Cash shortages are a major source of stress. Even large corporations can occasionally face liquidity crises. These challenges in forecasting and cash flow management can lead to issues such as payroll complications, increased pressure to collect accounts receivable, and the risk of material shortages.

According to a survey by the AFP (Association for Financial Professionals), 80% of organizations perform cash flow forecasting weekly or more frequently.

Businesses that regularly update their forecasting and cash flow management are more accurate in predicting their financial needs. Studies show that companies with accurate cash flow forecasts have a higher chance of meeting their financial obligations on time.

What is Cash Flow?

Cash flow is the movement of money into and out of a business. Money mainly comes from sales, but also from loan repayments, selling unnecessary items, receiving refunds, and grants.

Businesses should monitor cash flow closely and maintain a solid budget. Furthermore, a sudden shortage of cash can severely impact a business. Effective use of forecasts allows businesses to plan ahead by considering various scenarios and making informed decisions based on anticipated outcomes.

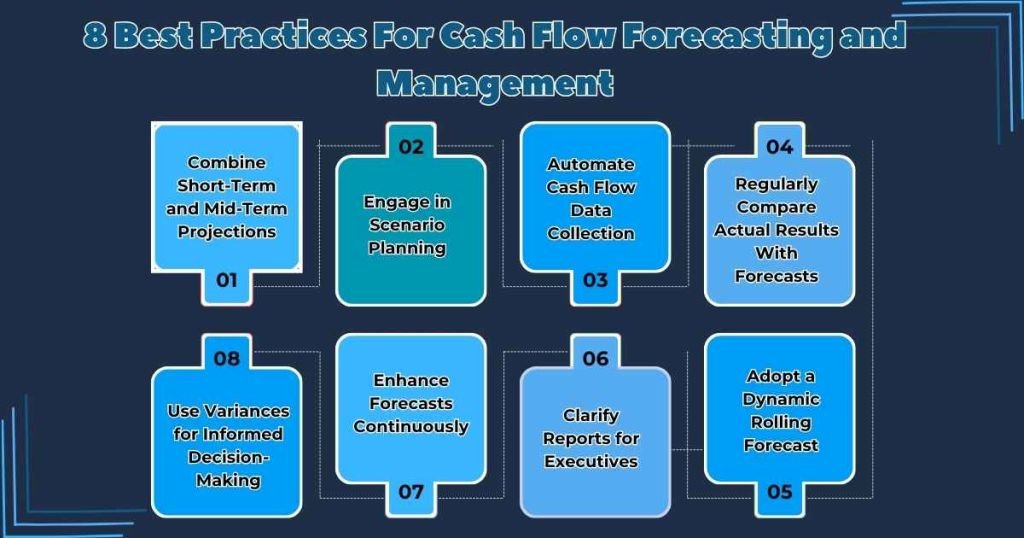

8 Best Practices For Cash Flow Forecasting and Management

1. Combine Short-Term and Mid-Term Projections

Short-term forecasting enhances KPIs by examining business segments, providing a complete view. Focusing on specific metrics like sales targets, marketing returns, and profitability helps pinpoint issues easily.

A study by the Corporate Finance Institute (CFI) indicates that companies that regularly combine short-term and mid-term projections see an improvement in KPIs by up to 20%.

To enhance short-term profits, companies may adjust prices or reduce expenses to increase revenue and maintain financial stability. However, it’s important not to only focus on the present. Looking ahead to the next few months or even a year is important. Monthly updates to these plans provide a broader understanding of the business’s performance and potential external impacts.

2. Engage in Scenario Planning

Scenario planning is important because it helps improve how accurately we predict what might happen and get ready for different situations. Moreover, it means thinking about what could happen if the economy is doing really well, struggling, or staying about the same. We plan how the company would handle its money in each situation.

This way, our team can make things happen faster and not have to start everything over if something unexpected comes up. It’s also really important to plan for good things that could happen. This way, the business is ready to do well when things go our way.

A report by McKinsey & Company highlights that 70% of businesses using scenario planning feel more prepared for economic fluctuations, whether the economy is booming, struggling, or stable.

3. Automate Cash Flow Data Collection

When your forecasting processes and financial tools are integrated, cloud-based, and automated, the forecast becomes a valuable business tool that you can use more effectively. Setting up these tools to work seamlessly allows your team to focus on important tasks.

