Cash flow problems can hurt even the most successful businesses.

Both big companies and smaller ones face challenges in keeping their cash flow steady. That’s why figuring out what’s causing cash flow problems is important for long-term growth.

While making money and earning profits show a business is doing well, the cash flow helps it grow. To succeed, a business needs to manage the money coming in and going out at the right times. This can be challenging, as businesses often run into cash flow problems along the way.

The good news is that many of the common cash flow issues can be solved if you understand where they come from.

Why Cash Flow Matters

Cash flow is the movement of money in and out of a business over time. It helps businesses track their financial health and plan expenses.

Balancing cash flow makes it easier to manage costs and determine how much money should be saved for tough times. It also helps business leaders see which areas are performing well and where money is being wasted, allowing them to make improvements.

A cash flow statement also shows extra costs not listed in the profit and loss report, giving a clearer picture of where money is spent. It’s also used for cash flow forecasting, which helps businesses predict future cash movements and reduce financial risks.

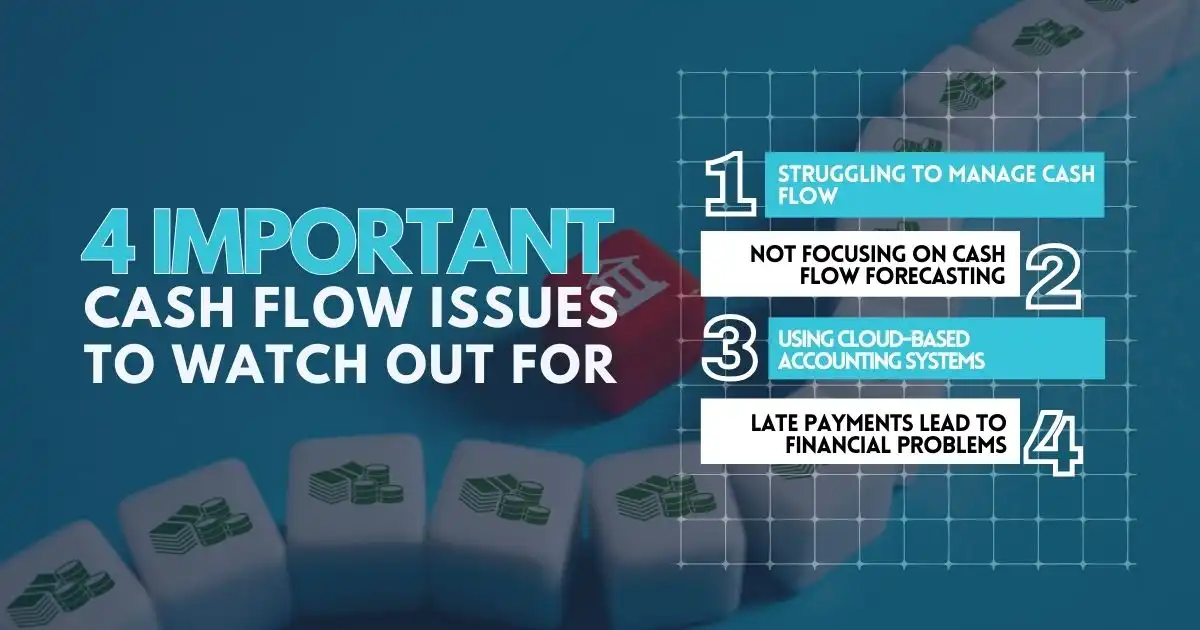

4 Important Cash Flow Issues to Watch Out For

Managing cash flow is important for any business, as it keeps operations running smoothly and supports long-term success. Here are four common cash flow issues that every business owner should watch out for to prevent financial problems.

1. Struggling to Manage Cash Flow

Managing cash flow means knowing how much money will come into and go out of a business and making smart choices about how to use that money. Businesses need to predict their future income and expenses accurately. This is easier when things are stable, but unexpected events can change things fast. When the economy gets tough, businesses often use the money they’ve saved up to stay afloat.

Every year, 400,000 businesses start, but half of them don’t make it past five years. A major reason is not managing money well. 82% of failed businesses say money management was a big factor.

2. Not Focusing on Cash Flow Forecasting

Cash flow forecasting is when businesses predict how much money will flow in and out over a certain time. It’s important for making smart decisions about spending, saving, and investing.

Businesses can forecast cash flow for short, medium, or long periods. Short-term forecasts cover about a month, helping businesses know if they need extra money. Medium-term forecasts cover one month to a year, and long-term forecasts can go up to five years or more. However, the longer the forecast, the less certain it is because things can change unexpectedly.

Why it’s important:

- It shows how much money will come in and go out, helping businesses plan.

- It helps decide if there’s enough money to start new projects, hire employees, or grow.

- It can help spot times when cash might be low, giving businesses a chance to fix the problem before it gets worse, like by getting a loan or cutting back on spending.

3. Using Cloud-Based Accounting Systems

Many accountants now use cloud-based accounting with the help of AI and automated tools. About 94% of accountants have switched to this, with 67% preferring it over older methods.

However, 60% of small business owners admit they don’t know enough about finance. Surprisingly, only 14% believe accountants can help them save money on taxes. Hiring an accountant can also be expensive, ranging from $20 to $100 per hour.

4. Late Payments Lead to Financial Problems

Small businesses need to keep their cash flow smooth by staying on top of their finances and making sure customers pay on time. This means keeping track of bills and following up with customers who are late.

In a study by QuickBooks in April 2020, they looked at how money moves in small businesses around the world. Here’s what they found:

- 34% of small business owners said late payments forced them to rely on overdrafts to meet their monthly payments.

- One in seven small business owners couldn’t pay their workers because they didn’t have enough money at the right time.

- 38% of small business owners with money problems couldn’t pay back what they owed.

- On average, small businesses lost about £26,000 because they had to turn down work when they didn’t have enough cash.

Don’t Let Cash Flow Issues Sink Your Business

Cash flow is the lifeblood of any business, and ignoring its importance can be the beginning of the end. It’s not just about tracking money—it’s about making sure you have enough at the right time. Businesses can’t afford to wait for problems to pile up before taking action.

If you’re not forecasting cash flow, you’re flying blind, and if you’re relying on overdrafts to make ends meet, you’re just one step away from disaster. Cash flow problems often sneak up when you’re least prepared, but by understanding the causes and addressing them early, you can prevent costly mistakes.

It’s time to take charge and avoid being another statistic in the long list of businesses that failed because of poor money management.

FAQs

Which of the following is a cash inflow?

Cash inflows are the money coming into a business, typically from sales, loans, investments, or any payments received from customers. Common examples of cash inflows include customer payments, new loans, and investment funds.

How do cash flow problems usually start?

Cash flow problems usually start when a business doesn’t have enough money coming in to cover its expenses. This can happen due to slow-paying customers, poor sales, unexpected costs, or mismanagement of finances. Without proper cash flow forecasting, businesses can quickly find themselves in a tight spot.

What is the best way to avoid cash flow problems is?

The best way to avoid cash flow problems is by forecasting cash flow regularly. This allows businesses to predict future inflows and outflows, helping to manage expenses and make informed decisions. Maintaining a cash reserve and staying on top of payments can also help prevent issues.

How to find cash flow to creditors?

To find cash flow to creditors, businesses need to look at their incoming payments and ensure they have enough funds to cover debts. Reviewing the cash flow statement helps identify available funds after covering operational costs, which can then be used to make payments to creditors.