As a finance manager, you face the daily challenge of balancing operational efficiency with financial control. Managing corporate credit cards often adds another layer of complexity. Without clear policies, these cards can lead to unnecessary expenses, accounting challenges, or worse—legal risks.

We know how much effort you put into preparing for financial stability, yet surprises are inevitable. It can feel overwhelming to juggle unexpected costs while trying to keep everything on track. That’s why a well-structured corporate card management system is essential.

By adopting best practices, you can give employees the flexibility they need while maintaining full transparency and control. This ensures your company’s resources remain secure and well-managed.

What is Corporate Card Management?

Corporate card management involves overseeing how corporate credit cards are used within an organization. It ensures employees follow company policies and stay within their allocated budgets.

Finance teams handle corporate card management by establishing policies and procedures to maintain accurate expense tracking, responsible card use, compliance with tax regulations, and overall financial control. The process typically includes:

- Creating spending policies.

- Issuing and authorizing cards.

- Monitoring and tracking expenses.

- Preparing and reviewing expense reports.

- Auditing and reconciling accounts.

- Examining spending patterns.

- Training employees on proper card usage.

- Enforcing security and compliance measures.

- Managing relationships with vendors.

This structured approach helps organizations maintain transparency, prevent misuse, and optimize their financial resources.

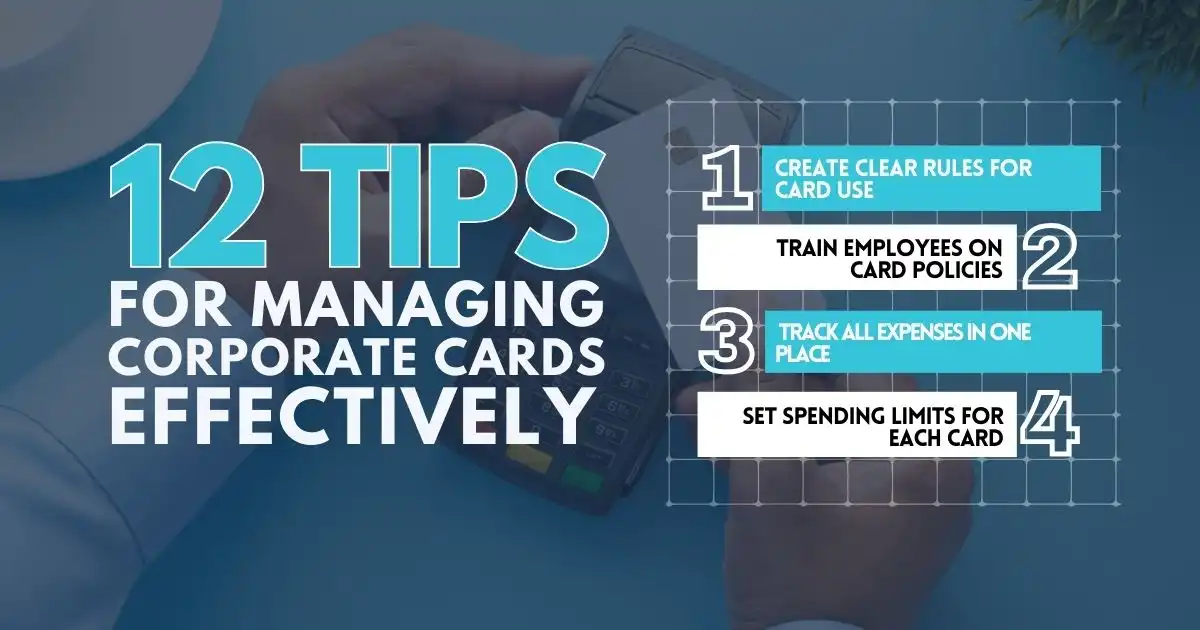

12 Tips for Managing Corporate Cards Effectively

Taking charge of your company’s corporate card program can be a big responsibility, but these 12 tips can make the process easier, more efficient, and secure. Here’s how to manage corporate cards effectively while keeping things simple for everyone involved.

1. Create Clear Rules for Card Use

Establish clear and easy-to-understand guidelines about how employees should use corporate cards. These rules should explain:

- What types of business expenses are allowed.

- Spending limits based on the employee’s role, department, or specific projects.

- When receipts are required and how to submit them.

- How to report any lost cards or unusual charges.

Communicate these rules to every employee who uses a corporate card. Consider providing a written guide or hosting a short training session to make sure everyone understands their responsibilities.

2. Train Employees on Card Policies

Once the policies are set, train your employees to use corporate cards correctly. Highlight key points, such as:

- Corporate cards are strictly for business expenses, not personal use.

- Steps they should follow for approvals or reimbursements.

Provide employees with easy access to the rules, such as uploading them to an internal system or sharing them in an employee handbook. Regular reminders can help reinforce these guidelines.

