You might think your books are in order—until the numbers don’t match.

A lot of businesses get caught off guard when their bank balance says one thing and their records say another. It doesn’t always mean fraud or a major mistake. But it does mean something’s off—and that can quietly snowball into bigger problems.

This guide isn’t just about balancing figures. It’s about spotting issues early, tightening your financial controls, and making sure you’re always working with real numbers.

What Is Bank Reconciliation?

Bank reconciliation is the process of matching a company’s cash records with its bank statements to ensure accuracy. It helps identify and correct differences caused by unrecorded transactions, bank fees, delays, or errors.

As businesses often use third-party payment services, reconciliation should also include these accounts. The process involves reviewing both the bank and internal records, then adjusting for any mismatches.

This task, usually handled by the accounting team or owner, is important for accurate cash flow management and strong financial controls. Skipping it can lead to growing errors, poor decisions, and a loss of trust from stakeholders.

Example: A retail shop once found a $1,500 difference. It missed recording a customer payment and a $50 bank fee. After adjustments, the records matched, showing why regular reconciliation is important.

Why Bank Reconciliation Matters

A company’s ability to invest in areas like marketing, R&D, and technology depends on having accurate, up-to-date cash information. Bank reconciliation helps determine whether the business can proceed with plans or needs to be more cautious.

Here are four important reasons it’s essential:

- Informed Decision-Making – Accurate cash records help avoid poor choices, such as paying bills without enough funds or missing good investment opportunities due to uncertainty.

- Fraud Detection – Regular, detailed checks can uncover unusual transactions and potential fraud early.

- Clear Cash Flow View – Understanding how much cash is coming in and going out supports better day-to-day and lon g-term financial decisions.

- Managing Receivables – Reconciliations highlight overdue payments and help resolve issues with accounts receivable promptly.

