Every strong company starts with a clear plan, and that includes how to manage money. Business planning and budgeting aren’t just about numbers on a spreadsheet; it’s about guiding your business in the right direction with purpose.

When you build your budget the right way, you give your team the tools to make smarter choices, use resources wisely, and prepare for what’s next. It’s not about perfection—it’s about setting a path you can follow and adjust along the way.

So, how do you prepare a budget for a company that supports your goals and adapts to changes?

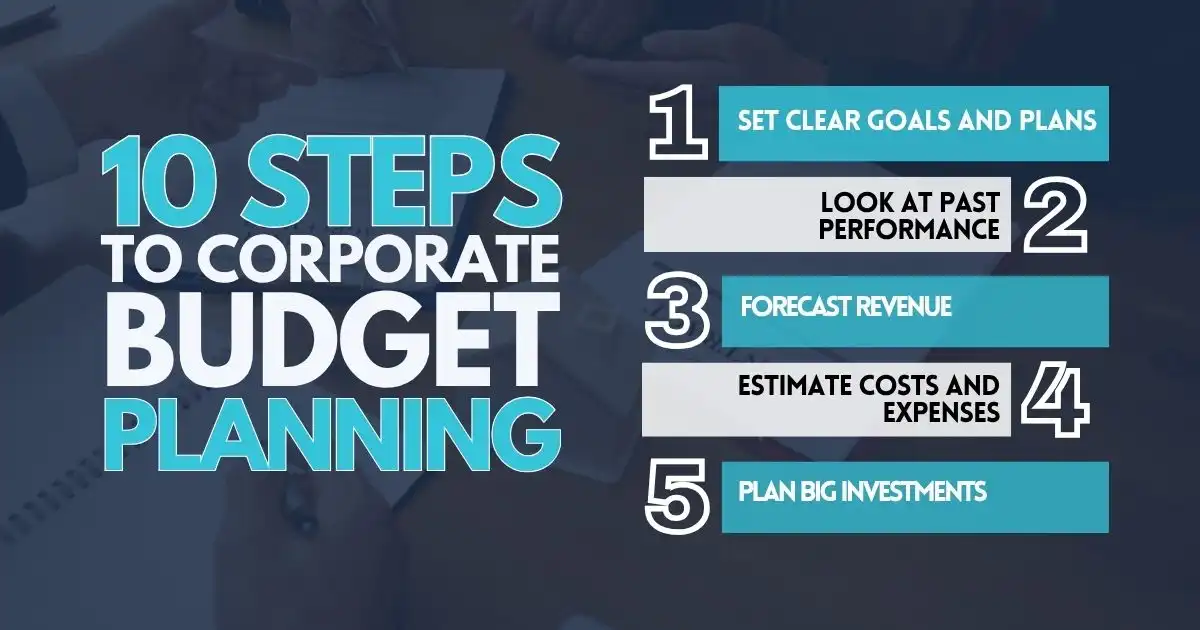

10 Steps to Corporate Budget Planning

Corporate financial planning enables businesses to manage their spending and investments in alignment with their goals and current market conditions. The process usually follows these 10 simple steps:

1. Set Clear Goals and Plans

Begin by establishing specific financial goals that align with the company’s overarching vision. These goals can include increasing sales, reducing expenses, entering new markets, or improving returns from investments.

These goals should be realistic but ambitious. To get the best results, involve different departments in setting them. That way, the goals reflect the company’s capabilities, current market conditions, and plans for the future.

Once goals are in place, create a plan that shows how the company will use its resources to reach them. This plan should explain how the company will increase revenue, manage costs, make smart investments, and reduce financial risks.

A good plan is based on current data and industry knowledge and should be flexible enough to adapt if situations change. Setting clear goals and following a smart plan helps the business stay focused and financially strong over time.

2. Look at Past Performance

Before planning for the future, it’s helpful to understand what happened in the past. This step involves reviewing financial statements, such as income statements, balance sheets, and cash flow reports, as well as business results.

The goal is to spot patterns and unusual results that can guide better decisions going forward. For example, if actual revenue was much lower than expected, it’s important to understand why. Was it due to market changes, internal issues, or unexpected events?

Looking at past expenses can also show where money was wasted or spent well. Finding out what worked allows companies to repeat success, while spotting what didn’t helps them avoid mistakes.

This review encourages accountability and helps every team set goals based on real results, not guesses. It lays the groundwork for smarter budgeting in the next cycle.

3. Forecast Revenue

Forecasting revenue means estimating how much money the company will earn in the future. This helps in setting goals, planning spending, and guiding growth efforts.

