FP&A teams are like captains steering a ship, helping businesses through the uncertain waters of financial planning and decision-making. However, just like sailing through rough seas, these teams face many challenges that can slow down their progress.

From handling too much data to making good predictions in an unpredictable market, the problems are real. However, with the right strategies, FP&A teams can find a clear path, overcome these obstacles, and lead their companies to financial success.

How to Fix FP&A Problems for Better Financial Planning?

Businesses face many problems with their Financial Planning and Analysis (FP&A) teams. These teams need the right tools, data, and processes to do their job well. However, it can be hard to keep up in a fast-changing business environment.

A 2023 study by Deloitte revealed that 86% of CFOs still face challenges in quickly assessing the impact of business decisions, managing unforeseen events, and preparing for disruptions. Only 14% reported that insufficient capacity was their primary concern, highlighting a continued struggle with agility and responsiveness in financial planning and analysis.

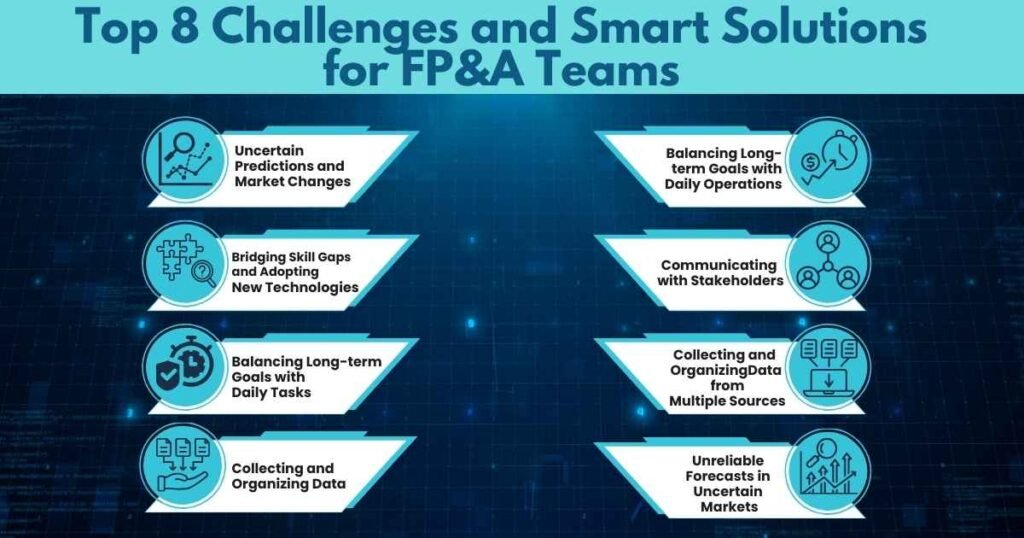

Top 8 Challenges and Smart Solutions for FP&A Teams

It’s important to solve these problems to keep your business running smoothly. Let’s look at the main challenges FP&A teams face and practical solutions to overcome them, setting your team up for success.

1. Uncertain Predictions and Market Changes

Forecasting in uncertain markets is tricky, and unexpected events can disrupt even the best plans. Improving prediction accuracy is essential in financial planning.

Use scenario planning to prepare for different future situations. This method helps teams make better decisions in uncertain conditions. Additionally, stay updated on market trends to make more accurate and timely predictions.

2. Bridging Skill Gaps and Adopting New Technologies

As new technologies emerge, FP&A teams often face skill gaps. It’s essential to regularly update skills to remain competitive.

To address this, provide continuous training for your team and encourage them to attend industry workshops. Choose easy-to-use technology platforms and set aside resources to ensure a smooth transition when adopting new tools. Having vendor support can also help in the adoption process.

3. Balancing Long-term Goals with Daily Tasks

FP&A teams must balance future financial goals with day-to-day operations. While focusing on long-term stability, they also need to ensure that daily financial tasks are handled accurately. This balance is essential for continued growth and financial stability.

How can teams handle this? Implement effective time management techniques to prioritize both daily and long-term tasks. Delegate responsibilities where necessary and set clear priorities to align daily operations with overall goals.

4. Collecting and Organizing Data

One major challenge FP&A teams face is gathering data from multiple sources. This process can be time-consuming and prone to errors, which affects the quality of data analysis.

To solve this, invest in financial planning software that consolidates all your data into one place. Automation tools can also help reduce manual errors and save time. Additionally, encourage collaboration between departments to ensure accurate and consistent data collection, leading to faster and better business decisions.

5. Balancing Long-term Goals with Daily Operations

FP&A teams must manage both strategic planning for the future and day-to-day financial tasks. Balancing these two responsibilities can be difficult, leading to resource strain and a lack of focus on either side.

Use time management techniques and set clear priorities. Delegate daily tasks to team members while focusing on long-term goals. This balance ensures smooth operations and strategic growth.

6. Communicating with Stakeholders

Communicating financial data to stakeholders who are not finance experts can be challenging. The difficulty lies in explaining complex information in simple terms.

To improve communication with stakeholders, avoid using jargon and explain financial concepts in easy-to-understand language. Use visual aids like charts and graphs to make the data clearer. Regular meetings also help ensure everyone is aligned and working together.

7. Collecting and Organizing Data from Multiple Sources

Many FP&A teams struggle to gather data from various systems and departments. This process is often time-consuming and prone to errors, which can affect the accuracy of the analysis.

Implement financial planning software that centralizes all data. This reduces errors and makes data collection quicker and more reliable. Automation can also help streamline the process, allowing teams to focus on analysis rather than manual data entry.

8. Unreliable Forecasts in Uncertain Markets

Predicting future financial outcomes is challenging, especially in unpredictable markets. Inaccurate forecasts can lead to poor business decisions and financial risks.

Use scenario planning to prepare for multiple possible future outcomes. Staying updated on market trends and regularly adjusting forecasts ensures better predictions and more informed decision-making.

Plant the Seeds for Growth, Not Chance

Listen, dealing with FP&A challenges is like planting a garden. The work you do today can help your plants grow, or you might end up with nothing. It’s easy to stick with the same routine when things get hard, but real growth comes when you face these problems head-on.

Are you planting the seeds for a strong future, or are you just hoping things will get better on their own?

FAQs

What challenges do FP&A teams face?

FP&A teams struggle with balancing long-term goals and daily tasks, collecting data from multiple sources, keeping up with new technology, making accurate predictions, and communicating complex information to non-financial stakeholders.

What are the key strategies for FP&A?

Key strategies include using tools for efficient data collection, improving communication, regular training, scenario planning for future uncertainties, and clear communication with stakeholders.

How can the FP&A function be enhanced?

Enhance FP&A by using financial software to automate data collection, providing regular team training, and improving collaboration between departments for accurate data.

What makes a strong FP&A team?

A strong FP&A team is skilled in data analysis, adaptable to new tools, communicates clearly with stakeholders, and prepares for market changes effectively.