How can you tell if a company is in good shape?

Think of it like checking someone’s health—you wouldn’t skip looking at their vital signs. In business, those vital signs are the three main financial statements. The income statement, balance sheet, and cash flow statement each show a different part of the business’s financial health. Together, they give a full picture, helping you understand how well a company is performing and guiding smart decisions.

What is a Financial Statement?

A company’s financial statements are key for corporate accounting. Management, investors, and lenders review this data to assess financial health and calculate ratios that highlight performance and potential issues.

There are three main financial documents:

- Income Statement: Shows how much money the company earned using standard accounting rules.

- Balance Sheet: Details what the company owns, owes, and the owners’ equity at a specific time.

- Cash Flow Statement: Tracks how cash flows in and out of the business through operations, investments, and financing activities.

The 3 Key Financial Statements

This guide explains how the three financial documents connect and work together in simple terms, so you don’t need to be an accounting expert to follow along.

1. Income Statement

Investors and analysts typically begin by reviewing the income statement to gauge a business’s financial health. Furthermore, this statement shows how well the business performed over a specific period, starting with sales revenue and subtracting the cost of goods sold to determine gross profit. Additional operating costs and income lead to the final net income, known as the “bottom line.”

Key points to remember:

- Shows earnings and expenses

- Covers a specific period (e.g., quarter or year)

- Uses accounting principles like matching and accruals

- Helps evaluate profitability

2. Balance Sheet

The balance sheet provides a quick view of a company’s finances. It shows what the company owns (assets), what it owes (liabilities), and what remains for the owners (shareholders’ equity) at a specific point in time.

Assets must equal liabilities plus equity, keeping the balance. Moreover, the sheet begins with cash, matching the cash flow statement’s ending balance. Profits from the income statement flow into retained earnings, adjusted for any dividends.

The balance sheet divides into three key parts: assets, liabilities, and equity, while maintaining the equation: Assets = Liabilities + Equity.

3. Cash Flow Statement

The cash flow statement shows a company’s money activities over a specific time. It tracks where cash comes from and how you spend it on daily operations, investments, or financing. Moreover, this statement helps assess how well a company manages its cash, providing insights into its ability to pay bills, debts, and invest in growth.

Key points to remember:

- Shows cash changes over time.

- Focuses on actual cash, not accounting entries.

- Includes three sections: operating activities, investments, and financing.

- Reveals cash flow changes from start to end of the period.

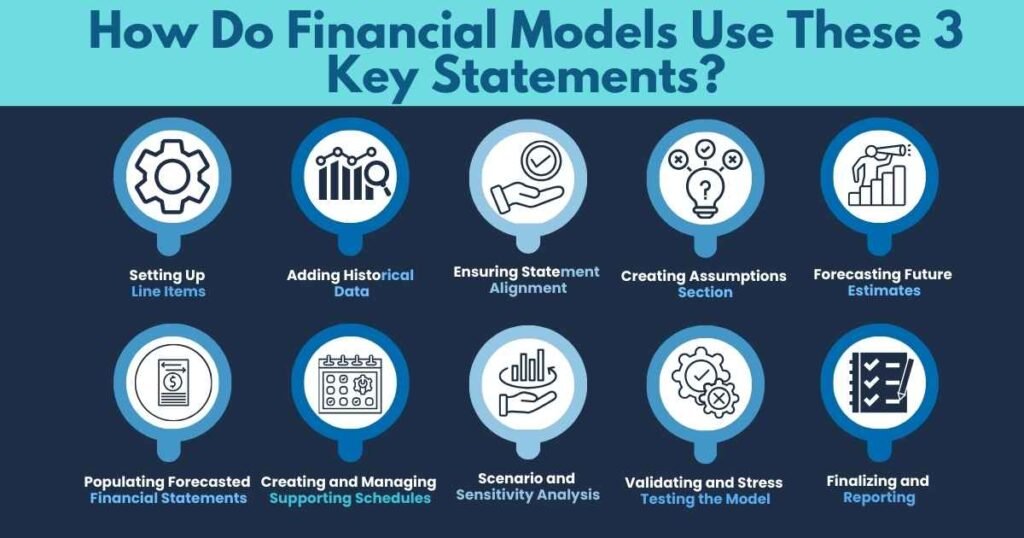

How Do Financial Models Use These 3 Key Statements?

