We hear a lot about how technology is reshaping jobs, but what does this mean for financial analysts?

It’s a question on the minds of many professionals and students considering a future in finance.

With Artificial Intelligence (AI) systems getting smarter every day, it’s natural to wonder if the role of a financial analyst—someone who digs into numbers, makes sense of data, and helps guide businesses—will become unnecessary.

Will AI replace financial analysts entirely, or is there more to the story?

What Is a Financial Analyst?

A financial analyst helps companies or clients decide where to invest their money. They conduct research by examining financial data, studying market trends, reviewing financial reports, and creating models to predict future outcomes.

Some analysts focus on the overall economy, while others specialize in specific industries. This job requires strong math and analytical skills. Financial analysts work for large organizations such as investment banks, insurance companies, mutual funds, and government agencies.

AI Helps Analysts Work Smarter, Not Harder

AI can’t replace the knowledge and skills of a financial analyst. But, like in many other fields, technology has changed how we handle work and solve problems.

Working faster and better

AI can quickly process huge amounts of data, saving time that a human analyst would need to do the same job. This means analysts can spend more time on important tasks, like making decisions from the data, instead of just processing it.

Fewer mistakes

When people do financial analysis, mistakes can happen. But with AI, which uses well-designed systems to analyze data, the chances of errors are much lower. AI helps create more accurate and reliable analysis, which helps make financial decisions.

Seeing the future

AI is good at spotting patterns and trends that people might miss. This helps businesses make predictions about things like market changes and customer behavior, so they can stay ahead of the competition.

Better customer service

AI tools, like chatbots, can give clients fast answers to their questions. These systems can also provide data analysis on the spot, helping businesses make decisions based on real information.

This leads to:

- Happier customers

- Better business efficiency

- Stronger business results overall

AI Can Improve Financial Analysis

Instead of worrying about what AI might take away from financial analysts, let’s focus on what it can add and how it makes their work easier and more effective.

Better Data Visuals

AI tools like Datarails can take complicated data and turn it into easy-to-understand charts and visuals. This makes it simpler for analysts to understand the information and make better decisions, which is especially useful during budgeting.

Live Updates

AI-powered financial tools can provide real-time updates, helping businesses quickly respond to market changes.

Combining Data from Different Places

AI can bring together information from many sources, which means the analysis includes all the important data for a complete picture.

Testing Different Scenarios

AI has the power to test many different situations at once, helping analysts see possible outcomes and make better decisions about risks.

The Limits of AI in Finance

AI is powerful, but it still has some gaps that it hasn’t filled yet. Here are follows:

Lack of Personal Touch

One of the biggest downsides of AI is that it can’t understand human emotions or show empathy. This is especially important in finance, where building trust and strong client relationships matters a lot.

Without understanding feelings, AI might have trouble handling tricky financial situations or giving clients the kind of personal support they need. Finding ways to combine AI with human empathy is still a challenge.

Ethical Concerns

There are also questions about if using AI in decision-making is always fair. This is a big deal in finance, where decisions can have a big impact on people’s lives. If AI isn’t programmed or monitored properly, it could reinforce existing biases or treat people unfairly.

So, businesses need to think carefully about ethical issues before depending completely on AI for financial decisions. Like any technology, AI needs to be used responsibly, with ongoing checks to avoid any negative impacts.