3. Track All Expenses in One Place

Managing multiple corporate cards can get overwhelming. Use an expense tracking platform that centralizes all spending in one place. This helps you:

- Monitor expenses in real time.

- Identify patterns or unusual charges.

- Streamline reporting and reimbursements.

Centralized tracking ensures accuracy and reduces the risk of misplaced data or missed deadlines.

4. Set Spending Limits for Each Card

Assign spending limits to each employee based on their role, responsibilities, and the type of expenses they handle. For example:

- A marketing manager attending conferences may need a higher limit than an intern.

- A department head may have a higher limit than their team members.

Spending limits help keep expenses in check and align them with your company’s budget.

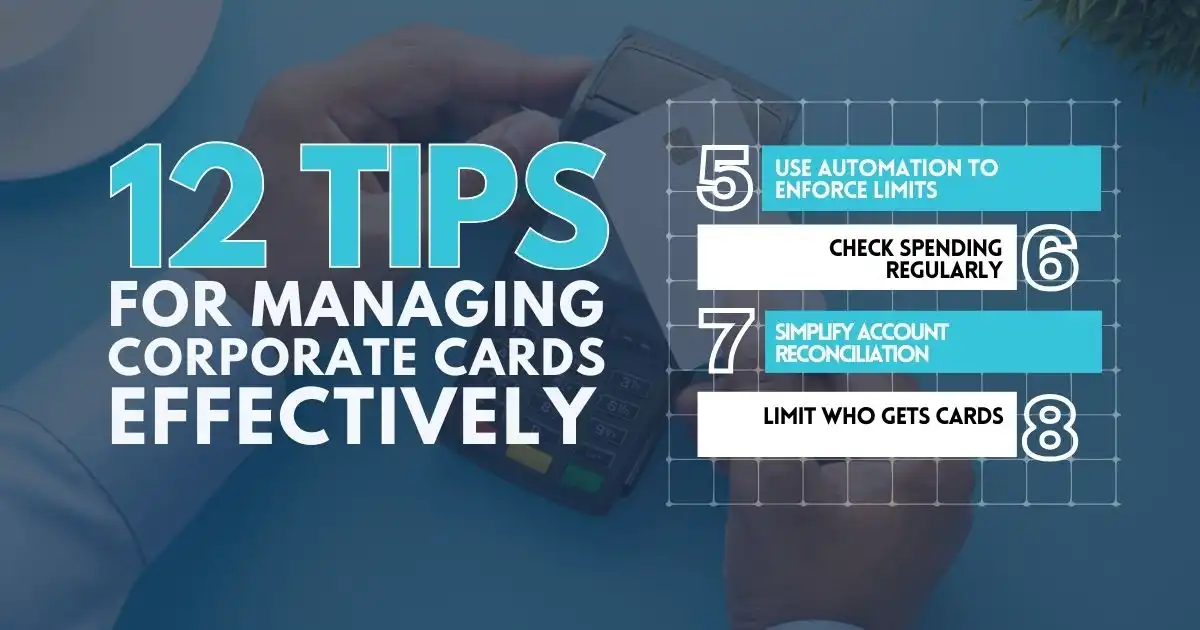

5. Use Automation to Enforce Limits

Take advantage of automation to enforce spending limits. Many corporate card programs allow you to set automatic restrictions. These controls prevent:

- Overspending.

- Unauthorized purchases.

- Exceeding approved budgets.

This reduces the need for manual monitoring and ensures compliance with company policies.

6. Check Spending Regularly

Perform regular audits to review employee spending and confirm compliance with your rules. These audits help you:

- Spot any misuse or fraud.

- Identify patterns that need adjustments.

To make auditing easier, use a platform that reminds employees to categorize expenses and attach receipts. This minimizes back-and-forth and ensures all records are complete.

7. Simplify Account Reconciliation

Reconciliation—matching credit card statements with internal records—can be tedious. Simplify it by:

- Using tools that automate the process.

- Syncing your corporate card platform with accounting software.

This ensures that all transactions are accurate, documented, and easy to review.

8. Limit Who Gets Cards

Not every employee needs a corporate card. Only issue cards to those whose roles require them, such as managers, team leads, or employees who travel often.

When an employee leaves the company, immediately cancel their card to prevent misuse. For added security, consider using virtual cards that are tied to specific projects or vendors.

