Let’s clear things up—aggregation and consolidation are not the same.

People often mix them up, but if you work in finance or accounting, knowing the difference can save you time, prevent mistakes, and help you make better decisions. Aggregation simply adds up numbers. Consolidation, on the other hand, follows specific accounting steps, handles ownership structures, adjusts entries, and produces complete financial statements.

But what happens if you treat consolidation like simple aggregation?

Aggregation vs. Consolidation – Simple vs. Detailed

Aggregation is a basic process. It simply means adding up data based on different categories or levels (like by department, region, or time). There’s nothing complicated about it—just summing things up.

Consolidation, on the other hand, is more involved. It’s not just adding numbers. It includes accounting steps that must happen in a certain order. Each step may be easy on its own, but when there are many steps and lots of data, the process can feel hard to follow.

Financial Consolidation and Close: The Basics

For accountants and finance teams, financial consolidation and close isn’t just about putting together financial data. It means bringing together financial reports from across the company to make the needed calculations and adjustments.

The goal is to prepare final income statements and balance sheets that follow accounting rules like GAAP, IFRS, and others.

During this process, companies often need to do several things, such as:

- Convert values from different currencies

- Remove transactions between related parts of the business

- Make changes through journal entries

- Account for different ownership levels within the business

There are also different methods for handling consolidation, like full consolidation, the equity method, and proportional consolidation. The choice depends on how the company is structured.

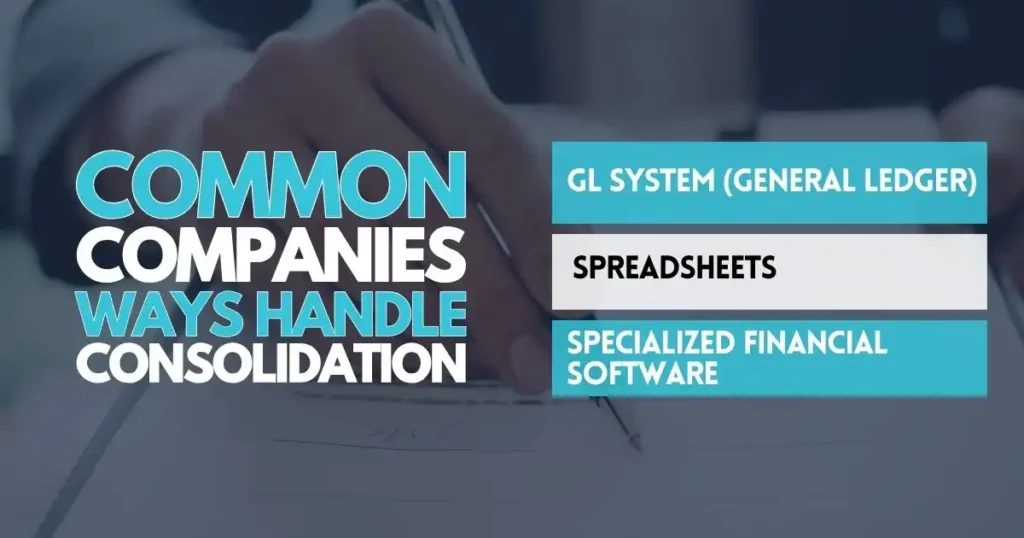

Common CompaniesWays Handle Consolidation

Most companies today no longer use fully manual methods. Instead, they often use one of these

GL System (General Ledger)

The General Ledger (GL) system is the central part of any accounting framework and is usually built into ERP (Enterprise Resource Planning) software. It records all financial transactions in one place and provides the foundation for financial reporting.

While powerful, GL systems can become difficult to manage, especially in companies that use different systems across departments or business units. Without proper integration, this setup can create gaps, delays, or data inconsistencies that impact the accuracy of financial reports and the speed of month-end close.

Spreadsheets

Spreadsheets like Excel are still widely used by finance teams—even in large companies. They’re flexible, familiar, and allow for fast customization. However, as companies grow, relying heavily on spreadsheets can slow down processes. Manual data entry, version control issues, and the lack of real-time collaboration make it hard to maintain accuracy.

This can delay financial analysis, reporting, and decision-making, especially during budgeting or closing periods.

Specialized Financial Software

Specialized financial close software has become more common among large and mid-sized companies. These platforms are purpose-built to support faster, more accurate financial closing processes. They often come with built-in controls, automation features, audit trails, and dashboards to streamline reconciliations, approvals, and consolidations.

Available through cloud-based platforms, these tools also improve collaboration across teams and allow finance departments to work more efficiently while reducing the risk of errors.

However, not all online tools offer true financial consolidation. Many only do basic data collection, which is explained next.