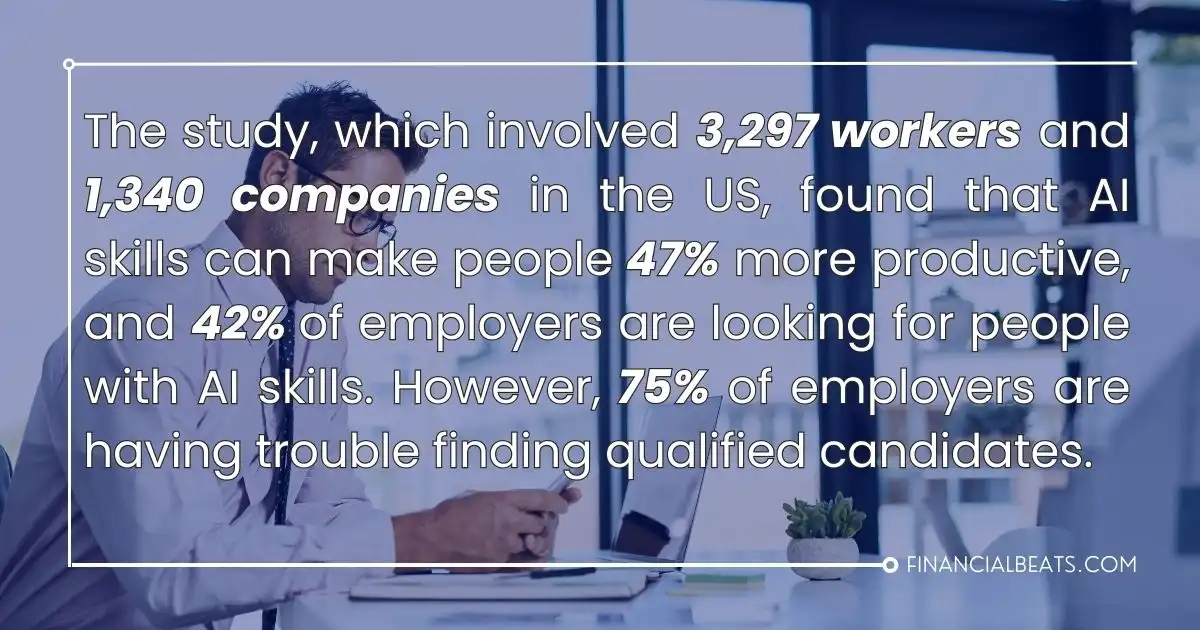

Better Pay for Employees Who Know AI

A recent study by AWS shows that having AI skills could boost salaries by at least 35%. For companies, it’s a good idea to train employees in AI, and for individuals, learning AI could be very beneficial.

The study, which involved 3,297 workers and 1,340 companies in the US, found that AI skills can make people 47% more productive, and 42% of employers are looking for people with AI skills. However, 75% of employers are having trouble finding qualified candidates.

This need for AI skills isn’t just for older employees—over 80% of younger workers (like Gen-Z and Millennials) are interested in learning AI, and even about two-thirds of older workers (Boomers) would take an AI course if their company offered it, even though they are nearing retirement. Now is the perfect time for companies and individuals to invest in AI skills.

Humans vs. Machines in Financial Analysis

Regarding financial analysis, both humans and machines have their strengths.

Skills That Only Humans Have

Even with all the progress in AI, there are some skills that only human financial analysts can bring. These include critical thinking, ethical judgment, and solving complex problems. Financial analysts need to understand the numbers and the bigger picture—like the economic, political, and social factors behind the data.

Example

During the 2008 financial crisis, analysts who could see beyond the numbers and understand the bigger economic changes were very valuable.

How AI and Humans Work Together

Instead of seeing AI as a replacement, it’s better to think of it as a helpful tool. AI can do the initial data analysis, and then human analysts can use their deeper understanding to make smart decisions. This teamwork uses the strengths of both: AI provides speed and accuracy, while humans bring critical thinking and creativity.

Real-Life Use

In many companies, AI systems point out possible investment opportunities, but human analysts make the final decision by considering factors that AI may not fully understand.

The Future of Financial Analysts and AI

AI is changing how financial analysts do their jobs, but it won’t replace them completely. Instead, analysts will work alongside AI, using it as a tool to make better, faster decisions.

Changing Job Roles

The role of a financial analyst isn’t going away, it’s just changing. With AI taking over many routine tasks, financial analysts now need skills in data science, machine learning, and using AI tools. Instead of just creating reports, they need to understand and interpret what AI produces.

Career Tip

“Financial analysts should focus on learning AI skills and improving their strategic thinking to stay relevant.” — Career Coach

Looking Ahead

It’s hard to know exactly how AI will change financial analysis, but one thing is clear: AI will keep becoming more important. Experts agree that AI will be a regular part of financial analysis, much like computers replaced old paper ledgers.

Expert Opinion

“AI will become as essential to finance as spreadsheets; analysts need to adapt to keep up.” — Finance Professor

AI’s About to Turn the Tables!

AI is changing the way financial analysis works, but it won’t fully replace human analysts. While AI can quickly process lots of data and make fewer mistakes, it still can’t think like a human.

Financial analysts are important because they understand how different factors, like the economy or world events, impact businesses. When AI and humans work together, they can make better decisions, with AI handling the data and analysts focusing on smart choices.

With continuous improvements in AI, financial analysts need to learn new skills to work with it. Instead of worrying about losing their jobs, analysts can use AI to work faster and more effectively. For those considering a career in finance, building skills in data science and learning how to use AI will help them succeed in this ever-evolving field.

FAQs

What is the impact of AI on entry level financial analyst positions?

AI is transforming finance and AI technologies are automating tasks. Entry-level financial analyst positions may shift towards data analysis and interpretation as AI handles repetitive tasks.

How can AI replacer technologies affect corporate finance?

AI replacer technologies can streamline processes in corporate finance by automating forecasting, budgeting, and data analysis, allowing financial teams to focus on strategic decision-making.

Why should companies integrate AI for corporate finance?

Integrating AI for corporate finance enhances accuracy and efficiency in financial reporting, risk management, and decision-making, leading to more informed business strategies.

How can finance and AI together create better opportunities for financial analysts?

Finance and AI can create better opportunities by enabling entry-level financial analysts to work alongside AI tools, improving their efficiency in data analysis and financial modeling.