Every business spends money, but not all expenses work the same way. Some costs keep things running each day, while others support long-term plans. That’s the difference between operating expenses and capital expenditures.

Knowing how each one works helps you plan better, manage cash flow, and make informed decisions.

So, how do these two types of spending shape the way a business operates and grows?

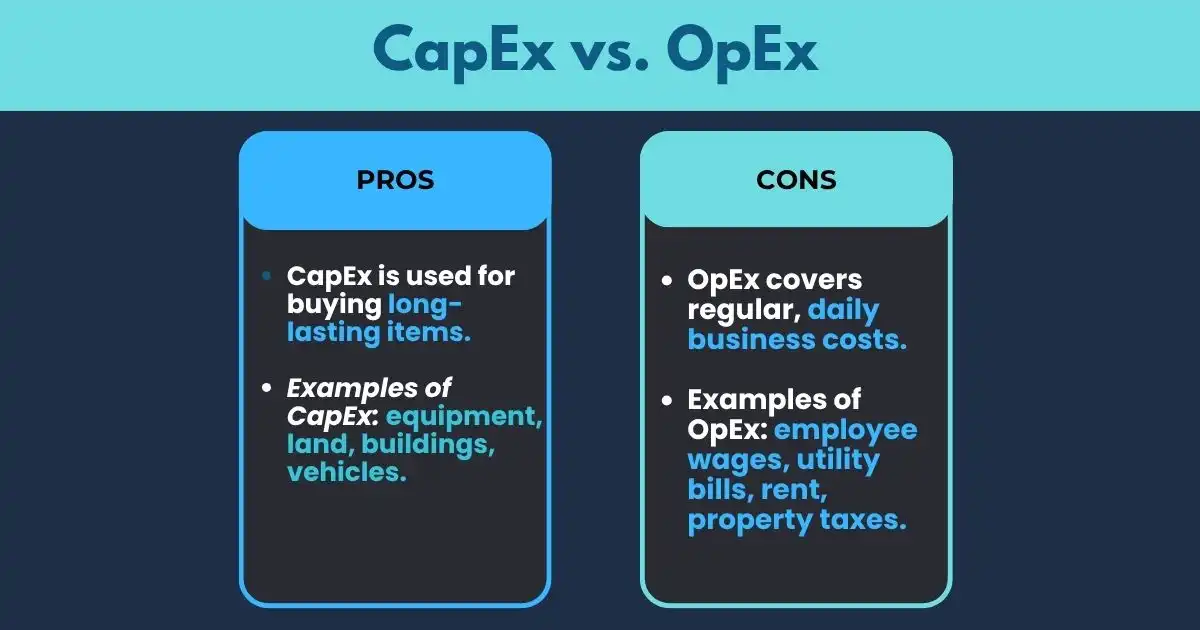

CapEx vs. OpEx: What’s the Difference?

Businesses spend money in different ways to keep things running and to grow. Two common types of spending are Capital Expenditures (CapEx) and Operating Expenses (OpEx).

CapEx refers to big purchases that a business makes to help it in the long run. These are usually things the company will use for many years, like buildings, machines, or vehicles.

OpEx, on the other hand, refers to the everyday costs a business pays to stay open. These include things like rent, salaries, and electricity bills.

Main Points to Know

- CapEx is used for buying long-lasting items.

- OpEx covers regular, daily business costs.

- Examples of CapEx: equipment, land, buildings, vehicles.

- Examples of OpEx: employee wages, utility bills, rent, property taxes.

- Items paid for with OpEx are usually used up within a year, while CapEx items help the company for several years.

- CapEx can’t be subtracted from income for tax purposes, but OpEx can.

