Some people believe that finance is more important than accounting, thinking it drives business success. However, this view overlooks how important accounting is in keeping financial records and ensuring everything is correct.

Without strong accounting practices, finance strategies can easily fail. Both areas play essential roles, and understanding their differences can help your business thrive. What do you think? Can you see the value in both accounting and finance?

What is Finance?

The finance field focuses on managing money and investments for individuals, companies, and governments. Finance professionals work in areas like investment banking, wealth management, and financial planning.

Their main job is to ensure there is enough capital for different needs and to use that money wisely. They aim to create value by managing funds in a way that produces good returns while keeping risks in mind.

Importance and Role of Finance in Business

Finance is important for businesses because it helps them achieve their financial goals. It includes different activities to manage and make the most of available resources. Managing cash flow is key to ensuring there is enough money for daily expenses. Finance also helps with investment choices, guiding companies to select assets that can earn returns.

Moreover, finance plays a big part in managing risks by looking at market trends and finding ways to reduce risks while keeping revenue steady. Good financial management, if it is done internally or with outside help, is essential for businesses to succeed in a competitive and uncertain economy.

What is Accounting?

Accounting is about managing a company’s finances by tracking money, recording financial activities, and preparing reports. Accountants can work alone, for businesses, or at public accounting firms.

Their main job is to ensure that all financial transactions are recorded accurately, account balances are correct, and financial statements are precise.

Importance and Role of Accounting in Business

Accounting is very important for businesses and is often referred to as the “Language of Business.” It involves recording, summarizing, and analyzing financial transactions, helping owners, managers, and investors understand a company’s financial health. This information is essential for making smart business decisions.

Accounting is needed to keep track of a business’s activities, like assigning costs to products or services, creating budgets, and preparing financial reports. These reports can be tailored to support specific financial strategies for different areas of your business.

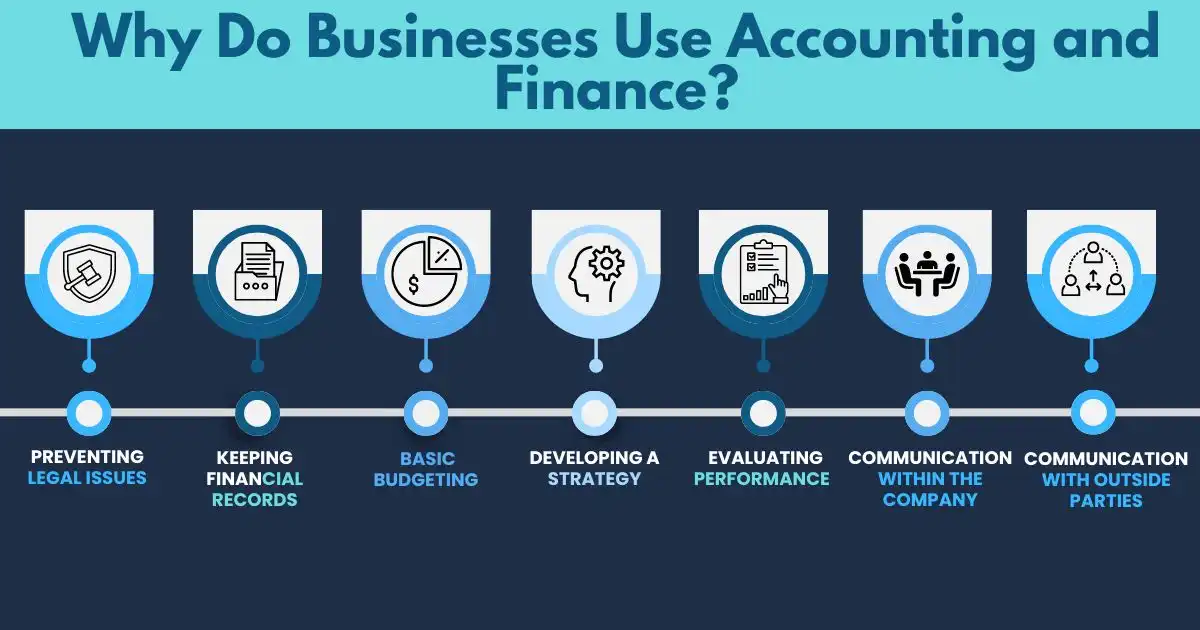

Why Do Businesses Use Accounting and Finance?

Managing your business’s accounting and finances is essential. Without a clear view of your cash flow, you could lose control of your business. Effectively managing income and expenses not only encourages growth but also gives you strategies to handle unexpected financial issues.

1. Preventing Legal Issues

Precise financial records are essential for following business laws. Missing even small details can lead to significant tax problems; the IRS estimates that 1 in 3 small businesses is audited.

Financial managers must know which expenses can be deducted, how much tax is due, and when to pay. Poor record-keeping can result in audits and legal troubles, with businesses facing penalties averaging $9,000 per audit.

