Do you ever think about how AI might change finance?

Machines start taking on more roles in making financial decisions. Just like in the movie “I, Robot,” where the story explores the ethical and moral issues of artificial intelligence, the rise of AI in finance brings up serious concerns. We face a scary possibility of losing control!

This shift could lead to a lack of accountability and transparency, leaving us uncertain who is responsible for important financial choices. By 2027, Artificial Intelligence (AI) in finance will become a $130 billion industry. But what does that mean, and why is it important?

AI can process huge amounts of data that humans can’t handle, but here’s the catch—what happens when AI starts making financial decisions faster than humans can understand or control?

It could cause big changes in the market or affect entire economies before anyone realizes it. AI is so fast and powerful that it might change finance in ways that people can’t keep up with, making it harder to control and understand what’s happening.

Understanding AI in Finance

AI in finance uses technologies like machine learning (ML), deep learning (DL), natural language processing (NLP), and computer vision (CV). ML predicts risks or fraud, DL handles complex tasks like trading, NLP helps understand language, and CV processes images.

These tools automate tasks, identify patterns, and improve efficiency, helping financial companies make better decisions, manage risks, and serve customers effectively.

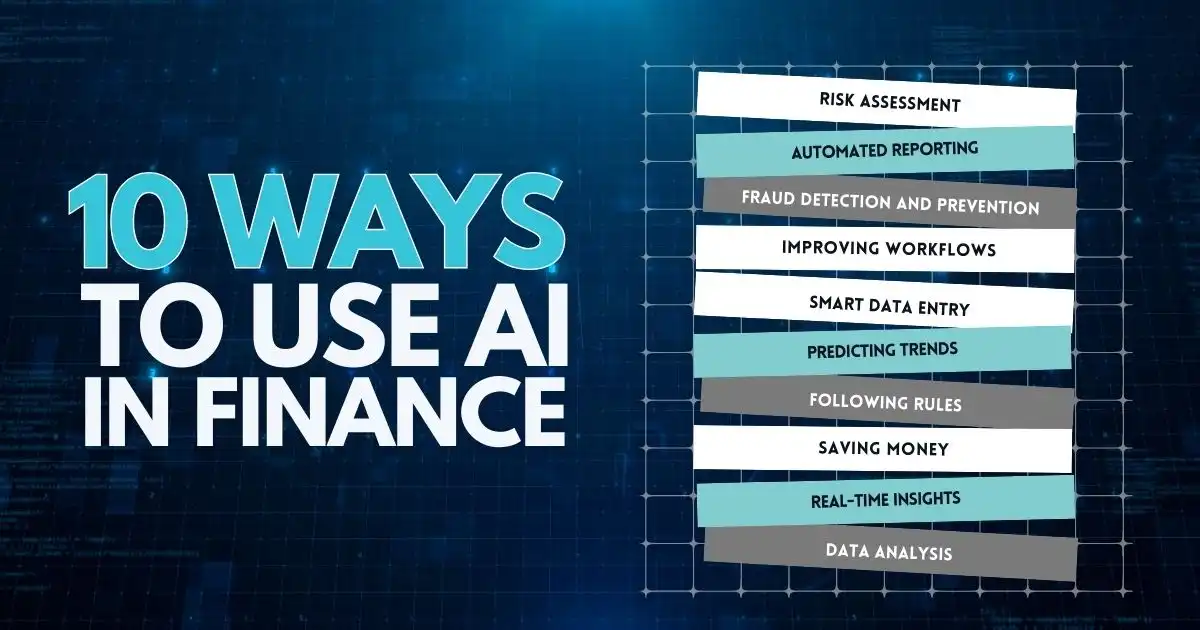

10 Ways to Use AI in Finance

People in finance are finding more ways to use AI to make smarter choices, save time, and work more effectively.

10. Risk Assessment

Banks and lending apps use AI to evaluate loan risks. AI can quickly go through huge amounts of data, making it easier to decide who should get a loan and create offers to meet their needs.

9. Automated Reporting

AI generates financial reports on its own, so people don’t have to do it manually. This means reporting is faster and has fewer errors.

