The rapid advancements in technology offer Chief Financial Officers (CFOs) an opportunity to harness the power of Artificial Intelligence (AI) to drive innovation and efficiency.

From cost savings to skill development, AI enables CFOs to stay competitive by leveraging it for strategic growth and financial improvements.

However, with these opportunities come considerations such as data security, ethical standards, regulatory compliance, and AI biases. Thus, AI implementation can be challenging if you don’t have these insights for CFOs to tap into the potential of Generative AI while managing its associated risks effectively.

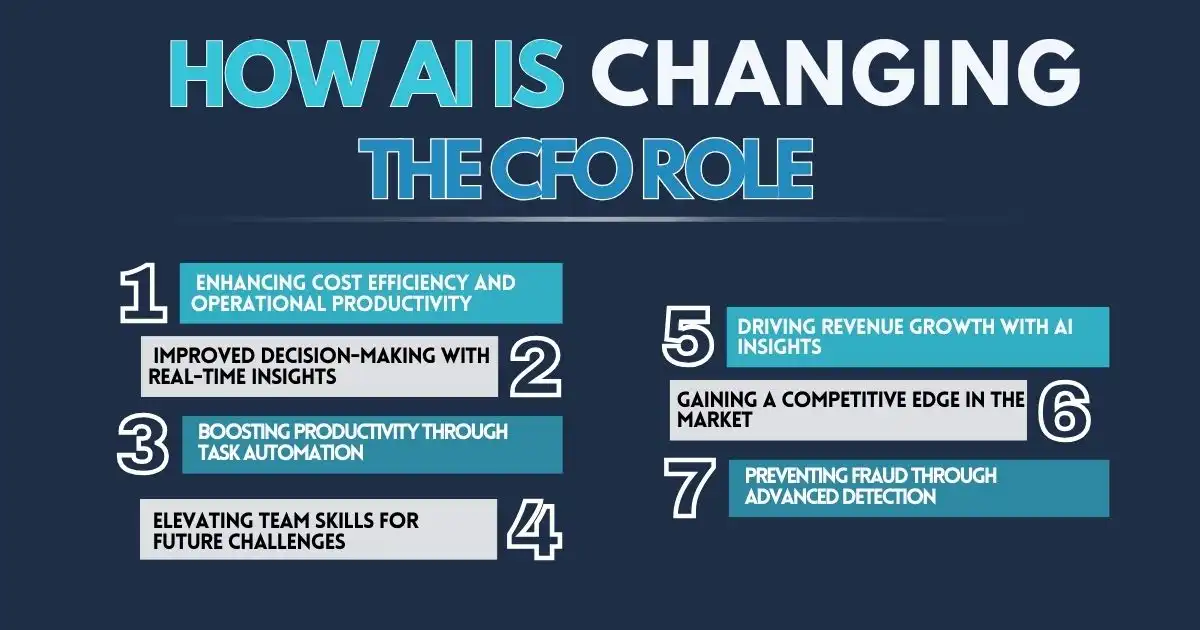

How AI Is Changing the CFO Role

1. Enhancing Cost Efficiency and Operational Productivity

Generative AI enables CFOs to streamline financial processes and optimize resource allocation through automation. This leads to more efficient operations and greater cost savings.

2. Improved Decision-Making with Real-Time Insights

AI-powered analytics allow CFOs to access accurate, real-time financial data, making it easier to forecast and make informed decisions. This not only enhances risk management but also results in smarter business choices.

3. Boosting Productivity Through Task Automation

AI automates repetitive tasks such as financial reporting and data analysis, allowing CFOs and their teams to focus on more strategic priorities, enhancing overall productivity.

4. Elevating Team Skills for Future Challenges

CFOs can foster a culture of learning within their teams by encouraging staff to upskill in AI tools. This combination of human expertise and AI capabilities creates more effective financial strategies.

5. Driving Revenue Growth with AI Insights

Generative AI helps CFOs identify revenue-boosting strategies, such as optimizing pricing models and personalizing customer experiences, which can enhance customer loyalty and increase revenue.

6. Gaining a Competitive Edge in the Market

Integrating AI in financial operations allows organizations to stay ahead of competitors by accurately predicting market trends and offering innovative solutions.

7. Preventing Fraud Through Advanced Detection

AI can analyze large volumes of transactional data to identify patterns indicative of fraudulent activities, providing real-time alerts to CFOs. This helps protect the organization from financial losses and fraud risks.

