According to Ayn Rand, ”Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.”

Learning to manage your money is key to your long-term financial success. Without good spending habits, it’s tougher to achieve big financial goals, reduce money worries, or have extra cash for unexpected costs.

A report from the National Foundation for Credit Counseling revealed that individuals who use a budget are more likely to save money regularly, with 80% of budgeters having a savings plan.

Managing money can be challenging. Many people feel nervous when thinking about it. You might have delayed saving for retirement or feel anxious about not having enough emergency savings. But it’s important to start managing your finances now. Begin as soon as you can to develop good money habits.

What Does The Term Budget Mean?

According to Investopedia, “The term budget refers to an estimation of revenue and expenses over a specified future period and is usually compiled and re-evaluated on a periodic basis.”

In simple terms, a budget helps you understand how much money you make and spend over a certain period. It ensures that you can handle your finances comfortably, even if unexpected expenses come up.

Budgets are used by governments, businesses, small business owners, and individuals to plan their financial needs. A budget is a financial plan that helps you manage your money effectively.

10 Budgeting Tips To Keep Your Finances On Track

1. Set Clear Financial Goals

Setting clear financial goals is essential for effective budgeting tips to keep your finances on track, as it provides direction and motivation. According to a survey conducted by Fidelity Investments, 91% of people who set financial goals feel more confident about managing their money.

Additionally, a study by Northwestern Mutual found that individuals with specific financial goals are 2.5 times more likely to feel financially secure compared to those without clear goals. Short-term goals, such as saving for a vacation or paying off a small debt, are essential for immediate financial planning.

On the other hand, long-term goals, like buying a house or building a retirement fund, ensure stability and security in the future. Having specific goals not only guides your budgeting strategy but also increases your chances of financial success.

2. Track Your Expenses

Understanding where your money goes is essential for effective budgeting. Keep a detailed record of your expenses for at least a month. Categorize your spending to identify patterns and areas where you can cut costs. Use budgeting apps or tools to streamline this process and ensure accuracy.

Research from the Consumer Financial Protection Bureau reveals that households spend an average of $3,000 annually on non-essential items. Utilizing budgeting apps or tools can further enhance this process, with studies indicating that 82% of smartphone users rely on finance apps to manage their money.

3. Create a Realistic Budget

Develop a budget that reflects your actual income and expenses. Start with fixed costs such as rent, utilities, and loan payments. Then allocate funds for variable expenses like groceries, entertainment, and transportation. Ensure your budget is realistic and flexible enough to accommodate unexpected expenses.

According to a survey conducted by the Federal Reserve, only 40% of Americans have enough savings to cover a $400 emergency expense. This highlights the importance of budgeting tips to keep your finances on track.

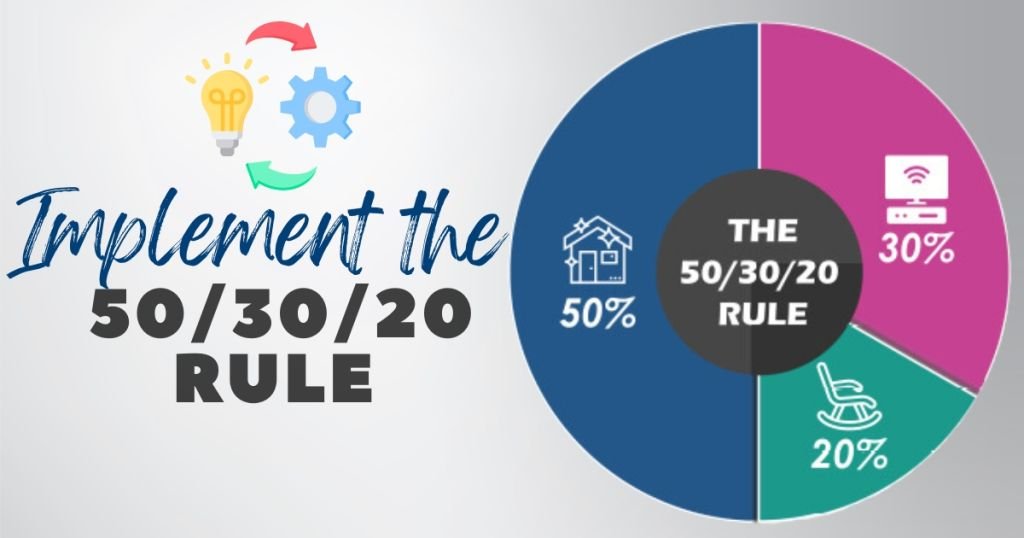

4. Implement The 50/30/20 Rule

A popular budgeting guideline is the 50/30/20 rule. Allocate 50% of your income to essential needs (housing, food, transportation), 30% to wants (dining out, hobbies, entertainment), and 20% to savings and debt repayment. This rule helps maintain a balanced financial lifestyle while ensuring savings growth.