8. Fraud Detection and Prevention

AI can spot unusual activities that could indicate fraud, helping keep money safe by detecting problems more quickly and accurately than people can.

7. Improving Workflows

AI speeds up approval processes for things like expenses and orders, which reduces waiting times and helps teams work together better.

6. Smart Data Entry

AI takes care of data entry, meaning fewer errors and less time spent on manual input.

5. Predicting Trends

AI looks at past data to predict what might happen in the future, helping finance teams plan budgets and make smarter financial choices.

4. Following Rules

The finance industry has a lot of rules. AI helps ensure everything is done properly by automatically checking transactions, which helps prevent mistakes and fines.

3. Saving Money

AI looks at past spending and market trends to find ways to save money, helping finance teams make better use of their budget.

2. Real-Time Insights

AI dashboards provide up-to-date financial information, giving teams instant insights so they can make quick decisions.

1. Data Analysis

Finance teams use AI to process large amounts of data, finding patterns and insights that help them make better decisions about loans, risks, and investments.

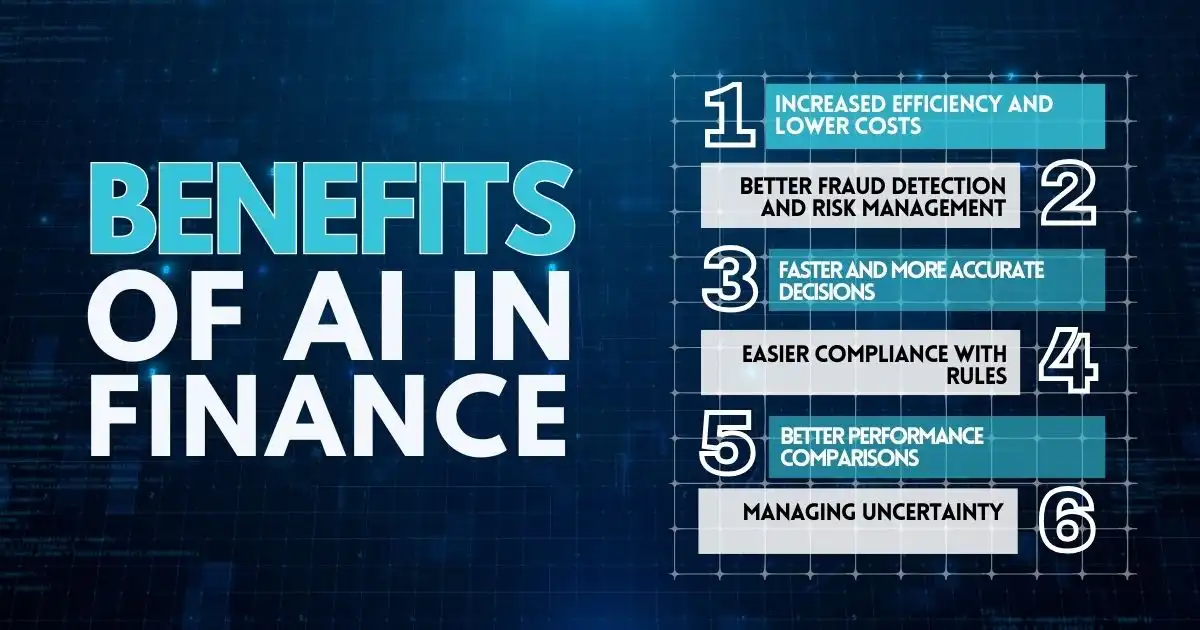

Benefits of AI in Finance

AI gives finance teams several benefits, making their work faster and more accurate:

Increased Efficiency and Lower Costs

AI can take over repetitive tasks like data entry, invoicing, and report making, so staff can focus on more important work.

Better Fraud Detection and Risk Management

AI can quickly look at transactions to catch anything suspicious and help prevent financial losses. It also looks at past data to make smart predictions and reduce risks.

Faster and More Accurate Decisions

AI can look at huge amounts of data to find patterns that people might miss, giving helpful advice and real-time information for better planning.

Easier Compliance with Rules

AI helps companies follow rules by collecting data and creating reports automatically, saving time and ensuring everything is done correctly.