2. Keeping Financial Records

Keeping financial records is like maintaining a diary of a company’s finances. The ledger, where accountants and business owners record income and expenses, is key for tracking daily activities.

Accurate financial records help businesses plan for the future and understand their cash flow. According to a QuickBooks survey, 40% of small business owners say they struggle with financial record keeping.

3. Basic Budgeting

Using financial records and understanding cash flow is vital for creating a budget, which helps keep your business on track. A budget gives a current view of your financial situation and guides your business toward growth.

Research from the U.S. Small Business Administration shows that businesses with a budget are 30% more likely to achieve their goals. When making a budget, consider net income, expenses, goals, and unexpected changes.

4. Developing a Strategy

Effective accounting and finance management leads to strong strategies. With a budget and detailed data analysis, it’s easier to create a plan to meet your goals.

According to a Deloitte report, 73% of companies consider financial data analysis essential for strategy development. Reviewing financial records enables informed decision-making in areas like staffing and supply management.

5. Evaluating Performance

Successful business owners regularly review their company’s performance. Analyzing past and current records of assets, liabilities, and other financial elements helps assess the company’s health.

A study by the Harvard Business Review found that companies that monitor their financial performance closely grow 25% faster than those that don’t. Learning from past mistakes allows for informed decisions that lead to a brighter future.

6. Communication Within the Company

Financial reporting is essential for sharing information with internal stakeholders. Employees interested in profit-sharing and stock options find this information useful.

A survey by Glassdoor shows that 82% of employees feel more engaged when their company shares financial information. Financial records help owners communicate their business’s strengths and weaknesses to their teams, fostering transparency and collaboration within the organization.

7. Communication with Outside Parties

Clear accounting and finance management are important when interacting with external parties. Well-kept financial records are valuable for securing loans or attracting investors.

Approximately 70% of small businesses fail due to cash flow problems, so good financial management allows you to provide accurate financial statements to external stakeholders, helping them make informed decisions about their involvement with your business.

Function of Financial Statements

Finance and accounting professionals have distinct roles when it comes to financial statements. Accountants mainly create the statements, while finance professionals primarily analyze them.

Corporate Functions

Here are the main corporate functions in finance and accounting:

1. Finance

- Funding the business

- Raising capital (debt and equity)

- Optimizing the firm’s Weighted Average Cost of Capital

- Seeking the best risk-adjusted returns

- Corporate strategy

- Budgeting and forecasting

- Mergers and acquisitions

- Accounting

2. Bookkeeping

- Tracking of revenues and expenses

- Internal reporting

- Financial reporting

- Auditing

- Risk management

Clientele Differences

Both accounting and finance experts serve individuals, businesses (corporations), governments, and non-profit organizations as clients. However, there are notable distinctions in their employment preferences. The primary opportunities for each group are outlined below.

1. Finance

- Banks (retail, commercial, and investment)

- Insurance companies

- Research companies

- Operating companies (regular businesses)

2. Accounting

- Public accounting firms (conducting audits for large companies)

- Firms specializing in personal tax filing

- Operating companies (businesses)

Distinguishing Traits

Accounting and finance careers attract different types of personalities. Here are the key traits for each:

1. Finance

- Analytical

- Inquisitive

- Pays high attention to detail

- Thinks about scenarios

- Focused on adding value

- Possesses business development skills

- Strong problem-solving abilities

2. Accounting

- Accountable

- Detail-oriented

- Uses rules-based thinking

- Emphasizes risk management

- Procedure-oriented

- Prioritizes accuracy

Different Roles, Shared Success

Many people think accounting and finance are the same, but they actually serve different purposes. Accounting tracks financial transactions and ensures compliance, while finance focuses on making smart decisions to grow wealth. Some might say finance is more important, but without strong accounting, financial strategies can fail.

Both accounting and finance are essential for a business’s success. Understanding their distinct roles helps you make informed financial decisions. Instead of seeing them as separate, recognize how they work together to build a strong financial foundation.

FAQs

What is the difference between accounting and finance?

While accounting and finance may go together, there are key differences: accounting focuses on the flow of money and out of a company or family, while finance is a more broad term that describes how one manages assets and liabilities.

Which is better finance or accounting?

Finance professionals handle areas like return on investment (ROI) and risk management, while accountants focus on documents like balance sheets and income statements. The finance field provides more job options but can be less predictable. Sometimes, jobs in finance may also pay more.

Is finance harder than accounting?

Is finance harder than accounting? Accounting depends on exact math rules, which can make it more complex. In contrast, finance involves understanding economics and accounting but doesn’t require as much focus on detailed math.

What is the difference between accounting and financial management?

Accounting is the process of tracking and recording a business’s money transactions. On the other hand, financial management helps businesses use their money and assets wisely to reach their financial goals.