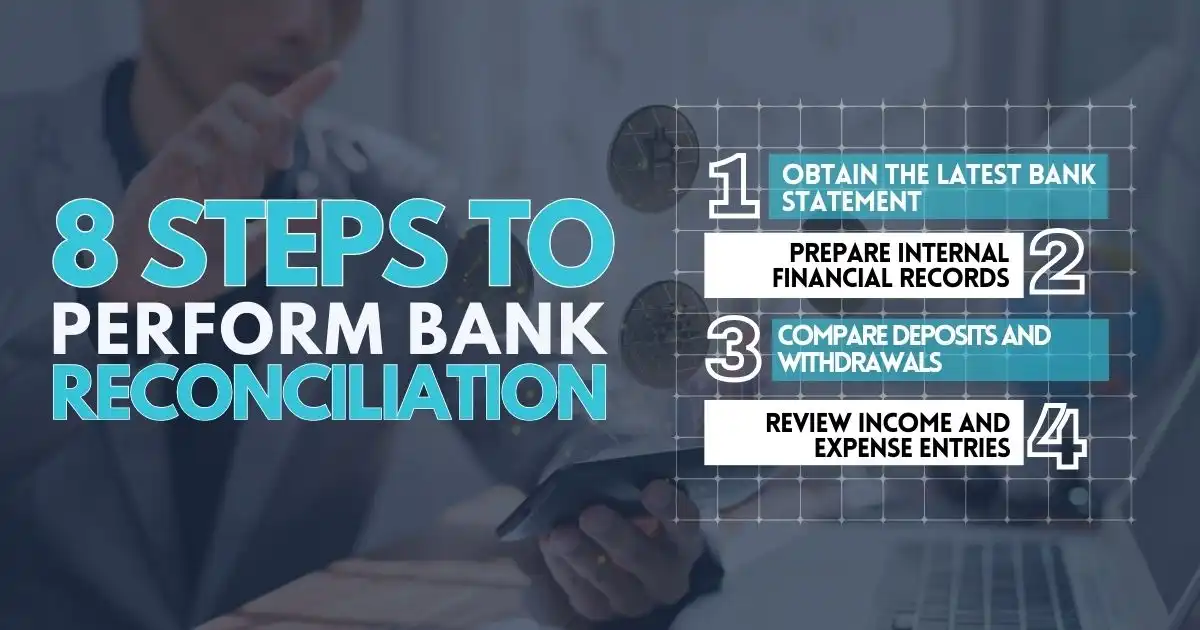

8 Steps to Perform Bank Reconciliation

Bank reconciliation involves comparing a company’s financial records with its bank statement to ensure consistency and accuracy. This process can be managed by a single individual or divided among multiple team members, depending on the size and complexity of the business. Below are eight detailed steps to help guide the reconciliation process:

Step 1. Obtain the Latest Bank Statement

Start by collecting the most recent bank statement. This document should list all transactions, including cleared and rejected checks, bank fees, interest earnings, and any service charges. A clear and complete bank statement is the foundation for an accurate reconciliation.

Step 2. Prepare Internal Financial Records

Gather the company’s internal financial data—usually maintained in accounting software or spreadsheets. Focus on the cash or bank account ledger in the general ledger and compare its ending balance with the ending balance on the bank statement. Ensure that all internal records are up to date before proceeding.

Step 3. Compare Deposits and Withdrawals

Match each deposit and withdrawal on the bank statement with those recorded in the company’s books. This step helps confirm that all transactions are accounted for. If discrepancies are found, investigate their source—mistakes could occur on either the company’s side or the bank’s. Contact the bank if a transaction appears incorrect or missing.

Step 4. Review Income and Expense Entries

Examine all income and expense entries to ensure they are correctly recorded in both the bank statement and internal records. Unrecorded items—such as automatic payments, bank interest, or unexpected fees—should be added to the company’s books during this step.

Step 5. Verify Check Transactions

Check reconciliation often presents challenges. Confirm that all issued checks have cleared and are reflected correctly in the bank statement. Identify any outstanding (uncleared) checks and note them in the reconciliation. If a cleared check doesn’t appear in the company’s records, add it immediately, and if there’s an error on the bank’s end, contact them for resolution.

Step 6. Account for Miscellaneous Transactions

Review any other transactions, such as direct debits, credit card payments, or bank adjustments. These entries are sometimes easy to overlook but must be reflected in your internal records to maintain accuracy.

Step 7. Adjust Internal Records as Needed

After identifying all discrepancies, make the necessary adjustments to your internal accounting records. Add any missing transactions, correct any errors, and update cash balances to reflect the true financial position.

Step 8. Perform a Final Reconciliation Check

Once all adjustments have been made, compare the final adjusted balance in your internal records with the bank statement’s closing balance. The two should now match. If there’s still a difference, review the previous steps to identify any missed transactions or errors, and repeat the process as needed.

