According to Statista Research Department, spending on artificial intelligence (AI) in the financial sector is expected to grow significantly, rising from 35 billion U.S. dollars in 2023 to an estimated 97 billion U.S. dollars by 2027.

The financial industry is changing in big ways—things are shifting so much that it will change how we think about money and banks forever. As technology and what people want from money come together, the old ways of handling money are being challenged more than ever.

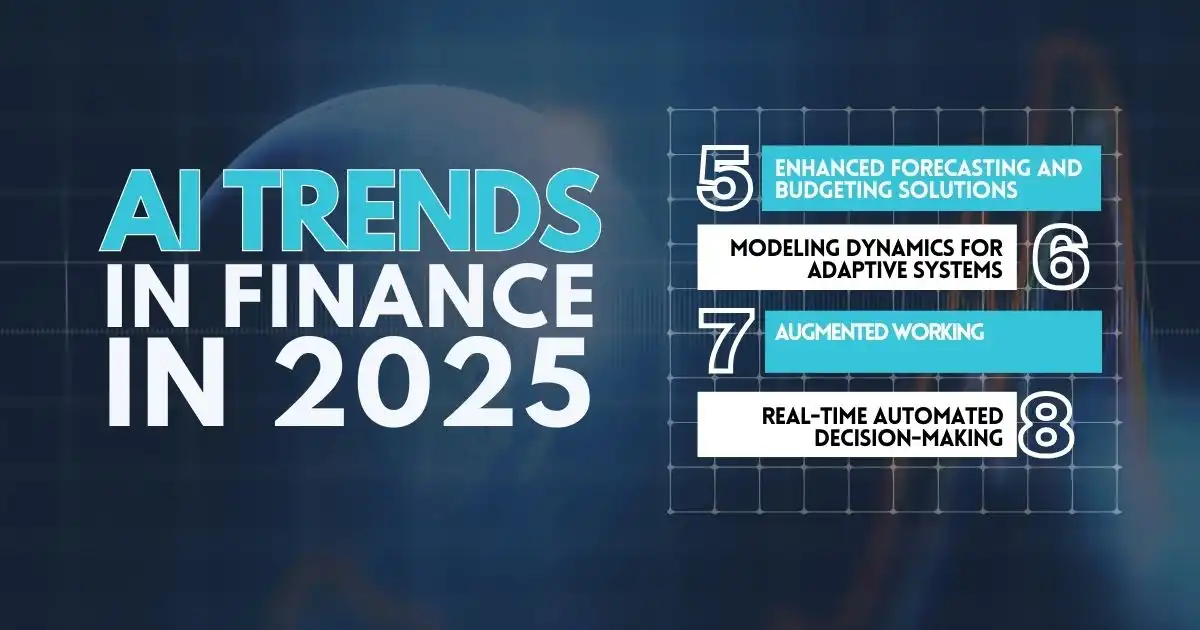

AI Trends in Finance in 2025

Here are the top eight financial trends to watch for in 2025.

1. Streamlined Expense Tracking

AI is improving the way businesses track and manage expenses. By using machine learning algorithms, AI can automate tasks like recognizing repeating expenses, categorizing them, and matching them with invoices. This reduces the chances of human error, cuts down on time spent on manual data entry, and ensures more accurate financial records.

Companies can also use AI to spot patterns in spending and identify areas where costs can be reduced. In a world where managing business finances is increasingly complex, AI brings significant value by offering smarter, faster expense-tracking systems.

2. Proactive Risk Assessment using Predictive Analytics

AI’s ability to analyze large amounts of data and predict future outcomes will improve risk management in finance. Through predictive analytics, AI systems can spot hidden patterns in financial transactions, consumer behavior, and market trends that might indicate potential risks.

For example, AI can detect unusual financial activities, flag possible fraudulent behavior or warn of economic downturns. This proactive risk assessment allows finance teams to act before small issues turn into major problems, thus providing better security and risk mitigation.

3. AI-Powered Customization

One of the most exciting applications of AI in finance is its ability to personalize services for customers. By analyzing data like spending habits, income patterns, and financial goals, AI can recommend financial products that best suit an individual’s needs.

