow

Positive cash flow occurs when a company takes in more money than it spends over a certain period. This is advantageous because having extra cash enables the company to reinvest, pay off debts, and explore new avenues for growth. However, positive cash flow doesn’t always equate to profitability; a business can be profitable without having positive cash flow, and vice versa.

2. Negative Cash Flow

Negative cash flow happens when a company spends more money than it earns. However, this doesn’t necessarily indicate a loss in profit. Negative cash flow can be due to a mismatch between expenses and income, which should be corrected promptly. It can also result from a company’s decision to invest in future growth. Monitoring changes in cash flow over time helps evaluate the overall performance of the business.

Final Thoughts

Cash flow represents the movement of cash into and out of a business. For finance professionals, understanding cash flow metrics is important for assessing a company’s financial health. Even profitable companies may face challenges if they experience negative cash flow, impacting their ability to cover expenses and expand. Conversely, businesses with positive cash flow and increasing sales might still struggle to generate a profit, a situation commonly faced by startups and growing companies.

FAQs

What is a cash flow statement and why is it important?

A cash flow statement summarizes the cash and cash equivalents entering and leaving a company. It is important to understand a business’s liquidity, solvency, and ability to fund operations and investments, aiding in informed decision-making.

What are the main components of a cash flow statement?

The main components are operating activities (cash flows from core business operations), investing activities (cash flows from buying and selling long-term assets), and financing activities (cash flows from borrowing, repaying debt, and equity transactions).

How does the cash flow statement differ from the income statement?

The cashflow statement shows revenues and expenses, leading to net income, while the cash flow statement focuses on actual cash movements. It reconciles net income with cash generated or used, providing a clearer picture of liquidity and cash position.

How can one use the cash flow statement to assess a company’s financial health?

Analyze the cash flows from operating, investing, and financing activities. Positive operating cash flow indicates good core operations, while negative cash flow may signal problems. Evaluating investing and financing cash flows reveals investment strategies and capital management. Overall, a healthy cash flow statement indicates strong liquidity and stability.