To build forecasts, companies look at past sales, market trends, and outside factors like the economy or competition. They also consider seasonal changes and new product launches.

These forecasts are updated regularly to reflect new information. This allows businesses to adjust quickly and make better decisions in areas like staffing, marketing, and resource planning.

Accurate forecasts help set realistic targets and keep spending plans on track.

4. Estimate Costs and Expenses

This step helps companies plan how much they expect to spend. It includes both fixed costs (like rent and salaries) and variable costs (like materials and shipping).

Looking at past spending helps predict future needs. Companies also factor in upcoming projects or changes that could increase or decrease costs.

They must also think about outside factors such as price changes in materials or legal changes affecting labor costs. It’s also smart to leave some room for surprise expenses.

Cost planning isn’t just about guessing numbers—it’s about understanding how spending supports the business and preparing for the road ahead.

5. Plan Big Investments

Capital budgeting is about choosing which large investments are worth making. These could include new equipment, software, or property—things that require a lot of money upfront but help the business grow over time.

To decide which projects to invest in, companies use tools that help estimate costs, benefits, and risks. The goal is to pick projects that match the company’s goals and bring strong long-term value.

This step also looks at how these investments may affect financial health and whether they fit into the company’s bigger strategy. Teams from different departments often work together to make sure plans are realistic and well thought out.

6. Distribute Resources

After planning costs and investments, companies need to decide where the money will go. This step ensures each team or project gets the funds it needs to do its job well.

Leaders decide how to divide money based on priorities, potential return, and overall business needs. Some areas may need more funding for growth, while others need just enough to keep running smoothly.

This process involves reviewing needs carefully, comparing options, and staying flexible. As things change, companies may shift funds to better support key goals.

7. Create Budget Drafts

Once the planning steps are done, teams put together the first version of the budget. This draft includes expected income, costs, and investments for the next year.

Each department gives input to make sure their needs and goals are reflected. Finance teams help bring all the numbers together and check for consistency.

The draft serves as a working plan. It may go through several updates as new information becomes available or adjustments are needed. This back-and-forth helps build a budget that is both realistic and aligned with business goals.

8. Review and Finalize the Budget

Before the budget is official, it goes through a careful review. Senior leaders check if the numbers are sound, the goals are reasonable, and the resources are well allocated.

They review the assumptions behind the plan, check the revenue and spending estimates, and make sure the plan supports the business’s top priorities.

After any needed changes, the budget is approved by leadership. This makes the plan official and signals to the whole company what the financial goals and direction will be for the next period.

9. Put the Budget into Action

Once approved, the budget is shared across departments so each team knows their targets and what resources they can use.

At this stage, systems are put in place to track income and spending. Managers begin using the budget to guide their decisions.

This step is not just about following the plan—it also involves staying ready to adjust if things change. Clear communication and regular check-ins keep everyone aligned.

10. Track and Review

Throughout the year, companies regularly check how they’re doing compared to the budget. If income or costs vary from the plan, teams look into why and make updates as needed.

This review helps spot issues early, make informed changes, and prepare better for the future. It also builds a sense of responsibility across departments, since everyone works together to meet financial goals.

By continuing to track and adjust, companies improve their planning and stay financially strong.

Turn Planning Into Progress

A well-built budget doesn’t just keep spending in check—it sets the pace for everything that follows. It shapes how you make decisions, where you invest, and how your teams move forward with confidence.

The steps are clear, but what makes them work is action. Don’t wait for the perfect moment or flawless numbers. Start with what you know, involve your teams, and shape a plan that reflects your goals and challenges.

Every smart financial decision starts with knowing how to prepare a budget for a company. So, what will you adjust, prioritize, or commit to today to help your business grow with purpose? The next move is yours.

FAQs

How do you prepare a budget for a company?

Start by reviewing past financial data, estimating future revenue, and identifying all expected expenses. Then, organize this information into categories and create a monthly or quarterly budget that aligns with your company’s goals.

What’s an example of a company budget?

A typical company budget might include revenue projections, cost of goods sold, operating expenses (like rent, salaries, and utilities), and a profit forecast. It often breaks down into departments, allowing each team to track and manage its own spending.

What are some smart finance strategies for businesses?

Good finance strategies include managing cash flow closely, cutting unnecessary expenses, setting realistic financial targets, and building a safety buffer. Regular reviews and adjustments help the business stay on track.

What’s involved in the corporate financial planning process?

The process includes setting financial goals, forecasting income and expenses, allocating resources, and tracking progress. It also involves analyzing risks and planning for different scenarios to help guide decisions throughout the year.