Risks CFOs Face with AI

While AI offers transformative benefits, it also presents certain risks that CFOs must address:

1. Data Security and Privacy

Make sure to use strong security systems to protect sensitive financial data. Keeping data safe helps maintain trust with clients and partners.

2. Ethical AI Practices

Ensure that AI algorithms are fair, transparent, and free from biases. This builds trust and ensures that decisions made by AI are reliable and equitable.

3. Regulatory Compliance

Stay up to date with financial regulations. As AI is integrated into your processes, make sure you’re following all rules to avoid legal issues.

4. Cybersecurity

Use advanced cybersecurity measures to protect your company from threats related to AI, like hacking or data breaches. Secure systems help prevent attacks.

5. Algorithmic Bias

Identify and correct any biases in AI algorithms to make sure decisions are fair for all users. This helps ensure that your AI supports ethical decision-making.

6. Scalability

Check that the AI solutions you choose can grow with your company. Scalable systems ensure that your AI will meet future needs as your business expands.

7. Vendor Reliability

Select AI vendors who have a solid reputation and experience in delivering quality AI solutions. Reliable vendors reduce the risk of problems down the line.

8. Change Management

Prepare your team for the changes AI will bring by managing the transition smoothly. Support your employees during this shift to make the process easier.

9. Workforce Reskilling

As AI becomes part of your company, train employees in new skills to fill any gaps. Reskilling helps workers adapt to AI-driven changes and keeps your team competitive.

6 Actionable Steps for CFOs to Minimize AI Risks

1. Prioritize Responsible AI Implementation

Establish safeguards to ensure the ethical and secure use of AI technologies. Form a cross-functional team that includes data scientists, legal advisors, and department heads to oversee AI adoption and ensure accountability.

2. Expand the Scope of ROI Evaluation

Standard ROI metrics might not fully show the value of AI projects. CFOs should broaden their evaluation methods, focusing initially on revenue generation, followed by cost savings and risk mitigation.

3. Understand AI’s Current Limitations

AI models, such as ChatGPT-4, may occasionally produce inaccurate results or hallucinations. Avoid using AI for high-stakes tasks without human oversight, and stay informed about ongoing improvements in AI reliability.

4. Start Small and Scale Gradually

Begin with proven AI tools on a smaller scale to test their effectiveness. Avoid rushing into large, untested applications, which can lead to overspending or unmet expectations.

5. Develop a Tech-Savvy Workforce

Invest in employee training to build a workforce that can effectively use AI technologies. A skilled team is crucial for maximizing AI’s potential and ensuring successful implementation.

6. Establish Clear AI Governance Frameworks

Develop and implement robust governance policies to manage AI deployment and usage across the organization. This includes setting guidelines for ethical AI practices, monitoring AI performance, and ensuring compliance with regulatory standards.

By creating clear accountability structures and oversight mechanisms, CFOs can minimize risks and ensure AI aligns with the company’s strategic objectives. Regular audits and assessments can help in keeping AI initiatives on track and mitigate potential risks before they escalate.

Leading Through AI-Driven Transformation

AI presents CFOs with a wealth of opportunities to transform financial operations, improve decision-making, and gain a competitive edge. However, challenges such as data security, ethics, and workforce adaptation must not be overlooked.

By addressing these areas with care and responsibility, CFOs can fully leverage the potential of AI to lead their companies into a future shaped by intelligent technology.

FAQs

How does a CFO manage risk?

A CFO manages risk by identifying potential financial threats to the company, such as market changes or cash flow issues, and developing strategies to reduce their impact. This can include diversifying investments, managing debt, setting up insurance, or creating emergency plans to protect the business.

How can we control the risk of AI?

To control AI risks, it’s important to set clear guidelines for how AI is used, regularly review the data it uses, and ensure that human oversight is part of the process. Testing AI systems before fully implementing them helps catch issues early, while ongoing monitoring helps avoid unexpected problems.

Why CFOs should have artificial intelligence on their minds?

CFOs should consider AI because it can help streamline financial processes, improve decision-making with better data analysis, and identify patterns that may not be obvious. AI can also reduce costs and improve efficiency, giving companies a competitive edge.

What makes a CFO strategic?

A strategic CFO looks beyond just managing the company’s finances. They focus on long-term goals, work closely with other leaders to guide the company’s overall direction and use data to support decisions that drive growth and sustainability. A strategic CFO helps ensure the company is prepared for future opportunities and challenges.