During the 2024 proxy season, reports show that many newly formed companies had to correct their financial statements and improve internal controls.

The U.S. IPO market in 2024 has shown improvement after tough years, with a 30% increase in IPOs and an 83% rise in proceeds compared to 2023. Sectors like healthcare, biotech, and green energy are leading the way, though challenges like regulatory burdens and competition from private capital remain. The outlook for the rest of 2024 is cautiously optimistic, with more major IPOs expected.

SPACs were viewed as a faster and cheaper way to raise money than traditional IPOs. They would first sell shares on the stock market and then merge with a private company, usually within two years, in what’s called a de-SPAC transaction.

Challenges with IPOs and Accounting Mistakes

However, due to strict regulations, compliance issues, global economic shifts, and challenges in getting good valuations, the number of U.S. IPOs dropped sharply to just 181 last year.

This trend reflects the ongoing struggle for companies to secure favorable valuations amid rising interest rates and economic uncertainty. Although there has been some recovery in funds raised, the overall number of IPOs remains far below pre-pandemic levels, indicating that the IPO market is still in a rebuilding phase.

1. Valuation Issues

Getting the valuation right is one of the biggest challenges during an IPO. If a company is overvalued, it can lead to a sharp decline in stock prices shortly after going public, disappointing early investors and damaging the company’s reputation. Conversely, undervaluation may result in the company raising less capital than needed, hindering growth and expansion plans.

According to U.S. IPO data in 2024, nearly 45% of newly public companies saw their stock prices fall within three months due to initial overvaluation. Mismanaged valuations can also lead to increased volatility, making it harder to maintain investor confidence.

2. Financial Reporting Requirements

Public companies must meet stringent financial reporting standards, including quarterly earnings reports, annual filings, and continuous disclosures. Any delays or inaccuracies in these reports can lead to penalties, investor skepticism, and even legal repercussions.

About 35% of newly public companies in the U.S. faced SEC scrutiny over delayed or incomplete financial statements. Failure to meet these standards not only results in penalties but also raises doubts among investors. Accurate and timely reporting is essential for building trust and ensuring the company’s smooth transition to public trading.

3. Accounting Errors

During the IPO process, a company’s financials come under intense scrutiny. Common accounting errors include misreporting revenue, misclassifying expenses, and inconsistently applying accounting standards. Such errors can lead to restatements of financial reports, which can severely damage a company’s credibility.

In 2024, around 22% of companies in the U.S. that went public had to restate their financial reports due to accounting errors, resulting in delays, additional costs, and loss of investor confidence.

4. Cost Management

The IPO process is expensive. Legal fees, underwriting costs, marketing expenses, and compliance costs can easily reach millions. Managing these costs efficiently is crucial to avoid overextending financial resources.

On average, IPO costs in the U.S. range from 7% to 12% of the total capital raised, depending on the size and complexity of the offering. Poor cost management during the IPO can lead to financial misjudgments and impact post-IPO performance. Companies that miscalculate these expenses often struggle with cash flow issues, making it difficult to meet growth projections.

5. Internal Controls

Strong internal controls are critical to ensuring accurate financial reporting and compliance once a company goes public. However, many private companies find that their existing controls are not sufficient to meet the demands of being a public entity.

Approximately 18% of newly listed U.S. companies reported significant deficiencies in their internal controls within their first year, leading to potential financial misstatements and increased audit costs. Weak internal controls can result in material misstatements and legal liabilities, impacting the company’s long-term success.

6. Regulatory Compliance

After going public, companies must comply with regulations like the Sarbanes-Oxley Act (SOX), which requires enhanced financial transparency and strict accountability. Compliance involves implementing rigorous internal controls, conducting regular audits, and maintaining clear documentation of financial processes. Failure to meet these standards can result in significant fines, reputational damage, and legal action.

Over $250 million in fines were issued to companies in the U.S. for non-compliance with SOX and other financial regulations. Compliance requires ongoing investment in processes and technology, which can be costly but essential for avoiding penalties.

7. Market Volatility

Market conditions greatly affect how successful an IPO can be. Even if a company’s financials are solid, external factors like economic instability, interest rate fluctuations, or global events can affect the IPO’s performance. Accounting errors, combined with market volatility, can exacerbate these risks, causing investors to lose confidence and stock prices to decline.

Approximately 30% of planned IPOs in the U.S. were delayed or canceled due to unfavorable market conditions or internal financial challenges. Market volatility combined with accounting errors can amplify investor concerns, leading to poor stock performance and a rocky start as a public company.

Key Lessons from Recent IPOs

Finance leaders from newly public companies highlight three main reasons why financial reports often need to be redone:

1. Accounting rules are very complex, requiring a lot of judgment and guesswork to apply correctly.

2. Following these complicated rules often involves manual work or using disorganized schedules and spreadsheets, which increases the risk of errors.