According to CNBC recent surveys, over 60% of millennials and Gen Zers find the 50/30/20 rule to be a helpful framework for managing their finances effectively.

5. Prioritize Debt Repayment

High-interest debt can disrupt your financial journey. Prioritize paying off debts, particularly those with high interest rates, to alleviate financial strain and allocate more funds for savings and investments, adhering to budgeting tips to keep your finances on track. Strategies like the debt snowball or debt avalanche methods can expedite repayment.

Additionally, data from the Consumer Financial Protection Bureau reveals that high-interest debts, such as credit cards and personal loans, often account for a significant portion of total consumer debt, contributing to financial strain for many individuals and families.

6. Build an Emergency Fund

An emergency fund is like a safety net for your money. It’s there to help you when unexpected things come up, like medical bills, car repairs, or job loss. Financial experts suggest saving enough to cover your living costs for three to six months.

That means having money for rent, food, and bills for that time. It may seem like a lot, but you can start by saving a little bit each time you get paid. By gradually building your emergency fund, you’ll have money set aside to handle any surprises.

7. Automate Your Savings

Automating your savings is a powerful strategy that ensures consistency and helps curb the temptation to spend impulsively. According to a survey conducted by Bankrate, 58% of Americans who automate their savings feel more confident about their financial future.

Setting up automatic transfers from your checking account to your savings or investment accounts is a proven method to increase savings rates. By simplifying the saving process and reducing the effort required to save, automation helps individuals stay committed to their financial goals in the long run.

8. Review and Adjust Your Budget Regularly

Life changes, and so should your budget. According to a survey conducted by Bankrate, 61% of Americans have experienced a major unexpected expense in the past year. This highlights the importance of regularly reviewing your budget to ensure it aligns with your current financial situation and goals.

Additionally, the U.S. Bureau of Labor Statistics reports that average annual household spending varies significantly depending on factors like income level and household composition. Adjusting your budget as necessary to accommodate changes in income, expenses, or financial priorities is important for financial stability. This flexibility keeps your budget relevant and effective, helping you navigate life’s uncertainties with confidence.

9.Restrict Non-Essential Spending

Spending money on unnecessary things can cause problems in the long run. It’s important to find ways to spend less without making life less enjoyable. For example, instead of eating out all the time, try cooking at home. It’s not only cheaper but also fun to do with family or friends.

Another idea is to use public transportation instead of always driving. This saves money on gas and parking. Also, look for free or cheap things to do in your area, like going to parks or local events. These small changes help you save money without feeling like you’re missing out.

10. Seek Professional Financial Advice

If managing your finances feels overwhelming, consider seeking advice from a professional financial planner. They can provide personalized guidance, help you develop a tailored budget, and offer strategies to achieve your financial goals. Investing in professional advice can pay off in the long run by enhancing your financial well-being.

A survey conducted by the National Endowment for Financial Education found that 68% of Americans feel stressed about their finances. However, seeking advice from a professional financial planner can make a significant difference.

Final Thoughts

It is important to remember that working around a budget is similar to cultivating a good habit. Furthermore, just as regular exercise leads to good physical health, financial stability depends on good monetary habits. Hence, budgeting must be treated as an ongoing process. Consolidating or designing a plan requires an accurate and honest assessment of your finances. But this will help you stay on track and make it easier to reach your financial goals.

FAQs

What budgeting tip would help you stay on track financially?

To stay on track with your money, set up automatic transfers from your checking to savings and automatic bill payments. This way, you save money regularly and pay bills on time, avoiding overspending or forgetting payments.

What is the best way to keep track of finances?

To manage your money better, use budgeting apps like Mint or YNAB. Hence, they track your income, spending, and savings, organize your expenses, offer money-saving tips, and alert you if you’re overspending. It makes handling your money simpler.

What is the 10 rule budget?

The “10% rule” advises saving 10% of your income. Furthermore, it encourages putting aside this portion before spending on other things. This habit helps build savings over time, preparing for future needs or emergencies.

What are the 5 tips to improve budgeting?

To improve budgeting, start by setting clear goals for your money. Keep track of your spending to find areas to save. Hence, create a budget that matches your income and spending, and be ready to change it if needed. Focus on saving and paying off debts to stay secure. Check your budget regularly and adjust it to fit your goals and how much money you have.