A company’s financial statements are key for corporate accounting. Management, investors, and lenders review this data to assess financial health and calculate ratios that highlight performance and potential issues.

Preparing and presenting this data can be complicated, but you usually follow these general steps when building a financial model:

- Setting Up Line Items: This foundational step involves outlining the structure of the income statement, balance sheet, and cash flow statement. Proper organization ensures a logical flow in the model.

- Adding Historical Data: Entering historical data for each line item establishes a reliable base for future projections. This data gives context and reveals trends.

- Ensuring Statement Alignment: Cross-verification of financial statements ensures consistency. For example, the ending cash balance on the cash flow statement must match the cash figure on the balance sheet, indicating accuracy.

- Creating Assumptions Section: An assumptions section tracks inputs and trends for each line item, forming the backbone of forecasted values. However, analysts typically consider factors like growth rates, margins, and economic indicators, allowing easy updates and scenario analysis.

- Forecasting Future Estimates: Using historical data and assumptions, projections for income, expenses, and balances are generated. These forecasts maintain consistency with past trends while adapting to current assumptions.

- Populating Forecasted Financial Statements: Forecasted figures are then populated in the income statement, balance sheet, and cash flow statement. These projections are aligned with both the historical data and the assumptions made earlier.

- Creating and Managing Supporting Schedules: Detailed schedules (e.g., debt, depreciation) are built to perform calculations that feed into the primary financial statements. Moreover, these schedules may include repayment timelines, depreciation methods, and capital expenditure details. This step adds depth and accuracy to the model, helping analysts manage complexities like interest expenses and asset aging.

- Scenario and Sensitivity Analysis: The model should incorporate flexibility for running different scenarios (e.g., best-case, worst-case) and sensitivity analysis to understand how changes in assumptions impact the outcome.

- Validating and Stress Testing the Model: Once the model is built, it is tested under various scenarios to ensure it holds up under different conditions, identifying any gaps or inconsistencies. This validation step strengthens the model’s reliability.

- Finalizing and Reporting: The completed model is then used to generate key insights, financial reports, and visualizations to support decision-making, ensuring it aligns with the strategic goals and provides actionable outputs.

Final Thoughts

Each of the three main financial statements plays a key role in evaluating a company’s performance. The income statement focuses on core activities that drive profit, while the balance sheet and cash flow statement highlight capital management, including assets and financial structure.

Successful companies balance efficiency, asset management, and capital structure. However, management is responsible for ensuring these areas are aligned with shareholders’ interests. Additionally, the way these factors interconnect emphasizes the importance of financial statements in tracking a company’s overall health.

FAQs

What are the 3 major components to a company’s annual financial statements?

A company’s annual financial statements have three main components: the income statement, balance sheet, and cash flow statement. The income statement shows revenue, expenses, and profit. However, the balance sheet provides a snapshot of assets, liabilities, and equity. In addition, the cash flow statement details the movement of cash in and out of the business, showing how well the company manages its money. Together, these statements give a complete view of a company’s financial health.

What are key financial statements used for financial analysis?

Key financial statements used in financial analysis are the income statement, balance sheet, and cash flow statement. The income statement shows profit by detailing revenue and expenses. Furthermore, the balance sheet gives a snapshot of assets, liabilities, and equity. Additionally, the cash flow statement tracks cash inflows and outflows, highlighting how well a company manages its finances. Together, these statements provide a complete view of a company’s financial health for informed decision-making.

What is the basic 3-statement financial model?

A basic 3-statement financial model links the income statement, balance sheet, and cash flow statement to evaluate a company’s finances. Moreover, the income statement shows profit, the balance sheet lists assets and liabilities, and the cash flow statement tracks cash movement. However, the model connects these statements by linking net income to equity on the balance sheet and adjusting cash flow for non-cash items and working capital. This structure gives a complete view of financial health.

What are the 3 important financial statements in accounting?

The three important financial statements in accounting are the income statement, balance sheet, and cash flow statement. The income statement shows revenue, expenses, and profit over time. Furthermore, the balance sheet provides a snapshot of assets, liabilities, and equity at a specific moment. Moreover, the cash flow statement tracks cash moving in and out, helping assess liquidity. Together, they give a full picture of a company’s financial health.