Friday night just got paid—you’re ready to splurge! But, that little voice asks: “Am I overspending?” Balancing fun and finances can be tough, but that’s where financial advisors step in, helping you take control.

They help you put strategies in place to bring some order to your finances and make your money work for you. And don’t think financial advisors are only for retirees or lottery winners—they’re for people like you, too.

Ever wondered what their day looks like?

What Is A Financial Advisor?

A financial advisor is someone who helps you with your money. They can either manage your money for you or advise you on how to manage it. The term “financial advisor” includes different kinds of helpers, like investment managers, financial consultants, and financial planners.

A financial advisor’s role can change depending on their type. Here’s a closer look at some of the main things financial advisors do:

Helping Clients Make Big Money Decisions

A financial advisor’s primary responsibility is to guide clients through valuable financial decisions, such as:

- Saving for big life events, such as buying a car or going to college

- Planning for retirement, so they can live comfortably when they stop working

- Choosing how to pay off debts or manage loans

- Deciding if they should buy a house or rent one

Giving Financial Advice

A financial advisor offers advice on how to handle money and grow wealth. They teach clients how to:

- Budget their money, so they don’t spend more than they earn

- Save for short-term needs (like a vacation) and long-term goals (like retirement)

- Invest in stocks, bonds, or other assets that can grow over time

- Protect their wealth through insurance or emergency savings

Looking Out for Investments

Advisors help clients make money by investing in the right places, such as the stock market or real estate. They:

- Keep track of the investments their clients have made, making sure they are growing as expected

- Research the best options for future investments, such as new stocks, bonds, or other financial products

- Watch the market for changes, like the rise or fall in stock prices, and advise clients on when to buy or sell

Buying and Selling Financial Products

Another important part of a financial advisor’s role is to help clients buy and sell financial products. These might include:

- Stocks – Small pieces of ownership in companies, where you can earn money if the company does well

- Bonds – Loans to companies or governments that pay interest over time

- Insurance – Plans to protect against things like accidents, health issues, or losing property

- Retirement accounts – Special savings plans like 401(k)s or IRAs, which help people save for retirement

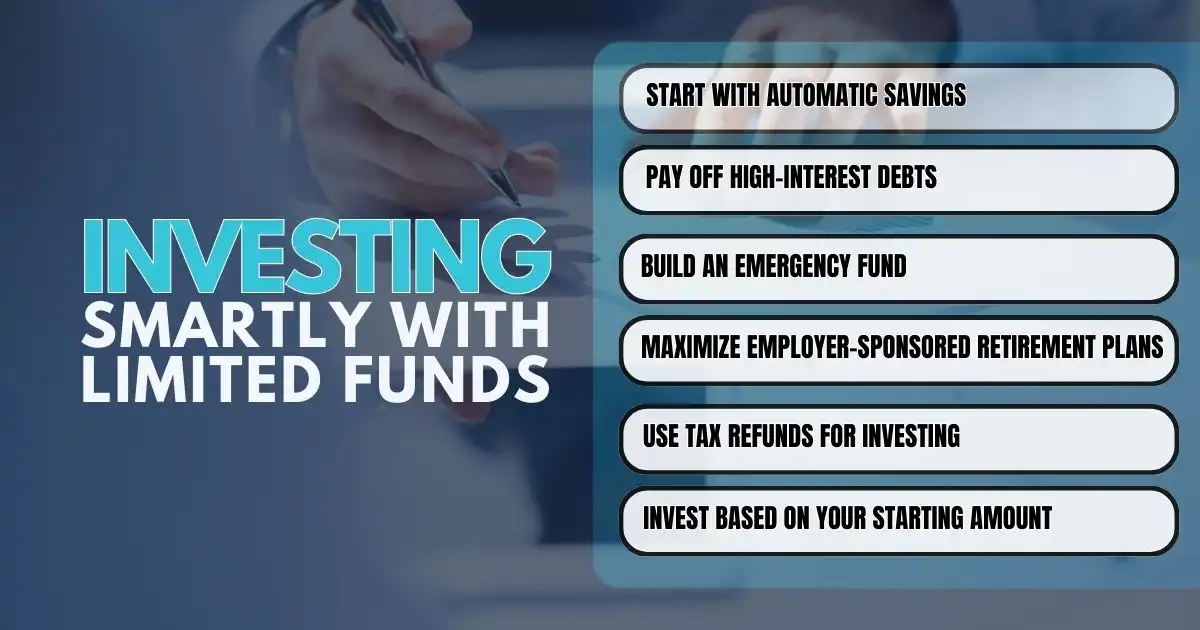

Investing Smartly with Limited Funds

Investing, even with a small amount, is possible and can lead to significant financial growth when approached wisely. Below are practical ways to start investing with limited resources:

