Year-end close is when businesses review and update their financial records to wrap up the year. This annual process helps set the company’s new short-term and long-term goals for the succeeding years.

It reveals any gaps or balances in the accounting, helping create a realistic budget based on true financial numbers. Completing a strong year-end close offers many benefits, like accurate reports and smarter decision-making.

How can your business make the most of this essential process—and how can you do it right?

Why Is the Year-End Close Important?

The year-end close is an important step for every company. It helps make sure all financial records are accurate and follow the rules. This process includes checking and updating accounts, fixing any errors, and creating final financial reports. These reports are important because they help the company stay on track and follow regulations.

Year-end close also gives companies helpful information. It shows areas that could be improved, helps plan for the next year, and supports growth by looking closely at the numbers. This process leads to better decisions, greater efficiency, and success for the business.

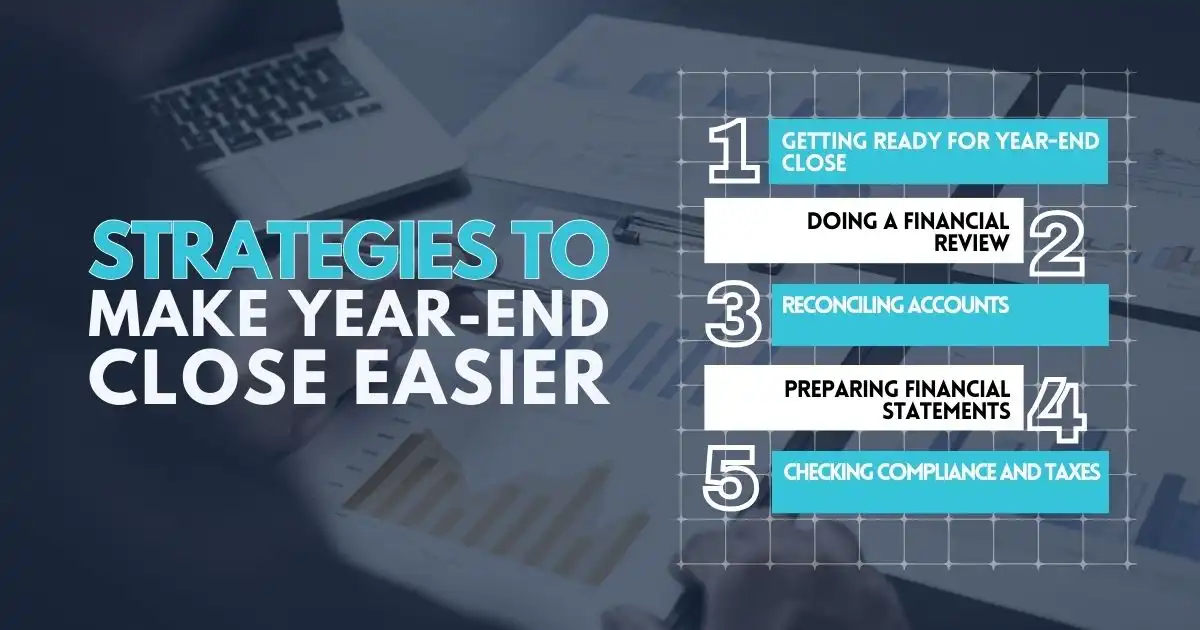

Strategies to Make Year-End Close Easier

The year-end close can be challenging and take time, but it’s important for accurate reports and good business decisions. By following a clear process, businesses can make this task much easier.

Getting Ready for Year-End Close

Start by planning. This means looking over financial information, setting clear goals and deadlines, and making sure resources are in place.

- Review Financial Records – Check records like bank statements, invoices, and receipts to make sure all transactions are accurate and complete.

- Set Goals and Timelines – Decide on specific targets and dates for each part of the process. These should be realistic and leave enough time to do the job well.

Doing a Financial Review

Next, look closely at your income and expenses to spot any patterns or issues. Then check assets and liabilities—like inventory, payments owed, and loans—so everything is accurate before creating reports.

- Review Income and Expenses – Look for trends in revenue and costs that could highlight areas for saving or growing.

- Check Assets and Liabilities – Make sure accounts for things the business owns and owes are complete and correct.

