Do you have a knack for numbers?

If you do, then maybe Financial Planning and Analysis (FP&A) is for you! But before you bury yourself with numbers and endless data, of course, it’s important to know what this career has in store for you.

The Road to a Successful FP&A Career

Usually, FP&A is part of a solid financial management setup, which includes accounting, revenue, cash flow management, and more. Moreover, it can even work as a standalone analytics tool that blends seamlessly with other business systems like ERP.

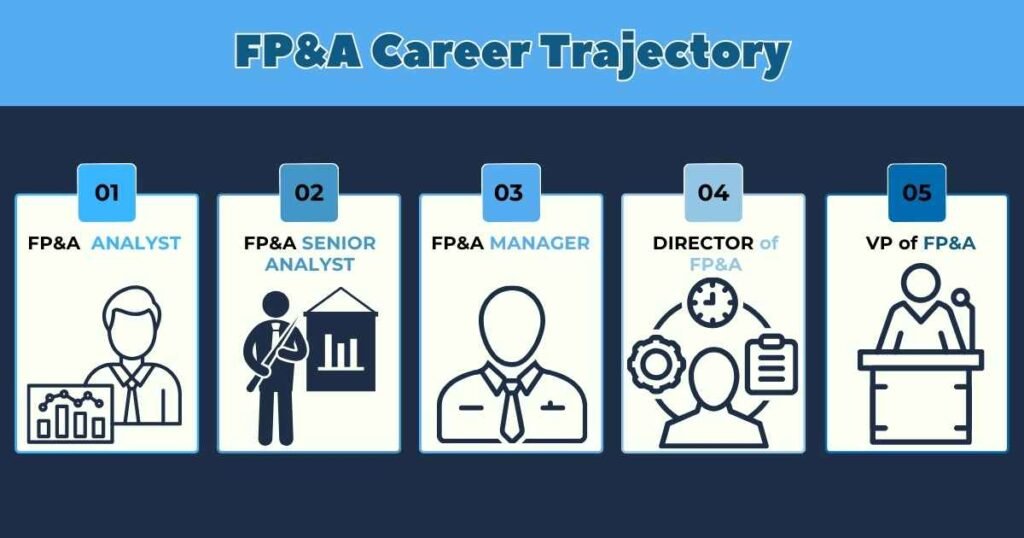

No matter how it’s used, FP&A has come a long way from old-school spreadsheets to modern cloud-based solutions using AI and automation. A career in FP&A typically kicks off at the analyst level and progresses to roles like Director or VP of FP&A over time.

- Analyst

- Senior Analyst

- Manager

- Director

- VP

FP&A professionals are responsible for monitoring, analyzing, and assessing all financial operations within the organization. Their duties span a broad spectrum, including:

- Annual Budgeting

- Financial Analysis

- Business Forecasting and Cash Flow Projections

- Investments and Capital Expenditures

- Tax Management

FP&A analysts primarily consolidate data and build financial models within organizations, while senior analysts and managers focus on planning and business forecasting. The career advancement from junior to senior positions in this field usually follows a specific trajectory.

FP&A Career Trajectory

FP&A Analyst:

Typically coined as the department’s backbone, FP&A analyst handles tasks like data collection, model development, and collaborating with stakeholders. This role falls within the junior to intermediate level and involves:

- Tracking, analyzing, and assessing financial activities.

- Creating monthly financial reports for department heads.

- Evaluating the ROI of current assets and investments.

- Examining ratios such as debt-to-equity and interest coverage to gauge financial well-being.

- Identifying avenues for cost reductions.

- Recognizing financial and operational risks.

- Offering financial planning guidance to senior management and stakeholders.

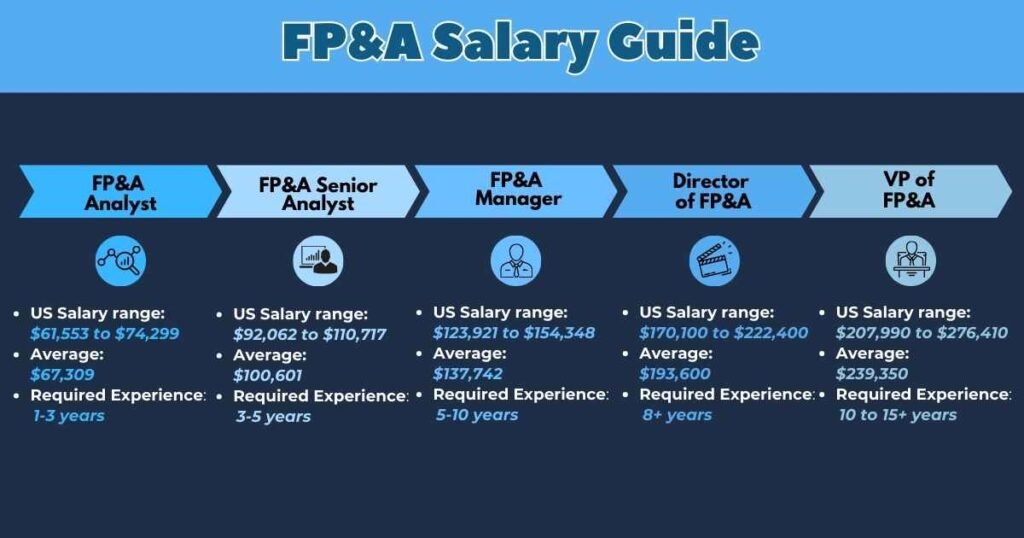

The majority of FP&A analysts in the United States earn a base salary between $61,553 and $74,299 annually, averaging $67,309. Typically, candidates possess 1-3 years of experience and an accounting background, although some larger organizations hire directly from undergraduate programs.

