Do you want to understand how well a business is performing?

Being able to read and understand an annual report helps you make informed decisions, like deciding to invest in the company or evaluating its performance.

If you’re an investor or thinking about becoming one, understanding an annual report can help you make wiser financial decisions.

What’s in an Annual Report?

A public corporation is required by law to release an annual report. It provides a summary of the company’s operations and financial condition. It also helps shareholders make informed decisions.

Typically, the report has two parts. The first part includes a narrative of the past year’s performance, featuring letters from the CEO, CFO, and visual elements.

The second part presents financial documents and statements without the narrative. Unlike other financial reports, annual reports include storytelling elements to make them more engaging. They are professionally designed and used for marketing purposes. Annual reports are shared with shareholders and made available on the company’s website.

4 Steps to Efficiently Review an Annual Report

Need a quick overview of how a company is doing? Here are four easy steps to help you efficiently review an annual report.

Step 1. Read the Letter to Shareholders

Start by reading the Letter to Shareholders. This section provides an overview of the company’s performance, future plans, and the perspectives of top executives like the CEO. It sets the context for understanding the rest of the report.

Step 2. Review the Management’s Discussion and Analysis (MD&A)

Be familiar with the Management’s Discussion and Analysis. This part gives an in-depth look at how the company has performed over the year, including any challenges faced and goals achieved. It helps you understand the story behind the numbers.

Step 3. Examine the Audited Financial Statements

Check the Audited Financial Statements, which include the balance sheet, income statement, and cash flow statement. These documents reveal the company’s financial position and performance, helping you assess its stability and profitability.

Step 4. Look at the Summary of Financial Data and Auditor’s Report

Lastly, go through the Summary of Financial Data and Auditor’s Report. The summary gives a quick overview of important financial metrics, while the auditor’s report confirms the accuracy and reliability of the statements.

Key Sections of an Annual Report

Understanding the key sections of an annual report is important for anyone interested in a company’s performance and prospects. Here, we’ll break down these sections to help you understand an annual report effectively.

Company Profile with Vision and Mission

This section gives a clear picture of what the company does and its aspirations. It includes details about the company’s core activities, history, markets, and its vision and mission. Understanding the company profile helps stakeholders grasp its strategy and market position.

Letter from the Chairman/CEO

This letter adds a personal touch, highlighting the company’s plans and summarizing its performance over the past year. It offers a leadership perspective, giving insight into the company’s strategic direction and priorities.

Table of Contents

Though basic, the table of contents is essential for navigating the report. It allows readers to easily locate specific sections, saving time and ensuring efficient review.

Board of Directors

This section provides information on the company’s board members, including their backgrounds. It offers insights into the leadership’s strength and diversity, which are important for assessing governance.

Management Discussion and Analysis (MD&A)

The MD&A presents management’s perspective on the company’s business and financial performance. It adds context to the financial statements, providing insights into operations, market conditions, and future outlook.

Corporate Governance Report

This report details the company’s governance practices, policies, and regulatory compliance. It highlights the company’s commitment to transparency and ethical standards, which are important for stakeholders.

Financial Statements

These are important for understanding the company’s financial health:

- Balance Sheet displays assets, liabilities, and equity at a given point in time.

- The Income Statement details revenues, expenses, and profits for the year.

- Cash Flow Statement provides insights into the company’s cash usage and liquidity.

- Statement to Shareholders summarizes financial performance and includes shareholder-related decisions.

Auditor’s Report

The auditor’s report includes the auditor’s opinion on the financial statements, noting any concerns. It provides important insights into the company’s financial practices and transparency.

Notes to Accounts

This section explains how financial activities are recorded, including asset valuation, currency changes, and reporting practices. It’s helpful to review notes from the past few years to identify trends, changes, and potential risks.

Other Information

This section may include additional details, disclaimers, and visual elements like stories, infographics, and photographs that enhance understanding and engagement.

Each section of an annual report provides a complete view of the company. Understanding these sections can help anyone analyze an annual report effectively, make informed decisions, and gain deeper insights into a company’s health and potential.

