A recent CNBC survey highlights growing financial concerns among Americans. It found that 77% feel anxious about their financial future, while 58% believe their finances control their lives. Additionally, 52% report struggling to manage worries related to money, reflecting the significant emotional impact finances have on daily life.

Even if you’re not interested in money matters, they can still affect your life in big ways. Many people think they don’t need to think about finances until problems show up. By then, it can feel hard to know what to do.

While resources exist, confusing terms, high costs, and uncertainty about trusted tools can be barriers. Learning basic skills like budgeting, saving, and managing debt early can reduce stress and help you handle financial challenges effectively.

Financial Fluency vs. Financial Literacy

When it comes to managing money, “financial literacy” often implies a fixed skill—either you have it or you don’t. On the other hand, “financial fluency” highlights that improving financial skills is an ongoing process. Each person’s financial learning needs are different. For instance, managers, recruiters, and finance professionals all face unique challenges.

To support financial growth, we need fresh ideas and tools that make it easier to talk about money and overcome learning barriers. Unfortunately, many people lack access to the resources they need to achieve “financial fluency” and gain a solid understanding of finances.

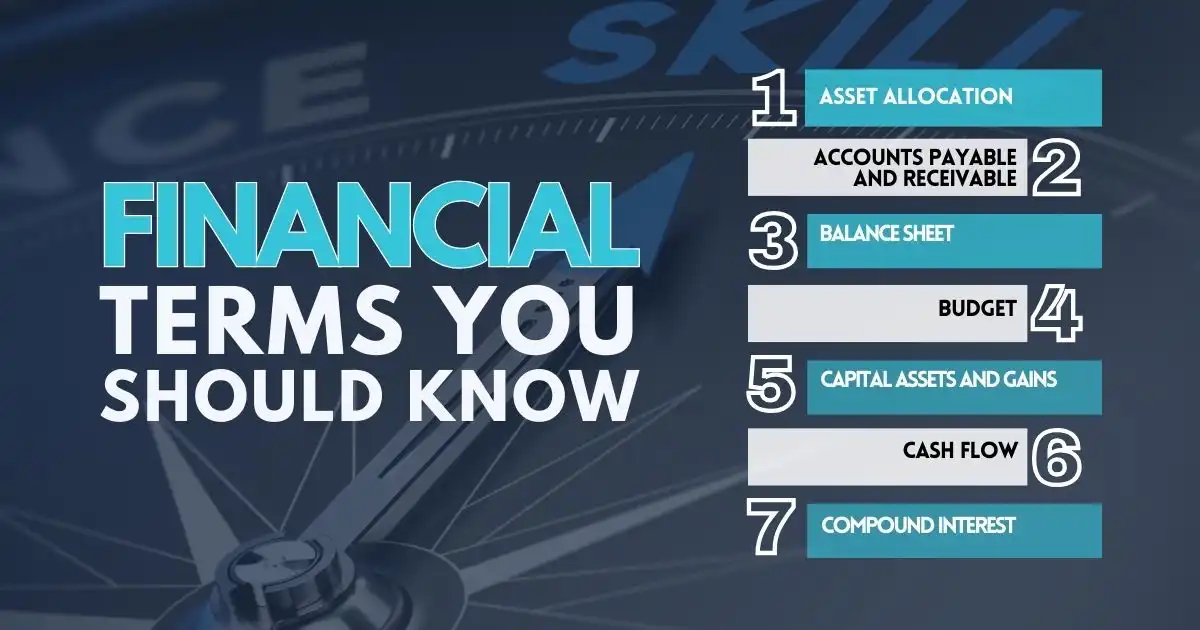

Financial Terms You Should Know

Learning basic financial terms can help you manage your money effectively and feel more confident in your decisions. These terms are not just for experts—they’re useful for anyone who wants to take control of their money and plan for a better future.

Asset Allocation

This is how you divide your money among different types of investments:

- Bonds – These are like loans you give to governments or companies. In return, they pay you interest over time. Bonds are considered safer investments but usually provide lower returns compared to stocks.

- Stocks – Buying stocks means owning a small part of a company. Stocks can be riskier than bonds but often have higher returns over time, especially when their value increases.

- Cash and Equivalents – This includes money in hand or savings that can quickly be turned into cash. It’s useful for emergencies or short-term needs.

Your choice between these depends on your goals. Bonds are good for steady income, while stocks offer higher potential growth, though with more risk.

Accounts Payable and Receivable

- Accounts Payable – This is the money a business owes to others for goods or services it has received but not yet paid for. For example, it’s like buying on credit and agreeing to pay later.

- Accounts Receivable – This is the money others owe a business for goods or services they’ve received. For instance, when a business sends an invoice to a customer, the amount owed becomes accounts receivable.

These terms are essential for understanding a company’s short-term finances.

Balance Sheet

A balance sheet is a document that gives a snapshot of a company’s financial health at a specific time. It shows three main things:

- Assets – What the company owns (e.g., cash, property, equipment).

- Liabilities – What the company owes (e.g., loans, unpaid bills).

- Equity – The remaining value that belongs to the owners after liabilities are subtracted from assets.

This document ensures that what the company owns and owes is balanced.

Budget

A budget is a financial plan that helps track your money. It shows:

- What you have now (income or savings).

- What you expect to earn (future income).

- What you plan to spend (expenses).

