Did you know that only 35% of FP&A teams’ time is dedicated to driving insights and actions, with the remaining 65% consumed by data gathering and process management?

This imbalance hampers strategic decision-making and organizational agility. Moreover, 63% of companies struggle to make accurate predictions beyond six months, highlighting significant challenges in forecasting accuracy.

FP&A is important in helping businesses stay competitive and make informed decisions. Measuring how well your FP&A team performs involves more than analyzing numbers—it’s about understanding how processes, tools, and strategies support the organization’s overall goals.

What Is FP&A?

Financial Planning and Analysis (FP&A) helps businesses plan, forecast, and budget for better decision-making and financial health. It includes tasks like budgeting, forecasting, scenario modeling, and performance reporting. While based on accounting, FP&A focuses on more than just tracking finances.

In large companies, the FP&A Director usually reports to the CFO. The main job of FP&A teams is to use current and past financial data to predict future revenue, expenses, profits, and cash flow. CFOs use these predictions to make important long-term business decisions.

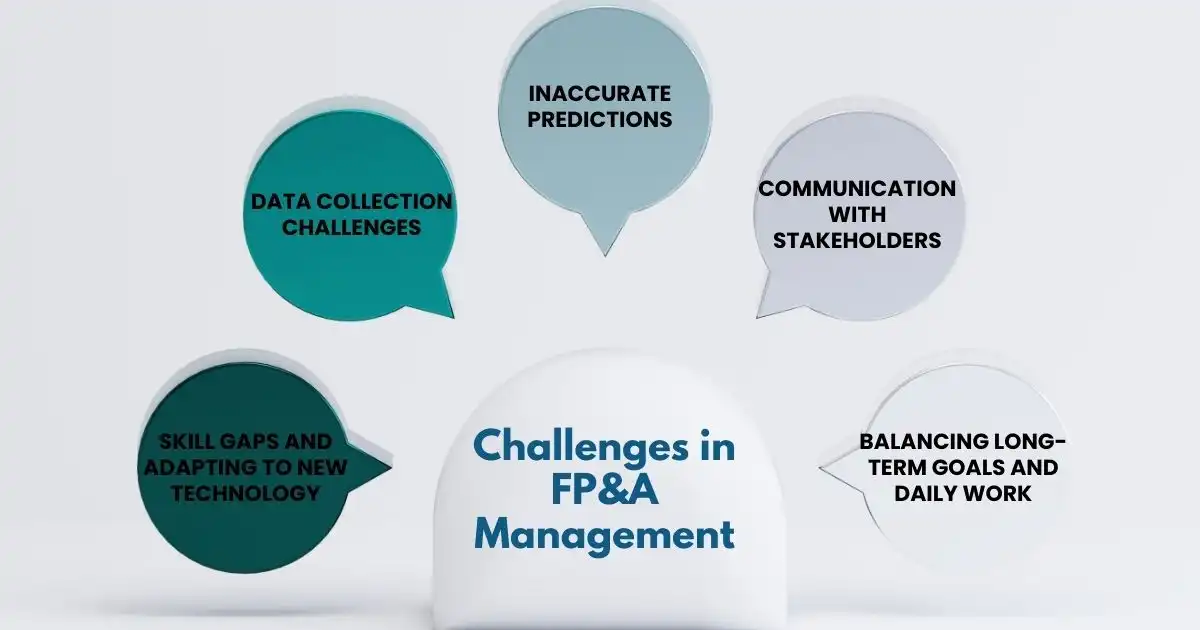

Challenges in FP&A Management

Addressing challenges in FP&A (Financial Planning and Analysis) is important for improving your team’s performance and ensuring business success. Below are the main issues FP&A teams face and simple ways to solve them.

Skill Gaps and Adapting to New Technology

FP&A teams often struggle to keep up with new tools and skills. While many companies invest in advanced technology, they may not provide enough training. Regular and ongoing training is essential to ensure teams stay updated and can use financial tools effectively.

Data Collection Challenges

Gathering data from multiple sources can be time-consuming and lead to errors. To solve this, businesses should establish a single, reliable source of truth for all financial data. This improves accuracy and saves time.

Inaccurate Predictions

Making reliable forecasts is especially hard in unpredictable markets. Mistakes in predictions can hurt financial plans. Improving forecasting methods and using advanced tools can help teams make faster, more accurate decisions.

Communication with Stakeholders

Explaining complex financial information to stakeholders, especially those without financial expertise, can be challenging. FP&A teams need to simplify their communication, using clear language and visual aids to make their insights understandable.

Balancing Long-Term Goals and Daily Work

Managing daily tasks while planning for the future is tough for FP&A teams. Prioritizing tasks and setting clear deadlines can help maintain focus on both immediate needs and long-term objectives.

By addressing these challenges, FP&A teams can improve efficiency and contribute more effectively to business success.

