Did you know FP&A teams spend up to 75% of their time just gathering and managing data? Despite being key strategic drivers, they’re stuck using outdated tools—mainly Excel—to handle critical financial data. With access to more cross-departmental information than almost any other division, these inefficiencies hold them back from driving real business impact.

Financial Planning and Analysis (FP&A) is evolving beyond static spreadsheets and manual workflows. 3rd Generation FP&A tools are transforming financial forecasting, analysis, and decision-making by automating processes and improving data accessibility.

If you’re still relying on legacy systems, it’s time to understand what you’re missing.

What are 3rd Generation FP&A Tools?

These tools represent a significant leap forward from their predecessors. They’re built on cloud-based platforms, leveraging advanced technologies like:

- Artificial Intelligence (AI) and Machine Learning (ML) – To automate tasks, identify patterns, and generate predictive insights.

- Cloud Computing – For scalability, accessibility, and real-time data integration.

- Advanced Data Visualization –To present complex financial information in a clear and actionable format.

- Collaborative Platforms –To foster seamless communication and teamwork across departments.

- Integrated Planning –Combining strategic, financial, and operational planning into a unified process.

3rd Generation of FP&A Software

FP&A software, previously known as Corporate Performance Management (CPM) or Enterprise Performance Management (EPM) software, has been available for over 40 years. To understand what 3rd Generation FP&A software means, it helps to look at how it has evolved.

First Generation FP&A Software

The first generation of FP&A software included platforms like Hyperion, SAP BPC, and TM1. While these were powerful and sophisticated, they were complex, on-premises systems that required more than six months to set up and came with high hardware costs.

As a result, only large companies with significant budgets could afford them. For these enterprises, the total cost of ownership (TCO) in the first year could exceed $1 million.

Cloud-Based Second-Generation FP&A

The second generation introduced cloud-based solutions like Anaplan, Planful, and Adaptive Insights. These tools had a lower TCO, were easier to implement, and offered better scalability.

They were more accessible to mid-sized businesses, but implementation still required extensive technical expertise, and the software was mainly used by FP&A professionals. Although they were more affordable than first-generation solutions, companies typically spent between $25,000 and $100,000 annually, plus at least $25,000 for initial setup.

3rd Generation FP&A

The third generation of FP&A software is cloud-based and designed to be user-friendly, cost-effective, and quick to implement. It includes self-service features, integrates easily with ERP systems, and provides a fast return on investment (ROI).

The typical annual TCO for these solutions ranges from $15,000 to $25,000, with a one-time setup cost of $10,000 or less. These advancements have made FP&A software accessible to small and mid-sized businesses.

Although Microsoft Excel remains the most widely used FP&A tool, modern solutions address its limitations by improving data governance, enabling team collaboration, and offering web-based modeling and reporting.