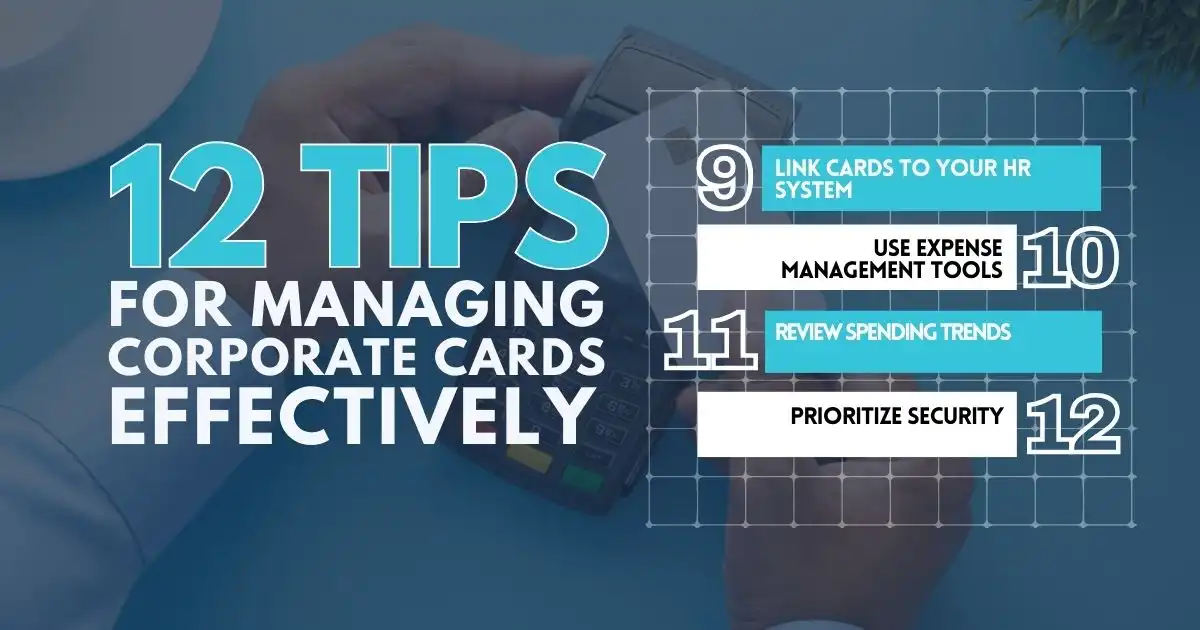

9. Link Cards to Your HR System

Sync your card management system with your HR platform. This ensures corporate cards are automatically deactivated when an employee leaves or changes roles. It also reduces the risk of active cards being overlooked.

10. Use Expense Management Tools

Expense management tools like BILL Spend & Expense can simplify tracking and managing corporate card expenses. These tools can:

- Automatically categorize expenses.

- Generate detailed reports for easy analysis.

- Streamline the reimbursement process.

By using these tools, you can save time, reduce manual errors, and ease the workload for your finance team.

11. Review Spending Trends

Take a closer look at how employees are using corporate cards. Analyze spending data to uncover:

- Areas where you can cut costs.

- Vendors who may offer better deals or discounts.

- Opportunities to negotiate early-payment discounts or long-term agreements.

Understanding trends can lead to better financial decisions and more efficient use of company funds.

12. Prioritize Security

Protecting your company’s financial information should be a top priority. Here are ways to keep your corporate cards secure:

- Use platforms that allow you to create virtual cards for vendors or specific projects.

- Set strict protocols for reporting lost or stolen cards.

- Regularly review and update your security measures.

If a virtual card is compromised, you can cancel it without disrupting other spending. This minimizes risk and protects your company from fraud or data breaches.

By following these tips, you’ll not only manage your company’s corporate card program effectively but also reduce risks and save time for everyone involved.

Turning Corporate Cards Into Company Assets

Every dollar counts, and corporate card management is your foundation for financial control. Without it, unchecked usage can quickly drain resources and create chaos.

Clear policies, automated oversight, and smart tracking turn corporate cards into tools for efficiency, not liabilities. Effective management prevents fraud, simplifies reconciliation, and ensures smooth operations while empowering your team.

Take control now. A well-structured system protects your resources and keeps financial headaches at bay. The choice is simple—make your corporate card program work for you, not against you.

FAQs

How to manage company credit cards effectively?

Managing company credit cards involves setting clear policies for card use, assigning spending limits, and monitoring expenses. Use expense management tools to track all transactions in one place and automate reconciliation processes. Regular audits and employee training on proper usage ensure compliance and minimize misuse.

What to do with company credit card after quitting?

If you leave a job, return the company credit card immediately to your employer or HR department. Ensure all outstanding expenses are reported and reconciled before your departure. Employers should cancel the card to avoid unauthorized charges and maintain financial security.

How to keep track of credit card spending?

To keep track of credit card spending, use centralized expense management software. These tools provide real-time monitoring, categorize expenses, and generate detailed reports. Setting up notifications for spending thresholds can also help you stay within budget.

Do corporate credit cards build credit?

Corporate credit cards generally do not build credit for individual employees, as the company is usually responsible for payments. However, if the card is tied to an individual’s personal credit, responsible usage and timely payments may positively impact their credit score.