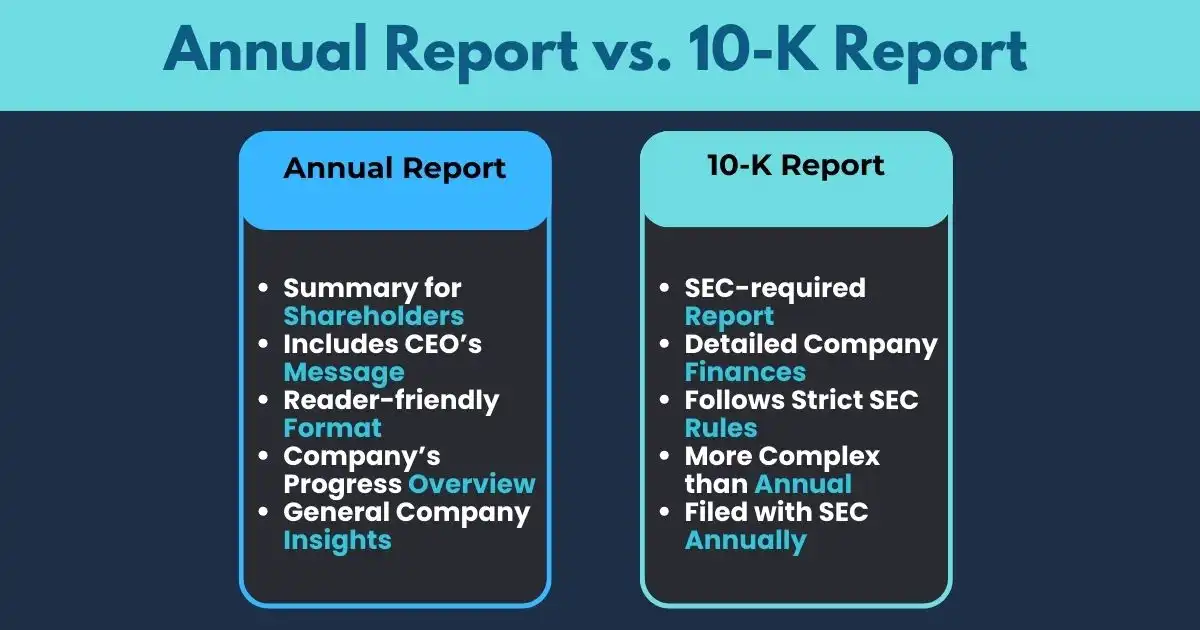

Annual Report vs. 10-K Report

Public companies are required to produce a 10-K report every year, in addition to their annual report. The 10-K, mandated by the US Securities and Exchange Commission (SEC), provides investors with detailed information about a company’s financial condition to help them make informed decisions about buying or selling shares.

While there is some overlap, the 10-K and annual reports are distinct documents. The 10-K adheres to SEC guidelines and offers an in-depth view of the company’s finances, agreements, risks, opportunities, operations, executive compensation, and market performance. It also includes detailed discussions of the company’s yearly activities and insights into its industry.

Due to its comprehensive nature, the 10-K is longer and more complex compared to the annual report. It must be filed with the SEC within 60 to 90 days after the fiscal year ends. You can find 10-K reports on the SEC’s website for review.

Smarter Investment Decisions

Reading an annual report can feel overwhelming, but understanding the key parts makes it much easier. Each section tells a story—from how the company performed to its financial health. Reviewing these reports provides valuable insight into the company’s goals, challenges, and opportunities. This knowledge can guide your investment choices effectively.

Using an annual report can help you make wiser decisions about your investments or evaluate a company’s trustworthiness. Knowledge puts you in control, and with annual reports, you gain that advantage. So next time you come across an annual report, don’t let it sit on a shelf—take charge and see what you can learn.

FAQs

How to make an annual report?

To make an annual report, start by gathering key information about your company’s performance, financial statements, and future goals. Focus on including sections like the CEO’s annual report letter, management discussion, and detailed financials. Use visuals like graphs and charts to make the data more engaging and easier to understand.

What are the best annual report examples?

The best annual report examples are those that present data, use engaging visuals, and include transparent discussions about the company’s performance. Look at reports from well-known companies, as they often include a strong CEO annual report letter, financial highlights, and well-structured narratives to guide readers.

What makes a good annual report?

A good annual report is clear, engaging, and informative. It includes essential sections such as the CEO’s annual report letter, financial statements, and a company overview. It should provide a comprehensive yet easy-to-understand look at the company’s performance, goals, and prospects.

What should be in a CEO annual report letter?

A CEO’s annual report letter should summarize the company’s achievements, challenges, and future plans. It should be transparent, inspiring, and aligned with the company’s mission and goals. A well-written CEO annual report letter helps set the tone for the rest of the report, offering readers insight into the company’s direction.