Instead of spending time collecting data and creating spreadsheets, your team can focus on defining action plans and addressing challenges. By turning your cash flow forecast from just a visual report into a practical resource, it becomes a catalyst for positive change.

According to a report by the Aberdeen Group, businesses that automate their cash flow data collection experience a 90% reduction in data entry errors compared to those relying on manual processes.

4. Regularly Compare Actual Results With Forecasts

Continuously comparing your actual results with the forecast is a highly effective way to improve accuracy and reliability. However, generating automated variance reports that can be shared with the team provides clear insights into whether targets are being met, exceeded, or missed. This helps team members understand how their actions impact the business’s success.

Regularly checking actual results against forecasts is important for making financial predictions more accurate and reliable. Moreover, automated variance reports show how well the company is performing, helping teams to make needed changes and see how their actions affect the business. This process improves forecasting accuracy, builds trust in predictions, and helps the organization make better decisions.

5. Use Variances for Informed Decision-Making

It’s important to closely examine differences between forecasts and actual results. However, this helps understand why these variations occur and find ways to prevent them in the future.

Using variances for informed decision-making is essential for any business wanting financial stability and smooth operations. However, by understanding and fixing the differences between forecasts and actual results, companies can make their forecasts more accurate, improve how they run, and make better strategic choices. This process not only improves future forecasts but also boosts overall business performance, leading to long-term growth and success.

6. Enhance Forecasts Continuously

Change happens all the time, and forecasting is no exception. Moreover, use a forecast that gets updated regularly over the next 6 to 18 months. As time goes on, this forecast gets more accurate and becomes very important for keeping your organization successful. It’s a tool that helps with important decisions in a changing business world.

Continuously improving forecasts is important for companies that want to stay competitive and strong. It helps make decisions quickly, makes predictions more accurate, improves how efficiently things run, and keeps plans in line with long-term goals. Moreover, this all helps businesses succeed even as things change fast in the business world.

7. Clarify Reports for Executives

The goal of forecasting is to help executives make smart decisions for company success. Furthermore, this means using clear, easy-to-understand reports that show forecasted information and any differences clearly. Clear reports are important. They show predicted and actual financial info simply. Executives use clear reports to spot trends and risks, adjust strategies fast, and build trust.

Clear reports save time, letting executives focus on planning and decisions. However, this boosts company flexibility and responsiveness. In short, clear reports make forecasting a powerful tool for smart, quick decisions that drive growth and competitiveness.

8. Adopt a Dynamic Rolling Forecast

Rolling forecasts improve forecasted and budgeted revenue accuracy by about 14% compared to the static forecasting and budgeting methods that many organizations use. However, their real benefit lies in the agility they provide.

For example, if there are sudden changes in product demand, a static forecast would delay adjustments until the next forecasting cycle. This delay can make it difficult to manage supplier payments and overall financial health effectively. On the other hand, integrating forecasting and managing cash flow with a rolling forecast provides a more accurate view. This allows businesses to optimize planned expenses better and arrange timely financing if needed to cover costs.

Final Thoughts

By adopting the best practices of forecasting and managing cashflow, businesses can become better at managing their cash flow, making their predictions more accurate, and making smart decisions for long-term financial success. Furthermore, using ongoing predictions, analyzing differences from expected results, and staying flexible in strategies help organizations succeed in changing markets and stay financially secure.

FAQs

What is the optimal approach to cash flow forecasting?

The best practice for forecasting and cash flow management is to use a rolling forecast, continuously updated to reflect changing circumstances and improve accuracy and agility.

What are some of the best ways to manage cash flow for business?

Effective forecasting and cash flow management involves maintaining a cash buffer, optimizing accounts receivable and payable, managing inventory efficiently, and creating a comprehensive budget.

How can you improve the forecast of cash flows?

To enhance cash flow forecasting, regularly compare actuals to forecasts, engage in scenario planning, use variances for decision-making, and ensure integration of financial tools and processes.

Why does good management of cash flow start with good forecasting?

Good forecasting and managing cash flow provides a clear understanding of expected cash inflows and outflows, enabling businesses to plan, make informed decisions, and take proactive measures to maintain financial stability.