If you’re in the market for a financial planning and analysis (FP&A) tool, you’ve probably heard of Planful. It’s one of the heavy hitters in the FP&A world, promising to make budgeting, forecasting, and reporting faster and smarter.

But is it really the right fit for your business—or just another tool that sounds good on paper?

What is Planful?

Planful is a cloud-based tool that helps financial planning and analysis (FP&A) teams manage their work. It makes it easier for teams to plan, make decisions, and spend less time on manual tasks.

While Planful has many features, it might not be the best fit for fast-growing companies that need more advanced financial consolidation and reporting tools. Some of Planful’s main competitors are Cube, Anaplan, Workday Adaptive Planning, and Vena Solutions.

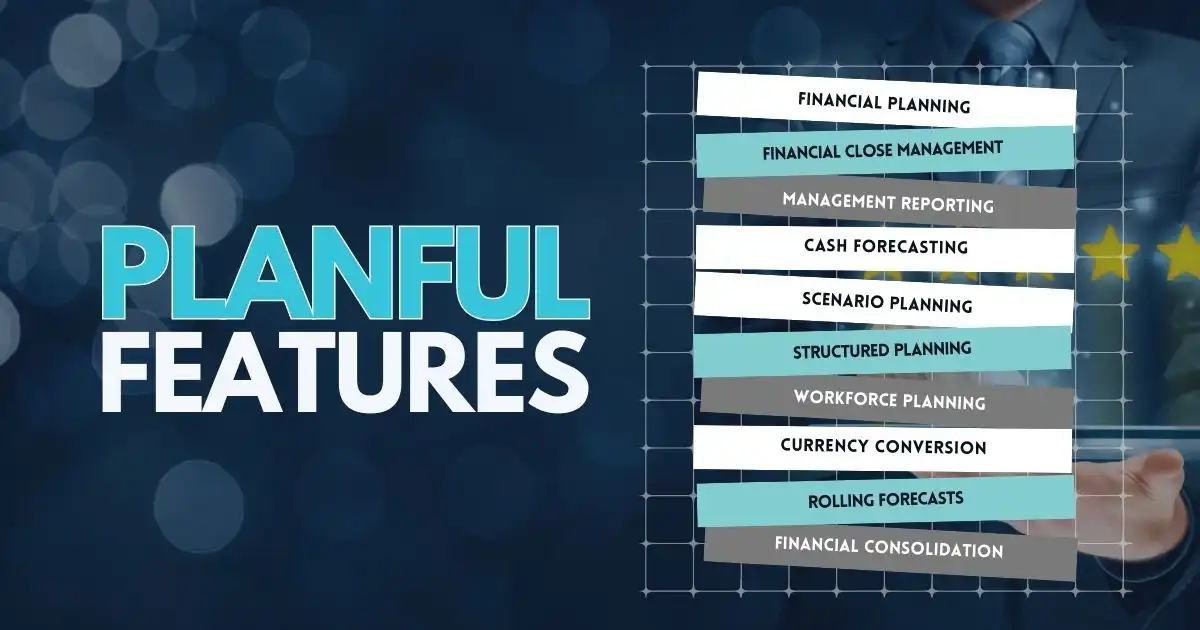

Planful Features

Planful helps FP&A teams save time and automate their work. Some of its main features include:

- Financial planning – Speeds up planning with ready-made templates and smart financial tools.

- Financial close management – Helps automate the process of closing financial records from different sources.

- Management reporting – Lets users quickly create reports to help leaders make decisions.

- Cash forecasting – Helps businesses manage their cash flow, plan ahead, and stay financially strong.

- Scenario planning – Allows users to test different situations and see how decisions could affect their finances.

- Structured planning – Helps companies build yearly plans across different teams and departments.

- Workforce planning – Helps forecast hiring needs and costs while improving teamwork.

- Currency conversion – Lets users set exchange rates for planning and budgeting.

- Rolling forecasts – Provides real-time financial data to support ongoing planning.

Financial consolidation – Combines data from different spreadsheets and systems into one clear source of truth.