Start with Automatic Savings

Begin by setting aside a portion of your income regularly. Apps like Acorns, Qapital, and Chime simplify this process:

- Example: John uses Acorns to round up his purchases to the nearest dollar, automatically investing the spare change into low-cost ETFs. Over a year, he accumulates $500 in savings effortlessly.

Pay Off High-Interest Debts

Clearing high-interest debts before investing is important. For example, a 20% credit card interest rate surpasses the average annual stock market return of 9%.

- Example: Sarah prioritizes paying off her $5,000 credit card balance before investing, saving $1,000 annually in interest payments.

Build an Emergency Fund

Secure at least three to six months’ worth of expenses in an accessible account to cover unexpected financial needs.

- Example: Lisa sets aside $200 monthly into a high-yield savings account, building an emergency fund of $2,400 in one year.

Maximize Employer-Sponsored Retirement Plans

Take full advantage of 401(k) plans, especially if your employer offers matching contributions.

- Example: Mark earns $50,000 annually and contributes $3,000 to his 401(k). His employer matches $3,000, effectively doubling his investment instantly.

Use Tax Refunds for Investing

Instead of spending tax refunds, consider using them to kickstart investments in stocks, ETFs, or other financial products.

- Example: Emily receives a $1,000 tax refund and invests it in a diversified ETF, earning an 8% annual return.

Invest Based on Your Starting Amount

- $500 Investment – Invest in a certificate of deposit (CD) or short-term Treasury bills for safety, or buy fractional shares in dividend reinvestment plans.

- Example: Jake uses $500 to purchase fractional shares of a dividend-paying stock, reinvesting the payouts to grow his portfolio.

- $1,000 Investment – Choose a low-cost target-date fund or individual stocks.

- Example: Maria invests $1,000 in a target-date fund aligned with her retirement goals, benefiting from automatic risk adjustments over time.

- $3,000 Investment – Consider mutual funds or index funds with low fees for diversified exposure.

- Example: Alex invests $3,000 in a Vanguard S&P 500 index fund, minimizing costs while achieving broad market exposure.

- $5,000 Investment – Explore REITs or real estate crowdfunding platforms for exposure to property markets.

- Example: Kevin invests $5,000 in a real estate crowdfunding platform, earning an annual return of 10% on a commercial property project.

By focusing on these strategies, even small amounts can lead to meaningful investment growth over time.

Why Your Financial Future Matters Today

Think about it: your dreams of owning a home, sending kids to college, or enjoying a stress-free retirement depend on the choices you make now. A financial advisor doesn’t just manage money—they help you create a blueprint for success. Their insights can help avoid costly mistakes, grow your wealth, and protect what matters most.

The ball is in your court. Will you leave your financial future to chance, or take a leap and seek professional guidance? Time waits for no one, and neither do opportunities. Make the call today—it’s your choice.

FAQs

Where does a financial advisor work?

Financial advisors work in banks, investment firms, insurance companies, or as independent consultants. Some also operate remotely to serve clients online.

How to become a personal financial advisor?

To become a personal financial advisor, earn a degree in finance or a related field, gain experience, and obtain certifications like CFP. Building a client base and staying updated on financial trends are also key steps.

Do financial advisors need a license?

Yes, financial advisors need licenses for specific services, such as a Series 7 for investments or state licenses for insurance. Certifications like CFP add credibility and expertise.

What degree do you need for a financial advisor?

A bachelor’s degree in finance, economics, or business is required to become a financial advisor. Advanced degrees like an MBA can further enhance career prospects.