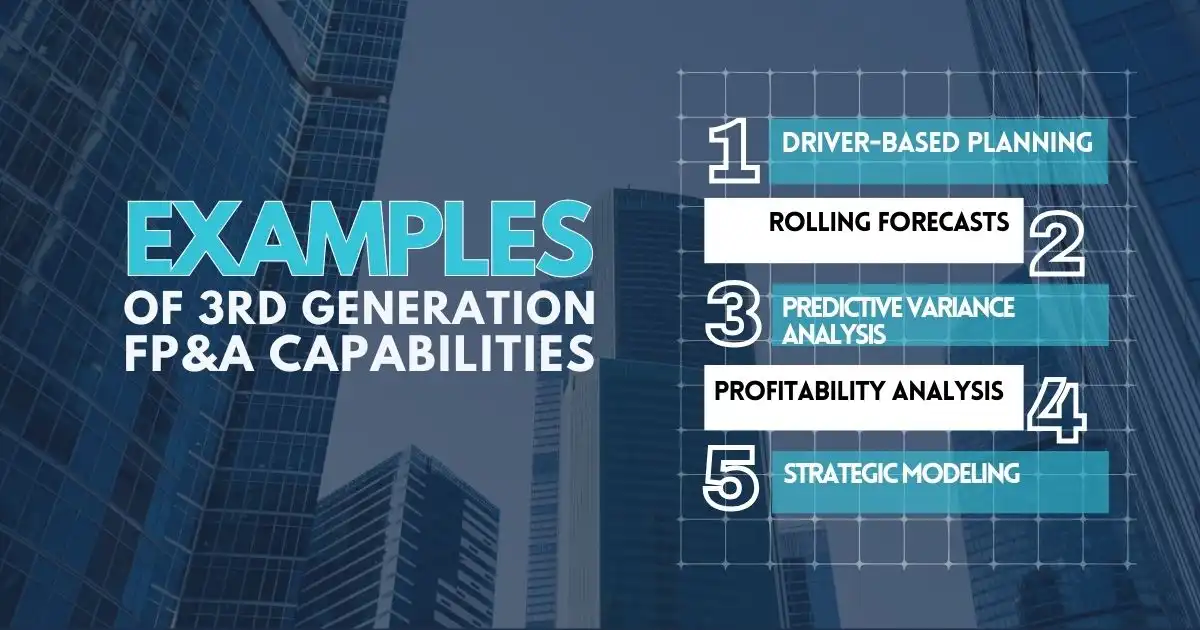

Examples of 3rd Generation FP&A Capabilities

- Driver-based planning – Modeling financial performance based on key business drivers.

- Rolling forecasts- Continuously updating forecasts to reflect the new information.

- Predictive variance analysis – Identifying and explaining deviations from planned performance.

- Profitability analysis – Understanding the profitability of different products, customers, and business units.

- Strategic modeling – Evaluating the financial impact of strategic initiatives.

Important Characteristics and Benefits

Enhanced Automation

- Eliminates manual data entry and repetitive tasks with AI and ML-driven automation.

- Automates data collection, cleansing, and analysis, allowing FP&A teams to focus on strategy.

- Enables automated forecasting and scenario planning for quick adjustments to market changes.

Predictive Analytics and Forecasting

- Uses predictive analytics to provide more accurate forecasts beyond historical data.

- Supports advanced scenario planning, helping businesses assess risks and opportunities.

- Identifies trends that might be overlooked by human analysis through machine learning.

Real-Time Insights and Data Integration

- Cloud-based platforms ensure real-time access to financial data, breaking down data silos.

- Integrated dashboards and visualizations offer a complete view of financial performance for faster decision-making.

- Connects data from various systems (e.g., CRM, supply chain) for a holistic business overview.

Improved Collaboration and Communication

- Enables seamless collaboration between FP&A teams and other departments.

- Version control and audit trails enhance transparency and accountability.

- Strengthens interdepartmental communication, leading to more accurate forecasts.

Agility and Flexibility

- Scalable cloud platforms adapt to evolving business needs and market conditions.

- Customizable dashboards and user-friendly interfaces make tools easy to tailor.

- Supports quick model adjustments and scenario planning to keep up with a fast-paced business environment.

Stop Chasing Numbers—Start Driving Strategy

Sticking to outdated FP&A tools is like trying to win a race with a flat tire. If your team spends most of its time wrestling with spreadsheets instead of shaping financial strategy, you’re already behind.

3rd generation FP&A tools aren’t just upgrades—they’re game changers. They cut out manual drudgery, turn raw data into real insights, and give finance teams the power to make fast, confident decisions. With automation, predictive analytics, and real-time collaboration, these tools turn finance from a back-office function into a business-driving force.

Ask yourself: Is your team managing numbers, or making an impact? The future belongs to businesses that adapt. Those who don’t will keep spinning their wheels while competitors accelerate. The choice is clear—invest in the right tools, or risk being left behind.

It’s time to move from spreadsheets to strategy. Where do you stand?

FAQs

What are FP&A software tools, and how do they help finance teams?

FP&A software tools streamline financial planning, budgeting, and forecasting by automating data collection, analysis, and reporting. These tools help finance teams move beyond spreadsheets, improving efficiency, accuracy, and decision-making.

How do CFO tools support strategic financial management?

CFO tools provide real-time insights, predictive analytics, and automated reporting to help finance leaders make data-driven decisions. These tools enhance cash flow management, risk assessment, and long-term financial planning.

What are FP&A systems, and why are they important for businesses?

FP&A systems integrate financial data from multiple sources, enabling real-time collaboration and scenario planning. They help businesses improve forecasting accuracy, align financial strategies with operational goals, and adapt quickly to market changes.

What are the best FP&A tools for modern businesses?

The best FP&A tools offer cloud-based accessibility, AI-driven insights, and seamless ERP integration. Solutions like Anaplan, Adaptive Insights, and Planful provide automation, real-time data visibility, and strategic financial planning capabilities for companies of all sizes.