Better Performance Comparisons

AI helps businesses compare their performance to others, which can lead to finding ways to reduce risks, improve efficiency, and increase profits.

Managing Uncertainty

AI can help finance teams understand changes in the market and solve difficult problems by giving clear data and helpful recommendations.

Challenges of Using AI in Finance

Using AI in finance comes with a lot of challenges, especially because the finance industry has many rules. Financial companies need to make sure that AI tools keep data safe, follow all the rules, and have good-quality information.

AI systems must obey strict rules for things like deciding on loans or watching trades, and keeping records to prove this adds a lot of work.

Companies must ensure that AI works properly, is fair, and doesn’t cause unexpected issues. Storing and processing the large amounts of data used by AI can be very expensive. While many companies use cloud storage, strict rules about data location and security make it challenging. Integrating new AI tools with older systems is also difficult for some companies.

Ethical Concerns and Bias

Using AI in finance comes with important ethical issues, like bias and fairness. Sometimes AI can unintentionally continue or even make existing biases worse if the data it learns from is biased. For example, if past loan data has unfair decisions against certain groups, the AI might do the same.

To solve this problem, financial companies use special techniques to make AI fairer. They also set up ethics teams and take steps to make sure AI decisions are easy to understand and fair for everyone.

Why AI Skills Are Important in Finance

AI brings many new opportunities to finance, but it also has challenges. To keep up, people working in finance need to learn skills in AI and data. Financial companies use a lot of data to make decisions, and AI can help them find useful information and make their work faster and more accurate.

AI Solutions

AI has changed how finance professionals work with clients. AI-powered chatbots and virtual assistants answer customer questions quickly, making people happier with the service. AI also gives personalized financial advice that helps clients make better decisions about their money and investments.

Better Automation and Efficiency

AI makes repetitive tasks faster and easier. In finance, AI handles things like data entry, checking accounts, and processing invoices. This saves time, reduces mistakes, and lets finance experts focus on more important work.

Smart Data and Prediction

AI can quickly look at lots of data and make accurate predictions. In finance, this means using past data, market trends, and customer habits to give helpful insights. These insights help companies make better choices about money, use their resources wisely, and manage risks.

Stronger Security

With more digital transactions, the risk of fraud has increased. AI can spot unusual activity and help protect businesses from losing money. AI systems also learn new ways that fraud happens, which helps them get better at stopping it.

Managing Risks and Following Rules

Finance has a lot of rules to follow, and AI tools help by monitoring transactions, detecting problems, and making sure everything is done properly. AI also helps identify risks, so companies can take action to prevent issues.

Learning New Skills

Since AI is taking over many tasks in finance, workers need to learn new skills like AI and data analysis. To stay ahead, people in finance need to keep learning and improving their skills.

Moving Beyond Automation for Better Results

AI in finance isn’t just about automating tasks—it’s about making things easier and finding new ways to improve. Finding a needle in a haystack would take forever, but AI acts like a strong tool to help find that needle quickly, allowing people to focus on more important work. This is how finance teams are using AI today—they are working smarter, making better decisions, and reducing risks.

To fully benefit from AI, people in finance need to learn new skills in data and technology. By gaining these skills, they can stay prepared for the future, turning challenges into opportunities to succeed and do their best work.

FAQs

How is AI used in corporate finance?

AI in corporate finance is used to automate repetitive tasks like financial reporting, data analysis, and forecasting. It helps improve decision-making by analyzing large datasets quickly and providing insights on cost optimization, risk assessment, and financial planning.

How will AI affect finance jobs?

AI will affect finance jobs by automating routine tasks, which means some traditional roles may change or disappear. However, it will also create new opportunities for finance professionals to focus on strategic decision-making and analysis, requiring new skills like AI management and data interpretation.

What are the best financial tools using AI?

The best financial tools using AI include platforms that help with budgeting, automated investing, fraud detection, and personalized financial planning. These tools use AI to provide better insights, make smarter investment decisions, and enhance the overall efficiency of financial management.

How is AI used in capital markets?

AI in capital markets is used for algorithmic trading, market trend analysis, and risk management. AI models can process huge amounts of data faster than humans, allowing for better predictions and smarter trading decisions, which helps improve returns and reduce risks.