Managing money can make or break a business. Poor financial tracking leads to cash flow problems, missed tax deadlines, and lost opportunities. The right finance software solves these issues, keeping your finances organized and decisions sharp.

With automated invoices, real-time expense tracking, and accurate profit forecasting, financial management becomes easier and more efficient. No more spreadsheets or guesswork—just clear insights that help your business grow.

So, what is finance software, and how does it optimize financial management?

What Is Financial Software?

Financial software helps businesses monitor their assets, expenses, liabilities, and other financial data in real-time. It offers in-depth analytics, enabling users to assess their financial performance against predefined KPIs and goals.

7 Best Finance Software for Businesses

Managing business finances effectively requires the right tools. These finance software solutions help with budgeting, forecasting, reporting, and overall financial management, making decision-making easier and more efficient.

1) QuickBooks

QuickBooks is a top accounting tool for small businesses and independent contractors. It simplifies financial management with features like expense tracking, invoice customization, and cloud storage for easy access across devices.

Key Features:

- Free support

- Secure cloud storage

- Accountant access

- Unlimited invoices

- 750+ integrations

Pricing:

QuickBooks offers a limited-time deal of $1/month for the first three months on all plans:

- Simple Start: $18/month – Ideal for new businesses and self-employed individuals

- Essentials: $27/month – Adds bill management and time tracking for growing businesses

- Plus: $38/month – Includes inventory tracking and budgeting for larger enterprises

2) Xero

Xero is an easy-to-use accounting solution designed to improve invoicing, financial tracking, and collaboration. It’s a great fit for small businesses, accountants, and bookkeepers.

Key Features:

- Bank connections

- Multi-currency accounting

- Cloud file storage

- Automated data capture

- Financial analytics

Pricing:

Xero offers a 30-day free trial and three plans:

- Starter: $29/month – Best for sole traders and freelancers

- Standard: $46/month – Suitable for growing small businesses

- Premium: $62/month – Includes multi-currency accounting for larger businesses

3) Datarails

Datarails is an AI-powered, Excel-native platform that consolidates financial data and automates reporting. Its FP&A Genius AI assists with forecasting and real-time insights.

Key Features:

- AI-driven financial forecasting

- Intuitive dashboard

- Customizable financial statement templates

- 200+ integrations, including QuickBooks and Shopify

Pricing:

Datarails offers customized pricing based on user needs. Contact their sales team for a quote.

4) Anaplan

Anaplan is a cloud-based financial planning platform tailored for large enterprises. It bridges the gap between strategic goals and execution with predictive insights and enterprise-wide intelligence.

Key Features:

- Predictive insights

- AI-powered analytics

- Unified data modeling for financial management

Pricing:

Anaplan provides Basic, Professional, and Enterprise plans. Pricing details are available upon request.

5) Cube

Cube is a spreadsheet-native FP&A tool with seamless integrations for finance teams using Excel and Google Sheets. It’s designed for startups and small businesses.

Key Features:

- Automated reporting and KPI tracking

- Forecasting and anomaly detection

- Integration with 500+ applications

Pricing:

- Cube Go: $1,500/month – Best for small finance teams

- Cube Pro: $2,800/month – Offers premium ERP connections and multi-currency support

- Enterprise: Custom pricing for large organizations

6) Planful

Planful (formerly Host Analytics) is a cloud-based financial performance management tool that automates budgeting, forecasting, and reporting.

Key Features:

- Multi-layer security

- AI-driven anomaly detection

- Advanced financial planning

Pricing:

Pricing is available upon request. Contact the sales team for a demo.

7) Vena

Vena integrates financial planning, budgeting, and reporting into an Excel-based interface, making it easy for finance teams to adopt.

Key Features:

- Scenario planning

- Workforce planning

- Incentive compensation management

Pricing:

Vena offers two plans:

- Professional – Includes standard support and a customer success manager

- Complete – Adds premium support, a sandbox environment, and expert-managed services

