Cash flow numbers show how healthy and sustainable your finances are. Research indicates that cash flow issues are a major reason small businesses fail, with around 20% not surviving their first year.

As we head into 2024, businesses that adopt new trends and technologies for managing cash flow will have a better chance of success. Paying attention to your cash flow can greatly impact your ability to reach your financial goals.

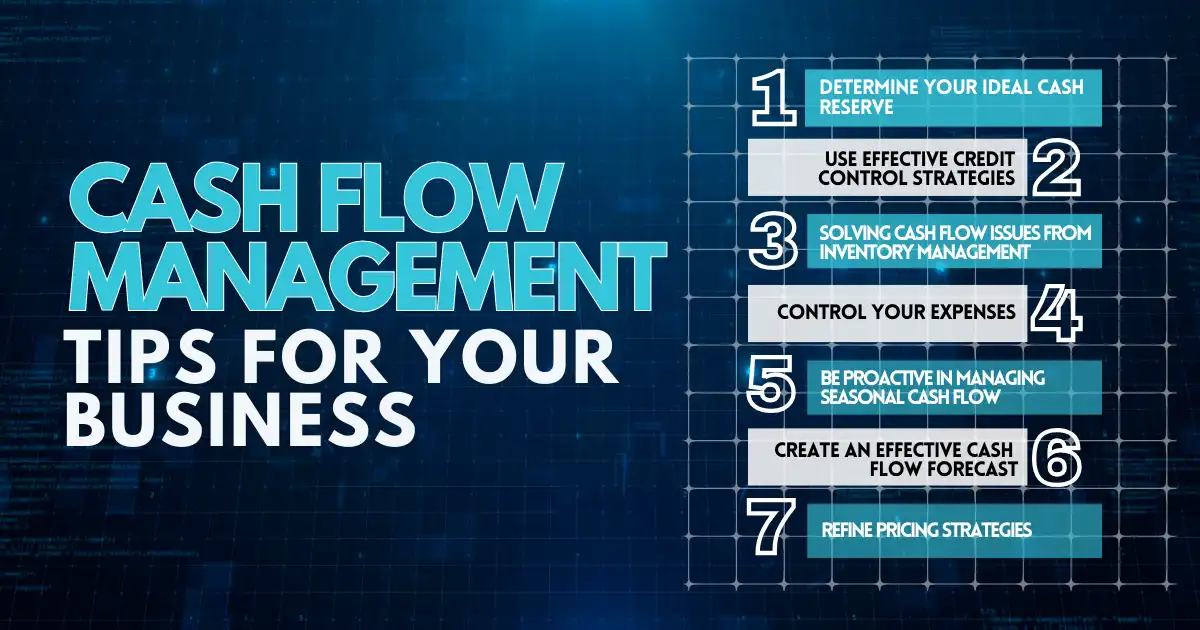

Cash Flow Management Tips for Your Business

Problem 1: Lack of Cash Reserves

Unexpected events like economic downturns, natural disasters, or sudden expenses can disrupt a business’s finances. Having some cash saved helps you handle emergencies without needing to borrow money or cut important costs.

It also allows you to take advantage of good opportunities, like expanding your business, making smart investments, or purchasing necessary items. Plus, it helps you respond quickly to market changes and encourages new ideas.

Expert Tip: Determine Your Ideal Cash Reserve

- Aim to save enough to cover fixed costs like rent, utilities, and salaries for three to six months.

- Set aside extra cash for unexpected expenses or opportunities like marketing or repairs.

- Check how quickly your business makes money during tough times by looking at past sales and industry trends.

- Consider any special risks your business might face, as some industries may need more cash saved for emergencies due to their unpredictability.

Problem 2: Poor Credit Management

Managing credit well is essential for keeping your business’s finances healthy. If you don’t handle credit properly, it can lead to serious cash flow issues:

When customers often delay payments, your income can drop significantly. Money tied up in unpaid bills can’t be used for urgent needs, which can cause cash shortages and trouble paying your bills.

The more credit you extend, the greater the chance that some customers won’t pay you back. Without proper credit management, unpaid bills can accumulate, making cash flow worse.

Expert Tip: Use Effective Credit Control Strategies

- Credit Policies: Set clear rules about when payments are due and what happens if they’re late. Make sure your customers know these rules.

- Credit Checks: Before lending money to new customers, check their creditworthiness. This helps you avoid risky customers and decide how much credit to extend.

- Invoices: Send clear and accurate bills quickly. Include payment details and your contact information.

- Credit Limits: Set credit limits for each customer based on their payment reliability. Review and adjust these limits as needed.

- Monitoring and Follow-up: Keep track of what customers owe you. Consider having a team dedicated to Accounts Receivable (AR) to remind customers to pay on time. You can also use tools to automate reminders.

Problem 3: Inventory Mismanagement

Poor inventory management can greatly impact a business’s cash flow.

- Holding too much inventory ties up money that could be used for bills or growth.

- Excess stock leads to higher costs for storage and insurance.

- Items don’t sell quickly, they can lose value, forcing the business to sell them at a loss.

On the flip side, not having enough inventory means lost sales. If customers can’t find what they want, they may go elsewhere, reducing the business’s income.

Expert Tip: Solving Cash Flow Issues from Inventory Management

- If cash is tight, check your inventory. Identify slow-selling or outdated items and consider selling them at a lower price to free up cash.

- Negotiate with suppliers for extended payment terms or discounts for early payments.

- Hold sales or promotions to increase cash flow quickly.

- Look for loans or credit lines to purchase more stock when funds are low. Adjust your orders based on customer demand and market trends.

- Save money for leaner times and diversify your products so you’re not dependent on a few items.

Inventory financing allows you to use some of your stock as collateral to get cash, which can help buy more inventory or support daily operations. AI can help assess your inventory’s market value to optimize sales.