Data Aggregation is Not the Same as Financial Consolidation

Many finance and accounting professionals run into daily issues with financial close and consolidation. According to one expert who has worked with both Hyperion Financial Management and OneStream, a major cause of these struggles is using the wrong approach to combine and manage financial data.

They explained that business leaders often don’t have access to the right information when they need it. Because of this, teams end up making manual adjustments late in the process, costing time that could have gone toward analysis and review.

The expert pointed out that most tools designed just for basic data collection don’t support the full process of financial close. As a result, teams are left with slower workflows and incomplete reporting.

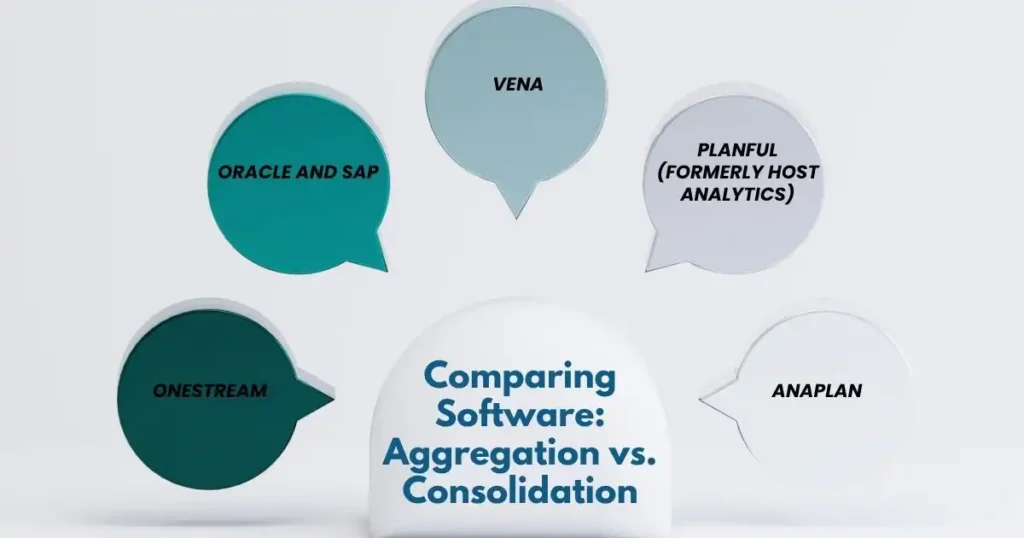

Comparing Software: Aggregation vs. Consolidation

Many software tools say they offer full financial consolidation. But in reality, few can be adjusted to fit a company’s setup and still work smoothly online.

Here are some commonly used tools:

- OneStream – A powerful tool made for accounting and finance, built to work online from the start. It can be shaped to match company needs and supports full automation. However, it often requires expert setup to use everything it offers.

- Oracle and SAP – Older systems that were not originally built for cloud use. They often need extra tools to fully support consolidation tasks.

- Vena – A smaller tool that works well for mid-sized companies that don’t need very advanced features.

- Planful (formerly Host Analytics) – Tries to offer both structured and flexible reporting. But users often say it’s either too rigid or too hard to learn without enough help.

- Anaplan – A newer tool that looks strong at first, but lacks basic connections, such as smooth Excel file use. Users also say its reporting features are limited and hard to adjust.

Before choosing any of these tools, it’s important to take a close look at what they do. Many of them include some automation and data collection, but most cannot support full consolidation tasks like managing different hierarchies or tracking calculation steps.

Don’t Just Add—Get It Right

Getting the numbers is one thing. Getting them right is another.

If you’re working in finance, it’s time to take a serious look at how your team handles reporting. Relying only on data aggregation may seem easier, but it leaves too much room for error, delays, and missed insights. Financial consolidation isn’t just a step up—it’s a step toward real clarity and control. It’s what turns raw numbers into complete, reliable reports that leadership can trust.

Now is the time to ask yourself: Are we just collecting data, or are we truly closing the books the right way?

Make the shift. Rethink your tools. Choose a process that works not just on paper, but in practice. Your numbers—and your team—deserve better.

FAQs

What is data consolidation in finance, and why is it important?

Data consolidation in finance is the process of bringing together financial information from different departments, systems, or entities into a single, consistent format. This ensures that reports, forecasts, and decisions are based on complete and unified data.

What are some common data consolidation tools used in finance?

Common data consolidation tools include ERP systems like SAP and Oracle, as well as financial close software such as BlackLine and OneStream. These tools automate data gathering, reconciliation, and reporting.

Can you give examples of data consolidation in real finance tasks?

Another example is merging expense data from different departments to create a company-wide budget vs. actuals report. This allows finance teams to analyze trends and spot areas of overspending.

How is financial data aggregation different from data consolidation?

Financial data aggregation focuses on collecting detailed records, such as transactions, balances, or payments, from different sources. It’s often used in investment analysis, banking, or fintech applications.