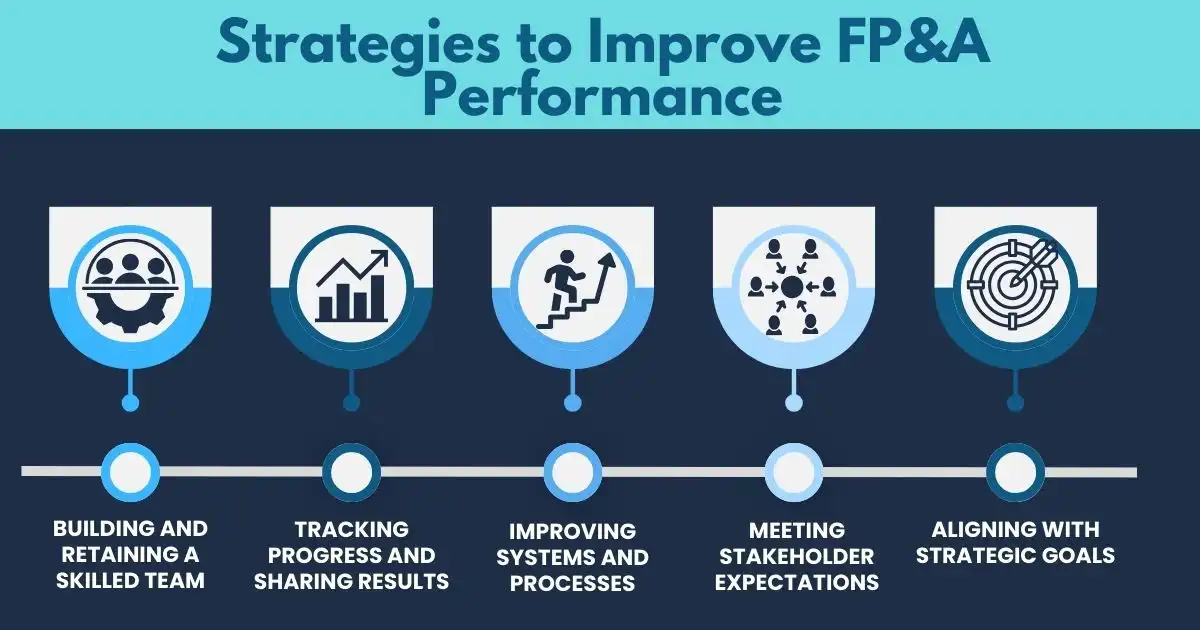

Strategies to Improve FP&A Performance

Here are practical strategies to enhance your FP&A effectiveness and efficiency.

Building and Retaining a Skilled Team

The success of your FP&A team relies on having skilled people with technical, analytical, business, and communication abilities, along with industry knowledge. Invest in their growth by offering training, mentoring, and career advancement opportunities. Foster teamwork, creativity, and accountability across the team and within the organization.

Tracking Progress and Sharing Results

To measure your team’s performance, regularly monitor key performance indicators (KPIs) and provide updates. Share progress monthly, quarterly, or yearly, depending on your needs. Use tools like dashboards and charts to present data clearly.

Reports should be accurate, and concise, and highlight key findings, trends, and actionable insights. Automating data processes can save time and reduce errors. Encourage collaboration across departments for better data collection and faster decision-making.

Improving Systems and Processes

Evaluate the methods and tools your FP&A team uses for data gathering, analysis, and forecasting. Identify areas of inefficiency, such as delays, errors, or repetitive tasks, and work on solutions to improve workflows. Gather feedback from team members and stakeholders to refine processes and boost overall performance.

Meeting Stakeholder Expectations

Understand what key stakeholders—executives, board members, investors, and regulators—expect from your FP&A team.

Clearly show how your work supports their decisions and outcomes. Simplify financial terms, use visuals like charts and graphs, and hold regular meetings to maintain alignment and trust. Effective communication ensures better collaboration and smoother operations.

Aligning with Strategic Goals

Your FP&A team should understand your company’s main objectives and how their work supports them. Set specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with organizational priorities. Regularly track and report how your team’s efforts contribute to these goals in both financial and non-financial areas.

Strengthen Your FP&A Approach

FP&A isn’t just a numbers game—it’s the foundation of smart business decisions. If 65% of your team’s time is spent chasing data, it’s time to shift gears. Don’t let outdated processes or missed opportunities slow your progress. Focus on developing your team’s skills, adopting modern tools, and simplifying communication to connect better with stakeholders.

Accurate forecasting and clear strategies act as your business’s foundation for success. Without them, you risk losing direction. Collaborate across departments, focus on what truly matters, and always stay aligned with your long-term goals.

It’s not about working harder but working smarter—align your FP&A efforts with long-term goals to drive your business forward. The tools are available, the strategies are clear, and the time to act is now. The future of your decisions starts today!

FAQs

Why is planning important in financial management?

Planning is important in financial management because it helps organizations allocate resources, set goals, and anticipate future needs. Effective planning ensures businesses can respond to challenges, seize opportunities, and maintain financial stability, which is a critical aspect of FP&A effectiveness.

How do financial forecasting and planning contribute to FP&A efficiency?

Financial forecasting and planning allow organizations to predict future revenues, expenses, and cash flows, helping them make informed decisions. These processes improve FP&A efficiency by reducing uncertainties, aligning resources with objectives, and ensuring a proactive approach to financial management.

What is financial analysis and reporting, and why does it matter for FP&A?

Financial analysis and reporting involve evaluating financial data to understand a company’s performance and providing clear insights to stakeholders. These functions are vital for FP&A as they help measure effectiveness, track progress, and identify areas for improvement, ensuring data-driven decision-making.

What are some basic long-term financial concepts relevant to FP&A?

Basic long-term financial concepts, such as capital budgeting, cash flow management, and return on investment, are essential for FP&A. Understanding these concepts helps teams align their strategies with the organization’s long-term goals, improving both effectiveness and efficiency.