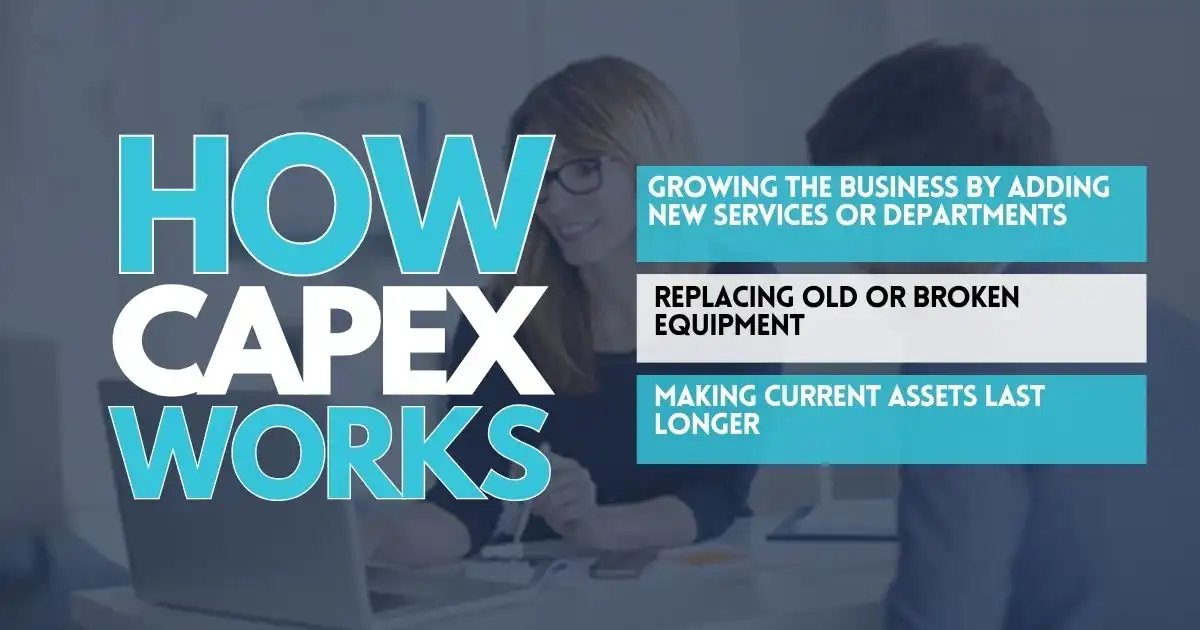

How CapEx Works

Capital expenditures are usually large purchases made to improve how a company works in the future. These are often physical items—also known as fixed assets—such as land, machines, or company vehicles. CapEx can also include non-physical items like patents or software.

One key thing about CapEx is that the item should last more than a year. That’s what separates it from regular business spending.

Companies spend on CapEx for reasons like:

- Growing the business by adding new services or departments

- Replacing old or broken equipment

- Making current assets last longer

To pay for CapEx, companies might use loans, issue bonds, or borrow money using their assets as security. Investors also watch CapEx numbers closely because they show how a company is planning for the future while still making a profit today.

How CapEx is Reported

You’ll find CapEx listed on a company’s balance sheet under Property, Plant, and Equipment (PP&E). It also appears in the investing section of the cash flow statement.

Since CapEx items usually last a long time, companies don’t record the full cost in one year. Instead, they depreciate the cost over several years. This helps reduce the impact on profits in the year the item was bought.

Examples of CapEx

Here are common things companies spend CapEx on:

- Machines used in manufacturing

- Office or factory buildings

- Delivery trucks or company cars

- Computers and IT equipment

- Renovations or building upgrades

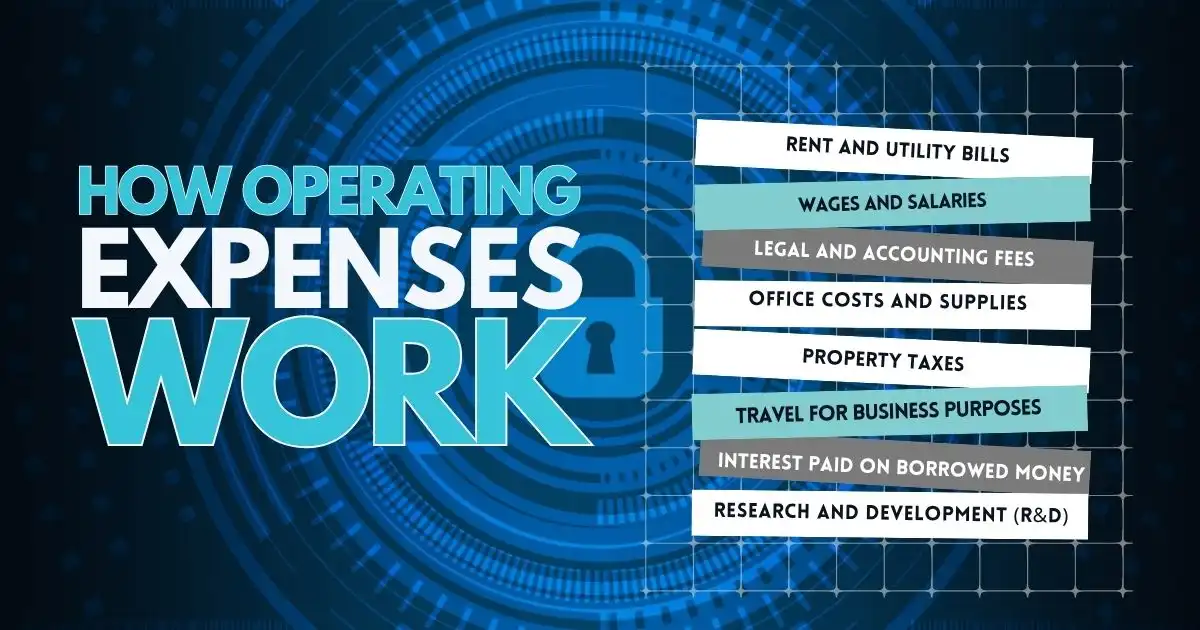

How Operating Expenses (OpEx) Work

Operating expenses are the regular costs a business pays to keep running each day. These do not include the costs of making goods or services. Instead, they cover the usual costs a company faces based on the kind of business it is.

These costs are part of normal business activities. A company becomes more productive by getting more work done while keeping these expenses under control. That’s why OpEx is often used to measure how efficiently a company operates.

Common Examples of OpEx:

- Rent and utility bills

- Wages and salaries

- Legal and accounting fees

- Office costs and supplies

- Property taxes

- Travel for business purposes

- Interest paid on borrowed money

- Research and development (R&D)

How Operating Expenses (OpEx) Is Reported

Operating Expenses (OpEx) are reported on a company’s income statement, which summarizes the revenues and expenses over a specific accounting period—typically quarterly or annually. These expenses include day-to-day costs required to run the business, such as salaries, rent, utilities, office supplies, marketing, and maintenance.

One of the defining features of OpEx is how it is recognized and accounted for:

- Expensed in the same period – Unlike CapEx, which are capitalized and then depreciated or amortized over time, OpEx is fully deducted in the accounting period in which the expense is incurred. This provides a more immediate impact on a company’s profitability and net income.

- No depreciation or amortization – Since OpEx does not involve the purchase of long-term assets, there is no depreciation or amortization schedule involved. The entire cost is recorded as an expense when it occurs.

This treatment affects financial performance metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and operating margins, making it important for stakeholders to distinguish between recurring operational costs (OpEx) and long-term investments (CapEx).

In summary, OpEx appears prominently on the income statement and is used by analysts and investors to assess the company’s operational efficiency and cost structure in real time.

Important Accounting Notes

In some cases, the way a cost is recorded depends on the company’s accounting method. For example, if a business leases a machine, that lease payment is usually counted as OpEx. But if the company buys the machine, it becomes CapEx.