Dashboards and Reporting

Planful offers ready-made, automated, and custom reporting tools that help teams find insights and share them easily with others.Its financial and regulatory reporting tools make it easy to create reports and do your own data analysis.

Planful also includes AI-powered tools that help teams find differences in data, create detailed reports, and share them with the right people automatically.

- Financial Close and Consolidation – Planful helps you collect and check your data automatically so you can close your month-end books faster and more confidently. It also speeds up financial closing with built-in reporting tools.

- Financial Planning – Planful automates the process of gathering data, which saves time and reduces mistakes. It also helps your team improve financial skills and brings more useful insights to your business.

- Workforce Planning – You can connect your HR and ERP systems to Planful, bringing all your workforce data into one place.

- Secure Financial Data – Planful has strong security features to keep sensitive information safe. Also, it offers role-based security, audit reporting, and an easy setup for security settings.

- Dynamic Planning – Planful includes a powerful planning tool that supports fast, flexible planning and deep analysis. It works through the web and an Excel-style front-end, making quick custom reports and “what-if” analysis easier.

Who is Planful For?

Planful mainly serves mid-sized companies.While some big companies use it too, small businesses might not need all its features, and very large businesses might find it too basic.

How to Implement Planful

Planful promotes itself as a finance-owned platform, meaning it’s designed to be managed primarily by finance teams without heavy reliance on IT support. However, real-world implementations often tell a more complex story.

While smaller or less complex organizations might manage the setup independently, many businesses—especially those with multiple entities, complex financial structures, or custom reporting needs—find that assistance from IT teams or external consultants is necessary.

Initial setup involves more than just installing software; it requires thoughtful configuration of data integrations, user permissions, workflows, and custom reporting templates. Depending on the size and complexity of the business, this process can take considerable time.

Many consultants estimate that a full implementation typically ranges from 8 to 12 weeks, covering activities like system configuration, data migration, testing, user training, and go-live support.

For businesses with more sophisticated needs, additional phases might include integrating Planful with ERP systems, setting up advanced financial models, and creating automated consolidation processes. Early planning and securing the right internal and external resources can make a significant difference in the overall success and speed of the implementation.

Planful Use Cases

Different departments use Planful:

- Finance teams – To build budgets, forecasts, reports, and do scenario analysis.

- Accounting teams – To close books and combine financial data.

- HR teams – For workforce planning and compensation modeling.

- Marketing teams – To plan budgets and measure marketing returns.

Does Planful Work with Excel?

Planful is not fully integrated with Excel.It uses a separate plug-in called AirliftXL, which only works on Windows 7 and doesn’t support single sign-on (SSO).So, it’s not a direct Excel tool—you’ll need Planful on your machine to use it.

Planful Pricing

Planful doesn’t share its prices publicly.However, it’s said to be cheaper than competitors like Anaplan or Workday Adaptive Planning.It often requires a multi-year contract.