AI doesn’t just suggest products; it learns from user interactions to improve the accuracy of its recommendations over time. This dynamic personalization helps businesses create deeper relationships with customers by offering products like customized savings plans, investment strategies, and even made-for-credit offerings.

4. Innovations in RegTech Compliance

Regulatory technology (RegTech) is another area where AI will play a major role in 2025. The regulatory landscape in finance is constantly changing, and compliance is both time-consuming and expensive. AI helps by automating compliance tasks like risk assessments, fraud detection, and reporting.

For example, AI can scan huge amounts of legal documents to ensure a company is up to date with the latest regulations. It can also help with real-time risk evaluations and fraud detection, which minimizes the chances of regulatory violations. This development is especially valuable for banks and financial institutions facing heavy non-compliance fines.

5. Enhanced Forecasting and Budgeting Solutions

AI-driven forecasting tools are enhancing how businesses plan their budgets. Instead of relying solely on historical data and assumptions, AI systems can process huge amounts of real-time data, from market trends to consumer behavior, to make more accurate financial predictions.

These forecasts aren’t static either—AI systems can adjust to new data as it comes in. This real-time flexibility is important in volatile markets, allowing businesses to make quick, informed decisions on resource allocation, investment, and future strategies.

6. Modeling Dynamics for Adaptive Systems

AI is increasingly being used to model financial dynamics in real time. Unlike traditional models that often rely on static assumptions, AI-driven systems adapt and adjust forecasts as new data emerges. This means that AI can update financial predictions based on current market shifts, changes in consumer behavior, or external events like political instability.

For example, during economic disruptions, AI can quickly modify financial models to offer more accurate predictions, helping businesses pivot faster than ever before.

7. Augmented Working

AI is not just replacing human tasks; it’s also enhancing human capabilities. AI will move beyond simple task automation to truly augment human abilities. In the finance sector, this could mean AI assisting in decision-making by offering insights and recommendations based on huge amounts of data.

It will allow humans to focus on creative, strategic, and interpersonal tasks that AI cannot handle, improving both efficiency and job satisfaction. This collaboration between humans and AI will allow businesses to leverage the strengths of both, increasing productivity and innovation.

8. Real-Time Automated Decision-Making

AI will automate decision-making across entire business processes. This is particularly relevant in areas like logistics, customer service, and marketing, where AI will handle routine decisions such as inventory management or customer responses.

The real-time nature of AI’s decision-making capabilities means that businesses will be able to react much faster to changes in customer demand or market conditions. For example, AI could dynamically adjust marketing strategies based on real-time consumer behavior, driving higher efficiency and responsiveness.

AI is Leading the Way

Big changes are on the way, and AI is leading the charge. By 2025, AI will be everywhere, helping us track spending, predict risks, and make smarter decisions. It’s more than just replacing old tools; it’s about making everything work faster and more accurately. Using AI to your advantage will allow you to stay ahead.

Those who adapt first will lead the way. Don’t wait for change to come—think about how you can start using AI today to stay ahead. The future is here, and AI is ready to help—take action now!

FAQs

Why do experts say fintech is the future?

Fintech, short for financial technology, is reshaping how people and businesses interact with money. It’s streamlining banking processes, improving financial access, and offering innovative tools for payments, loans, and investments. As technology continues to evolve, fintech is expected to dominate the financial world, making processes faster, more efficient, and user-friendly.

Are digital trends safe for banking and finance?

Digital trends like online banking, mobile payments, and AI-based solutions are generally safe when proper security measures are in place. Banks and financial institutions use encryption, two-factor authentication, and fraud detection systems to protect user data. However, users should remain cautious, avoiding unsecured networks and keeping their login details private.

What are some examples of modern banking technology?

Modern banking technology includes tools like AI-powered chatbots, blockchain for secure transactions, biometric security features like facial recognition, and mobile apps for seamless banking. These advancements help banks provide faster services and enhance the overall customer experience.

What are the latest bank technology trends to watch?

Current bank technology trends include:

- AI Integration: Automating customer service and fraud detection.

- Blockchain Technology: Ensuring secure and transparent transactions.

- Open Banking: Allowing third-party apps to provide additional services.

- Digital Wallets: Simplifying payments and boosting convenience