3. Accounting teams may lack the necessary knowledge, experience, or skills, which is common for newly public companies dealing with unfamiliar regulations.

CFOs agree that having a skilled finance team with the right financial tools is important for a successful IPO and beyond. It’s not just about the team but also about having the right processes, technology, and control systems in place.

They also point out that there’s a shortage of skilled finance and accounting professionals, which makes it harder to set up systems, resolve accounting issues, create strong controls, and prepare financial statements that meet SEC and GAAP standards. When planning resources, companies should consider alternative ways to acquire the accounting and reporting expertise they need.

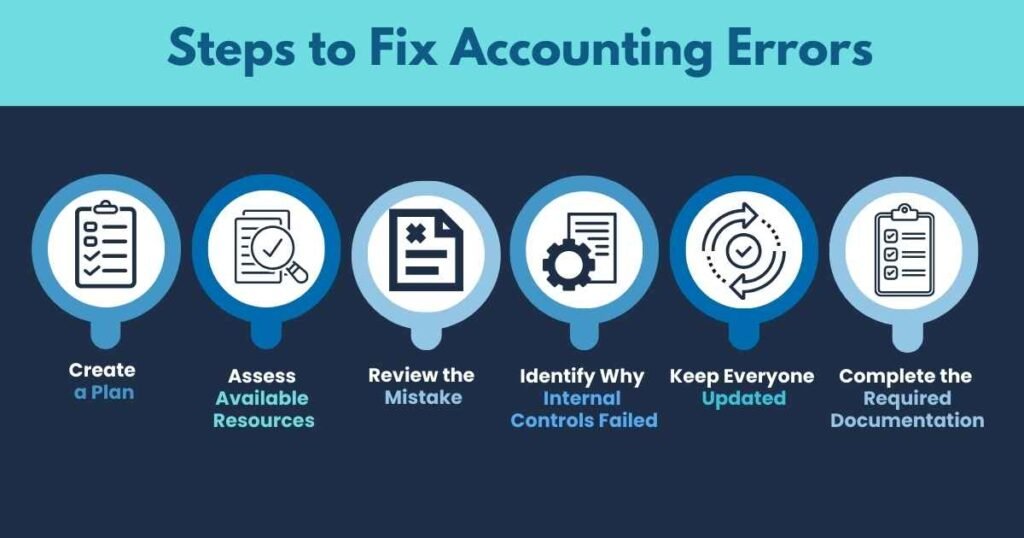

Steps to Fix Accounting Errors

Accounting mistakes often happen because of how well a company handles its internal controls as it grows. Even well-prepared companies might need to fix their financial records sometimes. When this happens, it’s important to act quickly and follow these steps:

- Create a plan.

- Assess available resources.

- Review the mistake.

- Identify why internal controls failed.

- Keep everyone updated.

- Complete the required documentation.

Preventing Financial Errors and Staying in Control

How can you strengthen your accounting team to avoid similar issues in the future? You’ll need to build a flexible and skilled team, set up strong controls and guidelines, and have a plan to address problems before they get worse. Using compliance and financial reporting software can help prevent these mistakes and improve teamwork.

Companies should regularly check if their internal controls are effective. With changes in technology, regulations, and business needs, it’s important to reassess risks and update rules or controls as needed. If they don’t do this, they may face bigger problems down the road.

Final Thoughts

The 150% increase in accounting mistakes among public companies shows the growing challenges in keeping accurate financial records. This surge is mainly due to many new companies going public, especially through SPACs and IPOs, which often struggle with weak internal controls.

As more businesses enter the public market, having strong financial management and audit practices is more important than ever. Fixing these problems quickly is key to regaining investor trust and securing financial stability in the long run.

FAQs

How can accounting errors affect a business?

Accounting errors can cause big problems for a business. They might lead to wrong financial reports, which can hurt decision-making, damage the company’s reputation, and even lead to legal issues. Inaccurate numbers can also affect budgeting, cash flow, and trust with investors or banks.

What is the error of the wrong amount in accounting?

An error of the wrong amount happens when a transaction is recorded with an incorrect number. For example, if a payment of $500 is mistakenly recorded as $50 or $5,000. This mistake can throw off the financial records and lead to wrong conclusions about the company’s financial health.

Is it normal to make mistakes in accounting?

Yes, it’s common to make small mistakes in accounting, especially when dealing with a lot of data. However, businesses should have checks in place to catch these errors quickly, so they don’t cause bigger problems later.

What are the effects of mistakes in accounting records?

Mistakes in accounting records can lead to incorrect financial statements, causing poor business decisions, tax problems, and even audits. Over time, these errors can also lower confidence from stakeholders, investors, and clients.