Planful Pros

- Lots of features for mid-sized businesses

- Similar to Excel, so it’s easier for Excel users to learn

- Competitive pricing compared to other FP&A tools

Planful Cons

- Difficult setup process, often needing external help

- Slow data pulling and complicated reporting

- Steep learning curve with a dated user interface

- Mixed customer service reviews

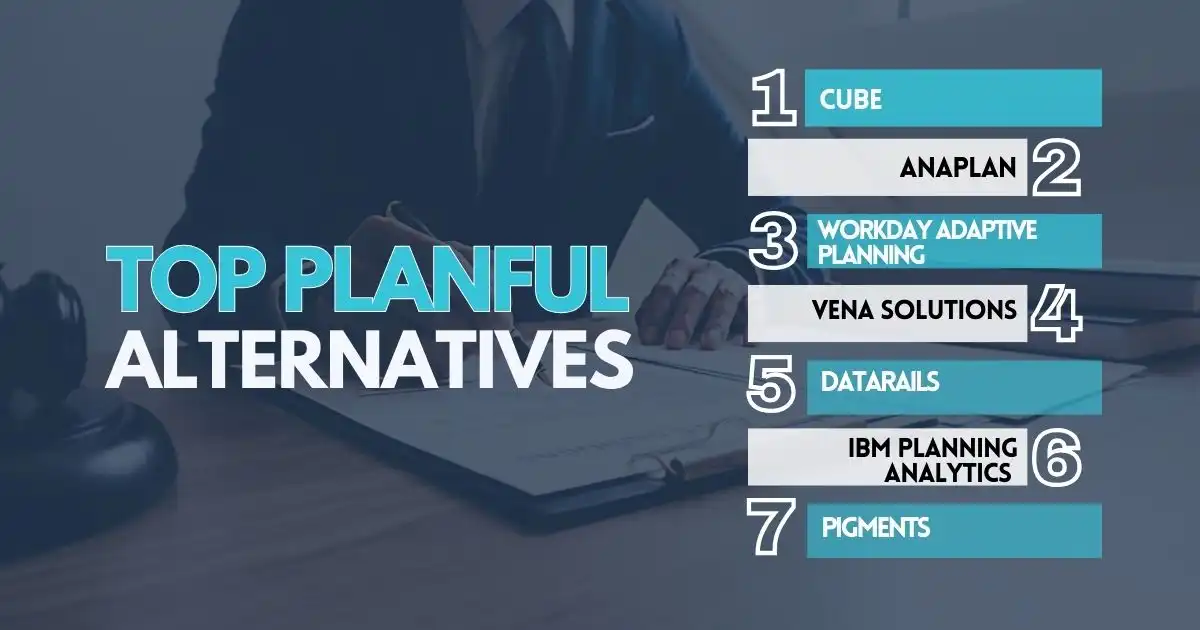

Top Planful Alternatives

If Planful doesn’t seem right, here are other options:

- Cube – Cloud FP&A tool with true Excel and Google Sheets integration. Faster setup and easy reporting.

- Anaplan – Great for big businesses, helps with real-time data planning but can be slow and less flexible.

- Workday Adaptive Planning – Good for large companies that need full workforce and operational planning.

- Vena Solutions – Strong financial planning tool, but has a learning curve and can be pricey for smaller companies.

- Datarails – Best for companies that already use Excel and want to automate financial reporting.

- IBM Planning Analytics – Great for companies needing deep financial modeling with AI support.

- Pigment – Good for growing startups and mid-sized businesses that need scalable financial planning.

Planful Reviews: Is It the Right FP&A Tool for Your Business?

Planful offers a strong set of tools for financial planning and analysis, making it a solid choice for mid-sized companies that want to automate workflows and boost financial accuracy. With standout features like dynamic planning, cash forecasting, and detailed management reporting, it can bring real value to finance teams.

However, its complex setup process, slower data handling, and steep learning curve mean it may not be the best fit for fast-growing businesses that demand agility and faster scaling.

If you’re a mid-market company looking for a cost-effective FP&A solution that feels familiar to Excel users, Planful deserves a close look. But if you prioritize faster deployment, deeper integrations, and a modern user experience, platforms like Cube, Anaplan, or Workday Adaptive Planning might better serve your needs.

Choosing the right FP&A solution can shape the future of your business. Don’t settle—invest in a platform that will grow with you.

FAQs

What is the pricing for Planful software?

Planful’s pricing depends on your business’s specific needs, such as the number of users and required features. It’s best to contact Planful directly for a personalized quote.

Where can I find Planful reviews?

Planful reviews are available on popular review sites like G2, Capterra, and TrustRadius. Also, these reviews can give you a better understanding of user experiences and the software’s pros and cons.

What features does Planful software offer?

Planful offers tools for budgeting, forecasting, financial reporting, and performance management. Also, it’s a versatile platform for businesses looking to improve financial planning and analysis.

What is Planful Perform, and how does it help businesses?

Planful Perform is designed to help businesses align financial plans with their strategic goals. Also, it allows teams to track performance in real-time and adjust plans based on key performance indicators (KPIs).