FP&A Senior Analyst:

A Senior Analyst transitions into a leadership role, supervising junior analysts, managing projects, and actively participating in financial modeling. At this stage, analysts pivot toward business forecasting, financial modeling, and planning.

- Conducting scenario analyses to map out growth strategies and financial forecasts.

- Crafting predictive budgets.

- Analyzing variances in budgets and forecasts to pinpoint areas for enhancement and offer insights on future trends.

- Keeping abreast of economic and business trends to predict potential challenges.

- Generating internal financial reports for the executive leadership team, often leveraging data visualization tools and dashboards.

- Providing recommendations to leadership for improved profitability.

- Reviewing financial models developed by analysts.

Senior Analysts typically receive a base salary ranging from $92,062 and $110,717, with an average of $100,601. Successful candidates commonly hold MBAs, possess 3-5 years of experience, and preferably have accounting backgrounds.

FP&A Manager:

FP&A managers use their years of experience and expertise through various analyses at this stage, proving to be a valuable asset in planning cycles. They collaborate closely with executives, offering insights to drive decision-making while ensuring the seamless operation of daily FP&A tasks.

- Developing, managing, and refining analysis, budget, and forecast procedures

- Assessing forecasts, budgets, and models created by analysts and senior analysts

- Partnering with business unit leaders to construct annual budgets and forecasts

- Presenting budgets, statements, and forecasts to the leadership team

Like any career path, specific duties and advancement opportunities can differ based on the organization and its unique needs. In the United States, FP&A managers typically earn a base salary ranging from $123,921 and $154,348 annually, with an average of $137,742. The standard experience level falls within 5-10 years, and managers may progress internally, join from lateral positions, or transition from roles in Big 4 accounting firms or other accounting roles. A majority of managers possess either an MBA or a CPA credential.

Director (or VP) of FP&A:

The senior position entails overseeing and enhancing various functions within the FP&A team, reporting directly either to the VP of FP&A, the Chief Financial Officer, or both. When closely collaborating with the VP, this role assumes responsibility for critical areas such as the annual budget, monthly/quarterly reporting, forecasting, system improvements, business partnerships, and team supervision.

Typically, the Director or VP of FP&A reports directly to the CFO, holding the top position in the FP&A hierarchy. There are scenarios where a Director could also serve as the VP.

- Formulating a high-level strategy for managing corporate finances

- Supervising all FP&A procedures

- Evaluating team performance

- Analyzing reports to pinpoint new growth prospects

- Offering insights, recommendations, and risk evaluations to executives and stakeholders.

In the US, FP&A directors usually command an average annual salary between $170,100 and $222,400, with an average of $193,600. Successful candidates generally possess over 8 years of experience in overseeing corporate planning cycles, implementing new procedures, and spearheading numerous projects.

Conversely, VPs in FP&A typically earn an average annual salary ranging from $207,990 and $276,410, with an average base of $239,350. Since this role carries the most responsibilities in FP&A, successful candidates are expected to have accumulated 10 to 15+ years of experience.

What Drives FP&A Compensation?

Multiple factors contribute to FP&A salaries, with educational qualifications and certifications being key determinants. Typically, FP&As are required to hold a bachelor’s degree in finance, accounting, or a related field. Moreover, obtaining certifications like the Certified Financial Planning and Analysis Professional can have a positive impact on remuneration.

The level of expertise and years of experience are important in salary considerations. Professionals with specialized skills or extensive experience in areas such as data analysis or forecasting often command higher pay grades. Salary levels are also influenced by the market demand for FP&A specialists, as well as variables like job hierarchy, geographical location, and industry sector.

Why FP&A is a Leading Career Choice?

The finance industry’s growing demand has made FP&A a sought-after profession. The abundance of data underscores the necessity for FP&A experts to provide valuable insights and analysis for driving strategic business decisions. This career choice offers ample opportunities for advancement, making it an attractive option for professionals.

Below are some compelling reasons to consider FP&A as a promising career path:

- FP&A professionals help shape a company’s business strategy by delivering financial analysis and insights to management.

- By closely collaborating with top executives, including the CEO and CFO, FP&A professionals gain exposure and mentorship.

- FP&A professionals excel in solving complex issues related to financial performance and business strategy.

- Collaborating with cross-functional teams like sales, marketing, and operations is a regular part of an FP&A professional’s role as they aim for common objectives.

Final Thoughts

FP&A teams are the cornerstone of contemporary financial management. Progressing in FP&A involves a step-by-step journey, typically spending 3-5 years at each level before advancing. Along the way, professionals grow into indispensable assets for their organizations. While the field entails demanding work, it offers stability, lucrative rewards, and the potential to ascend to the prestigious role of CFO.

FAQs

What is the average salary for FP&A professionals?

The average salary for FP&A professionals varies based on experience and company size. Entry-level professionals earn between $60,000 to $80,000 annually. Mid-level professionals make $80,000 to $110,000, while senior FP&A managers can earn $110,000 to $150,000 or more.

How does location impact the salary of FP&A professionals?

Location significantly affects FP&A salaries. In major financial hubs like New York City and San Francisco, salaries are 20-30% higher due to the competitive job market and higher cost of living.

What industries offer the highest salaries for FP&A professionals?

High-demand industries like technology, finance, and healthcare offer the highest salaries for FP&A professionals. Moreover, tech companies and financial services provide particularly competitive pay.

How does experience influence the earnings of FP&A professionals?

Experience greatly impacts earnings. However, entry-level professionals earn less, while those with 5-10 years of experience move into senior roles with higher salaries. Advanced certifications like CFA or CPA can also boost earning potential.