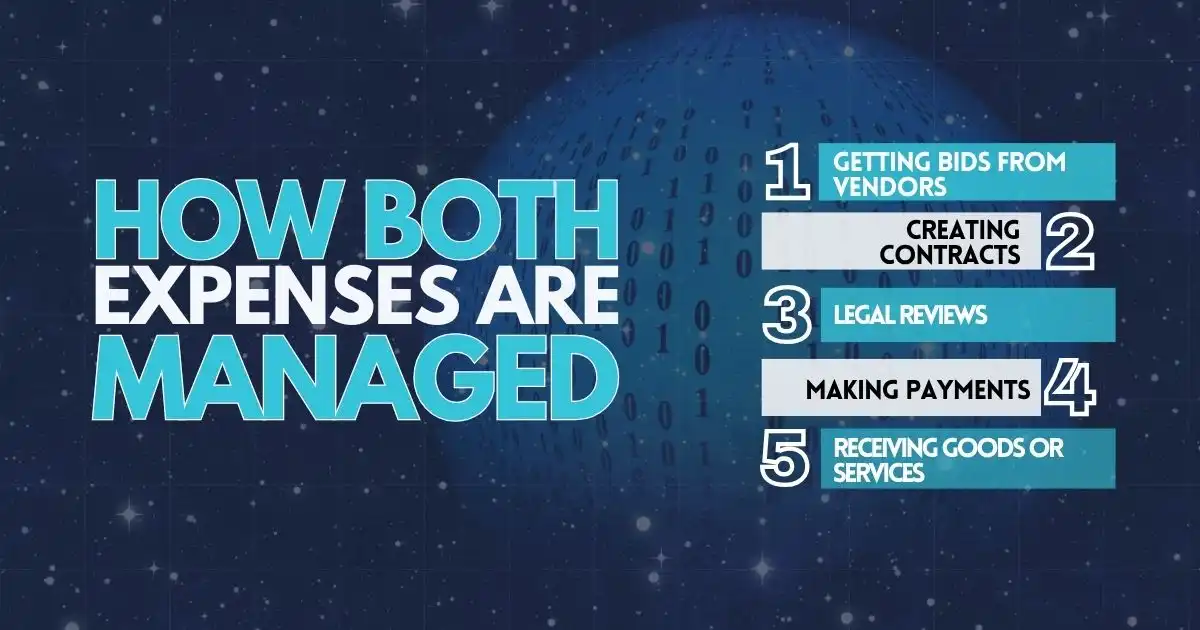

How Both Expenses Are Managed

Both CapEx and OpEx involve spending money and may follow similar steps, such as:

- Getting bids from vendors

- Creating contracts

- Legal reviews

- Making payments

- Receiving goods or services

Each type of cost affects income differently. OpEx lowers profit right away, while CapEx spreads out its cost over time through depreciation.

Companies usually plan for both types of expenses separately. Each one may have its budget, forecast, and team managing it.

Examples

CapEx – A company buys a new building or a delivery truck. These have been used for many years and help the business in the long run.

OpEx – A company pays rent, employee wages, or utility bills. These are needed to keep the business going day by day and help only in the short term.

CapEx or OpEx—Which One to Use?

Both are important for different reasons. If a business wants to grow and plans to use something for years, it may spend more on CapEx. If the goal is to stay flexible and manage cash flow easily, it might use OpEx instead. The right choice depends on what the company needs at the time.

Use What You Spend to Shape What You Build

Understanding CapEx and OpEx isn’t just about knowing the terms—it’s about using them to make better choices. Every cost should serve a clear purpose: either to keep your business moving or to build something stronger for tomorrow.

If you want to manage money wisely, don’t treat all expenses the same. Think carefully about what your business needs now and what will keep it moving forward later. Plan each expense with intention. Review spending patterns. Talk with your team. Ask if that cost helps your business grow, operate more efficiently, or solve a real problem.

Good decisions today set the path for stronger results tomorrow. Start using what you know about CapEx and OpEx to guide those decisions—one line item at a time.

FAQs

What is the difference between capital expense and operating expense?

Capital expenses (CapEx) are long-term investments in assets like equipment or buildings that provide value over time. Operating expenses (OpEx) are the day-to-day costs of running a business, such as rent, salaries, and utilities.

Can you give an example of capital expense vs operating expense?

Buying a company vehicle is a capital expense because it’s a long-term asset. Paying for fuel and regular maintenance of that vehicle is an operating expense, as these are recurring and necessary to keep the business running.

What are some common examples of operating expenses (OpEx)?

Typical operating expenses include rent, office supplies, utilities, payroll, and marketing costs. These are essential to maintaining daily operations and are fully deductible in the year they’re incurred.

Why is it important to distinguish between CapEx and OpEx in finance?

Separating CapEx and OpEx helps in budgeting, financial reporting, and tax planning. CapEx affects the balance sheet and depreciates over time, while OpEx impacts the income statement directly and reduces taxable income immediately.