Reconciling Accounts

After the review, it’s time to reconcile or match, accounts to ensure accuracy.

- Bank Reconciliation – Compare your records with bank statements to make sure they match. Fix any differences right away.

- General Ledger Check – Go through the general ledger (a summary of all accounts) and correct any errors.

Preparing Financial Statements

Next, create the main financial statements:

- Income Statement – Summarize the company’s yearly revenue, expenses, and net income to see overall performance.

- Balance Sheet – List assets, liabilities, and equity to get a clear picture of the company’s financial health.

Checking Compliance and Taxes

The final step is to make sure everything meets tax rules and deadlines.

- Review Tax Obligations – Look over any tax requirements and make sure to use any credits or deductions available.

- Finalize and Submit Reports – Check that all data is correct, and send in reports on time to stay compliant.

What Are the Benefits of Year-End Close?

The year-end close is important for a business because it helps finalize the financial records for the year, making sure everything is accurate and follows the rules. This process includes checking accounts, making corrections, and preparing reports.

Accuracy and Following the Rules

- Makes sure financial reports are correct.

- Check accounts to make sure they follow accounting rules.

- Gives a clear picture of the business’s financial health.

Better Decision-making and Planning

- Helps make better decisions based on reliable numbers.

- Spots trends or problems before they get bigger.

- Shows where the business can grow.

- Helps plan for the next year.

Improvement and Efficiency

- Helps find ways to improve financial processes.

- Makes sure resources are used wisely.

- Helps cut unnecessary costs.

- Improves the overall financial performance of the business.

Best Tips for a Successful Year-End Close

Handling the year-end close can be tricky, but following some helpful tips can make it easier and more efficient. Here are some smart ways to get the job done well:

- Start Early – Begin the year-end close process early. This gives you plenty of time to carefully check and fix any issues without rushing. Starting early also makes it easier to keep good records and spot any problems before deadlines.

- Work Together with Your Team – Good communication between departments is key. Working closely with others helps quickly identify and fix any errors, making the process faster and more accurate.

- Use Technology – Using accounting software with features like automation can make the year-end close faster and more accurate. This software helps avoid errors and gives a clear view of financial data so that any issues can be fixed right away.

- Keep Detailed Records – Write down every step of the year-end close process, including any adjustments or corrections. These notes are helpful for next year and ensure that everything is done consistently and accurately.

- Outsource Extra Tasks – For smaller businesses, outsourcing some tasks during year-end close can be helpful. This lets your team focus on the most important activities while experts handle the extra work, making sure everything gets done on time.

Your Path to a Smooth Year-End Close

Completing a successful year-end close is like setting the stage for a brand-new year. It’s not just about wrapping up old business, but also about opening doors to fresh opportunities. Think of it as cleaning your house before moving in. Only then can you truly see what’s working and what needs fixing!

When you take the time to organize financial records, you can spot problems early and make smarter decisions. If you skip the details now, it could cost you later. But if you put in the effort, your business will be better prepared to face the future.

So, start early, get your team involved, and use the tools available to make the process smoother. Don’t just check the box—take charge of your financial future. Set yourself up for success and make your year-end close a stepping stone, not a roadblock.

FAQs

What accounts do you close at the end of the year?

At the end of the year, you typically close temporary accounts, such as revenue, expenses, and dividends. These accounts are reset to zero to start fresh for the new year. The balances are transferred to permanent accounts like retained earnings in the equity section of the balance sheet.

What do closing entries accomplish?

Closing entries accomplish the process of resetting temporary accounts to zero, allowing the business to start the new year with clean financial records. This ensures that revenue and expense accounts reflect only the current year’s activity and help prepare accurate financial reports.

What accounting rule must be followed to ensure the accuracy of the balance sheet?

The accounting rule that must be followed to ensure the accuracy of the balance sheet is the double-entry accounting principle. This principle ensures that every transaction is recorded in two accounts, keeping the balance sheet in balance and accurate.

The most efficient way to accomplish closing entries is to

The most efficient way to accomplish closing entries is to use accounting software that automates the process. This helps reduce manual errors, speeds up the process, and ensures accuracy in transferring balances from temporary accounts to permanent ones.