Problem 4: Spending Too Much

Spending too much money and not managing costs well can lead to serious cash flow issues for a business. When a company overspends, it quickly drains its cash reserves. This can happen due to unnecessary expenses or a lack of attention to daily costs, leaving less money for important bills and employee salaries.

If overspending continues, the business may accumulate debt by relying on expensive loans or credit cards. With limited cash, it becomes challenging to grow, invest in new ideas, or handle unexpected financial problems.

Expert Tip: Control Your Expenses

- Carefully review all your overhead costs to identify unnecessary expenses and focus on what’s essential for your business.

- Negotiate with suppliers for better deals or consider buying in bulk to save money.

- Use technology to automate repetitive tasks, making operations more efficient.

- Allowing employees to work from home can also cut down on office expenses.

- Invest in energy-saving equipment to lower utility bills.

Problem 5: Ignoring Seasonal Cash Flow Changes

Not paying attention to seasonal cash flow changes can hurt a company’s finances. Here’s how it can happen:

- Sales may be high during some times and low during others, making cash flow hard to predict.

- Businesses that do well in certain seasons often need to buy more products before busy times, which ties up cash in inventory. Then, they may have to sell extra stock at a discount during slow periods, hurting profits.

- During busy times, you might need to hire more workers, increasing payroll costs.

- When sales are strong, companies may spend more on ads, which can put pressure on cash flow if not handled wisely.

Expert Tip: Be Proactive in Managing Seasonal Cash Flow

Here are some tips to avoid cash flow issues:

- Save money when business is good to help pay bills when it slows down.

- Hire temporary workers during busy times to save on labor costs.

- Keep less inventory during slow periods to save on storage costs.

- Plan your budget with seasonal sales changes in mind.

- Offer discounts to increase sales during quiet times and use marketing to attract customers when business is slow.

Problem 6: Misunderstanding Cash Flow and Profit

Cash flow is about tracking how money comes in and goes out of a business. Profit is what remains after you subtract all costs from your earnings.

A common mistake is thinking that if your business is making a profit, cash flow must be fine too. This isn’t always true. You can be profitable but still have trouble paying bills on time because money isn’t coming in when you need it.

On the flip side, you might have good cash flow, meaning money is coming in regularly, but still not make a profit because your expenses are too high.

For example, if you buy smartphones for $400 each and sell them for $500, you might think you’re making a 25% profit. However, when you factor in costs like transaction fees, shipping, rent for storage, and returns, you could find you’re just breaking even.

To keep your business healthy in terms of both cash flow and profit, it’s important to track all your expenses and subtract them from your earnings.

Expert Tip: Create an Effective Cash Flow Forecast

- Get Good Data: Collect past financial information like sales, expenses, and payment history.

- Predict Sales: Estimate future sales by reviewing past performance and current market trends.

- Track Expenses: List all expected costs, such as rent and materials, and include taxes.

- Know When Money Comes In and Goes Out: Figure out when you’ll receive payments from customers and when you need to pay bills.

- Prepare for Surprises: Set aside extra money for unexpected expenses or if sales fall short.

- Check and Update Regularly: Monitor your forecasts and adjust them based on actual results.

Problem 7: Not Reviewing Pricing Strategies

Pricing is key to how a business manages its money in several ways. The price you set for your products or services affects your earnings. Higher prices can lead to more income if customers are willing to pay, while lower prices might attract more buyers but bring in less money overall.

Your pricing strategy also influences your profits. Setting prices too low can mean low profits, while prices that are too high may reduce sales. Additionally, if customers take a long time to pay, it delays the money coming in, making it harder to manage expenses and pay bills on time.

It’s also important to consider how your prices compare to competitors. Charging significantly more may drive customers away, but charging less could start a price war that harms everyone’s profits. Therefore, it’s essential to think carefully about your pricing to manage your finances effectively.

Expert Tip: Refine Pricing Strategies

- Group your customers based on what they’re willing to pay. Offer different prices or services to different groups.

- Raise prices slowly over time, letting customers know in advance. Show them how they’ll get more value.

- Give extra services to justify higher prices. Make sure the customer experience keeps improving.

- Combine products or services to make them seem like a better deal. People are more okay with higher prices if they get a lot in one package.

- Test different prices to see how customers react. Use feedback to make your prices better.

- Tell customers why you’re changing prices and how it helps them. Be open about the reasons behind the changes.

Smart Cash Flow Strategies

Struggling to keep track of your business’s cash flow is a common challenge. Managing cash flow doesn’t have to be difficult; with the right strategies and tools, you can take control of your finances and help your business thrive.

Using the cash flow tips in this guide can help you make better decisions for your business now and in the future. Staying organized and proactive is key to success. Start applying these strategies today to improve your business’s financial health over time. Effective cash flow management will pay off in the long run.

FAQs

What are 4 ways a business can improve cash flow?

Provide monthly or quarterly payments instead of a single payment at the end of a contract. Hold off on disputed debts with suppliers while making sure to keep up with current payments. You can also discuss payment terms with other creditors, like HMRC and finance companies if you need to boost cash flow in the short term.

How would you manage cash flow in your business?

To manage cash flow, keep track of all income and expenses regularly. Create a budget to plan for upcoming costs and save money during busy times to cover slow periods. It’s also helpful to send invoices quickly and follow up on late payments.

What is the future cash flow method?

The future cash flow method involves predicting how much money will come in and go out of your business over a specific time. This helps you understand potential financial situations and make better decisions.

How can a cash flow forecast help a business now and in the future?

A cash flow forecast shows expected income and expenses, helping you plan your budget and make sure you have enough money for bills. It can also help you spot potential problems early, allowing you to take action to stay on track for future growth.