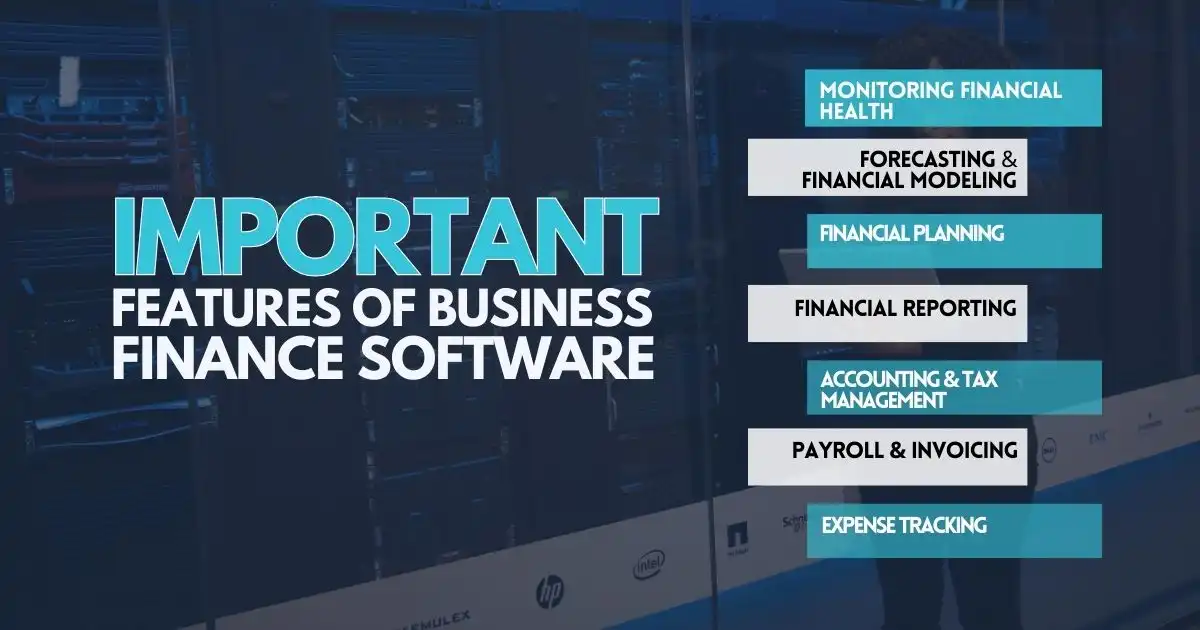

Important Features of Business Finance Software

Choosing the right finance software means focusing on features that simplify financial management. Here are the most important ones:

Monitoring Financial Health

A company’s financial condition is important for both internal teams and investors. Before investing, stakeholders review financial statements to assess stability.

Finance software helps track key metrics like revenue, cash flow, and profit/loss. It automates reporting and data collection, making it easier to identify trends, spot risks, and understand financial performance.

Forecasting & Financial Modeling

Good finance software analyzes past data to predict future income, expenses, and cash flow. It also models different scenarios—such as market shifts or acquisitions—to help businesses plan.

Financial Planning

Planning tools help businesses set financial goals based on real data. By reviewing past performance and current trends, companies can create strategies to improve profits, cash flow, and long-term stability.

Financial Reporting

Reporting features consolidate data from different accounts into clear financial statements. Businesses with multiple units benefit from automated tracking of revenue, expenses, assets, and liabilities, making it easy to assess performance.

Accounting & Tax Management

Finance software automates tasks like transaction recording, payroll processing, and bank reconciliation. It also manages tax settings, tracks liabilities, and simplifies tax filing.

Payroll & Invoicing

Payroll features handle employee payments automatically, saving time on tax calculations and salary distribution. Invoicing tools let businesses generate and send customized invoices for subscriptions, services, and recurring payments.

Expense Tracking

As businesses grow, so do their expenses. Expense tracking tools provide a clear spending overview, helping teams spot unnecessary costs and find ways to save.

A Tool or a Ticking Time Bomb?

Ignoring financial software is like sailing without a compass—you might stay afloat, but you’ll never know where you’re headed. Relying on outdated spreadsheets or manual bookkeeping can cost you time, money, and missed opportunities.

The right finance software doesn’t just crunch numbers; it uncovers hidden risks, predicts future trends, and streamlines decision-making.

Think of it as your financial GPS, guiding you through cash flow challenges, tax obligations, and growth opportunities. Without it, you’re gambling with your business’s future. Would you drive blindfolded? Then why manage finances without the right tools?

Now’s the time to take control. Choose software that fits your needs, automates the grunt work, and keeps you financially sharp. Your business’s future isn’t a guessing game—it’s a strategy. Make the right move today.

FAQs

What are the best financial management tools for small businesses?

Small businesses benefit from financial tools like QuickBooks, Xero, and Wave, which help with budgeting, invoicing, and expense tracking. These tools automate key financial tasks, making cash flow management and tax filing easier.

How does trade finance software help large businesses?

Trade finance software simplifies international transactions, manages letters of credit, and reduces financial risks. Large businesses use solutions like Surecomp and Finastra to automate payments, ensure compliance, and improve supply chain efficiency.

What are some finance software project ideas for businesses?

Businesses can develop finance software projects like AI-driven expense tracking, real-time budgeting dashboards, or automated tax filing systems. These projects improve financial transparency and help businesses make data-driven decisions.

What are some examples of financial software used in businesses?

Popular financial software includes QuickBooks for accounting, SAP for enterprise finance management, and Anaplan for financial planning. These tools help businesses track expenses, manage payroll, and forecast revenue.