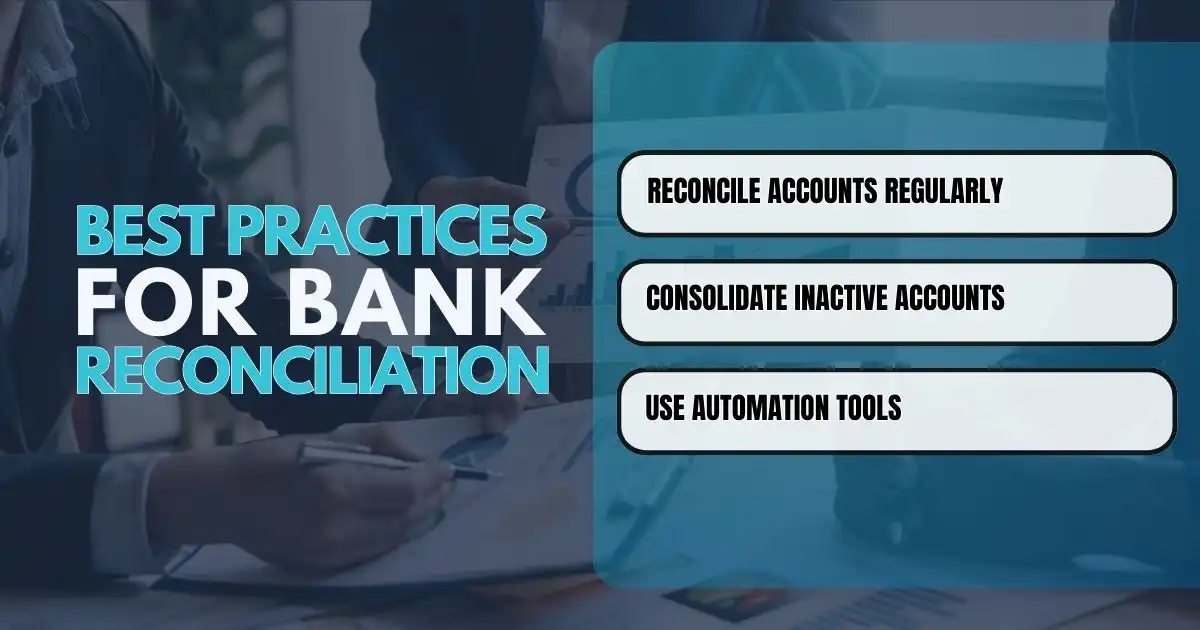

Best Practices for Bank Reconciliation

Bank reconciliation practices can vary depending on a business’s size and complexity. However, the following strategies are broadly effective for maintaining accuracy and efficiency:

Reconcile Accounts Regularly

Irregular reconciliations can lead to confusion and delayed detection of cash flow problems. To avoid this, businesses should aim to reconcile accounts at least monthly—weekly or even daily for high-volume operations like retail or hospitality. Many accounting platforms now offer real-time bank data integration, making frequent reconciliations more manageable.

Consolidate Inactive Accounts

If an account sees little to no activity, consider closing it and transferring the balance to an actively used account. This reduces unnecessary workload and simplifies the reconciliation process.

Use Automation Tools

As a company grows, managing an increasing number of transactions manually becomes inefficient. While accountants remain essential for oversight and decision-making, automation can streamline repetitive tasks. Investing in accounting software with bank reconciliation features can improve accuracy, save time, and support remote financial operations.

Mastering Your Financial Accuracy

If you think skipping bank reconciliation won’t hurt, think again. It’s like leaving the door to your business wide open—eventually, something’s going to slip through. You wouldn’t ignore your cash flow for long, so why let discrepancies fester?

An accurate bank reconciliation isn’t just about balancing numbers; it’s about staying ahead and making smarter decisions for your company.

With the right tools, like accurate bank reconciliation software, you can automate tedious tasks and focus on what really matters. Don’t let outdated processes drag you down. If you’re not already using reconciliation in accounting to your advantage, now’s the time to step up your game.

Make your financial health a priority today, and you’ll be better prepared for tomorrow’s growth. Don’t wait for the numbers to pile up—take control now!

FAQs

What is a bank reconciliation and how does it relate to a bank statement?

A bank reconciliation is the process of comparing your business’s financial records with the bank statement to ensure everything matches. It helps identify discrepancies such as unrecorded transactions, bank fees, or errors. By reconciling regularly, you can maintain accurate financial records and avoid costly mistakes.

Can you provide a bank reconciliation statement example?

A bank reconciliation statement example typically shows the starting balance from the bank statement, then lists adjustments for items like deposits in transit, outstanding checks, or bank errors. The goal is to match the adjusted balance with the company’s internal records to ensure accuracy.

How do I reconcile a check?

To reconcile a check, compare the check’s details with the bank statement. Make sure the check has been cleared and is correctly recorded. If it’s missing or there’s an error, you’ll need to make adjustments in your accounting records or contact the bank for clarification.

How often should you reconcile your bank account?

The frequency of checking account reconciliation depends on your business activity. For most companies, monthly reconciliations work well, but businesses with high transaction volumes, like retail stores, should reconcile your bank account weekly or even daily to ensure accuracy and catch discrepancies early.