Budgets are usually made for a year and checked monthly to make sure you’re staying on track. They’re a helpful tool for individuals and businesses to manage money wisely.

Capital Assets and Gains

- Capital Assets – These are valuable things you own, like property, equipment, or investments. In business, they include long-term items that help generate revenue.

- Capital Gain – This happens when you sell something for more than you paid for it. For example, if you bought a stock for $50 and sell it for $100, the $50 profit is your capital gain.

These terms are important for understanding how investments grow and are taxed.

Cash Flow

Cash flow tracks how money moves in and out of a business during a specific period. It shows:

- Money coming in (e.g., sales, loans).

- Money going out (e.g., expenses, salaries).

Positive cash flow means a business has more money coming in than going out, which is crucial for paying bills and operating smoothly.

Compound Interest

Compound interest is when your savings or investments earn interest, and that interest also earns interest over time.

For example, if you invest $1,000 at 5% interest, you earn $50 in the first year. The next year, you earn interest on $1,050, and so on. This makes savings grow faster but can also increase debt if loans or credit cards are not paid off quickly.

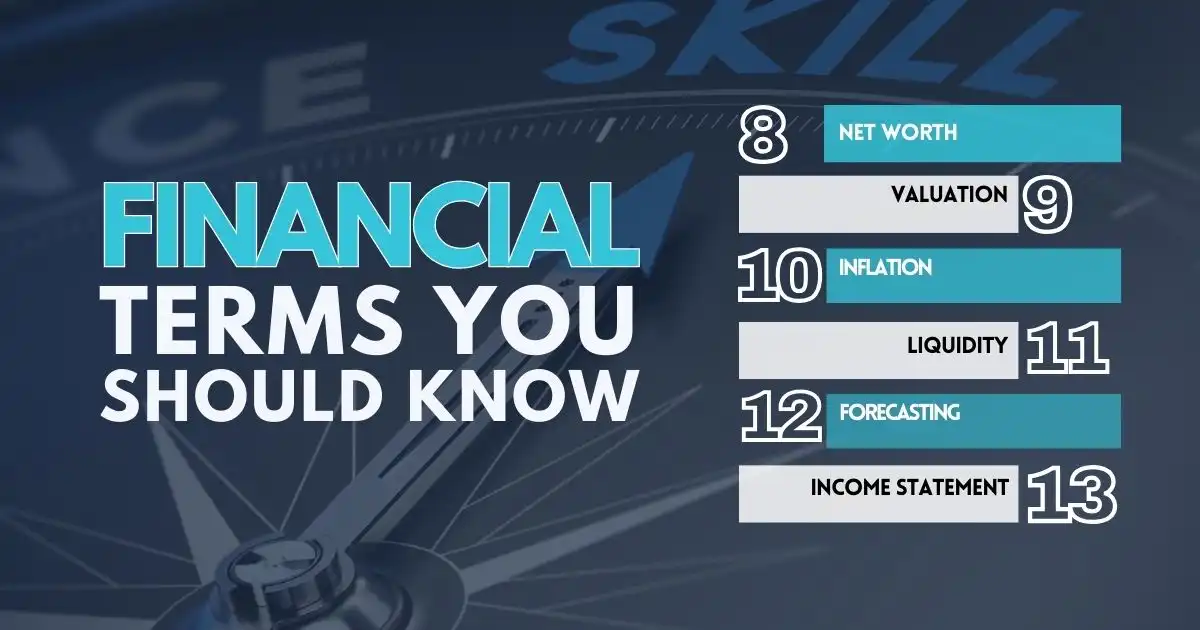

Net Worth

Net worth is a simple way to measure your financial health. It’s calculated by subtracting what you owe (debts) from what you own (assets). Positive net worth means you own more than you owe.

Valuation

Valuation is figuring out how much something is worth today. It’s important when selling a business, merging with another, or attracting investors. Regular valuations help you stay prepared for financial opportunities.

Inflation

Inflation is the gradual rise in prices over time. For example, something that costs $10 today might cost $12 in a few years. If your income doesn’t increase along with prices, your money buys less, which reduces its value.

Liquidity

Liquidity is how easily you can turn an asset into cash. Cash is the most liquid because you can use it immediately. Assets like property or artwork are less liquid because they take longer to sell.

Forecasting

Forecasting is predicting future income and expenses using current data. Businesses use this to estimate profits, plan projects, and decide if they can afford new investments. It’s also helpful for individuals to predict how much money they might need in the future.

Income Statement

An income statement, also called a profit and loss statement, shows how much money a business earns and spends over a period, like a month or a year. It helps measure how profitable a business is and whether it’s growing.

Take Charge of Your Financial Journey

Money talks, but are you listening? Too often, people wait until their finances are in hot water before paying attention. Don’t let that be you. Building financial fluency isn’t about mastering every term or becoming a finance guru—it’s about taking small, steady steps to understand how money works in your life.

Your financial health is like a garden. Neglect it, and weeds like debt and confusion will take over. But with a little care—like learning basic budgeting, understanding cash flow, or knowing the difference between assets and liabilities—you can grow a solid foundation that supports you for years to come.

Don’t let jargon or fear hold you back. Start with the basics, keep it simple, and take control of your future. After all, a little knowledge can turn pennies into power. The time to act is now!

FAQs

How do long-term financial goals differ from short-term financial goals?

Long-term financial goals focus on big milestones like retirement or buying a house and take years to achieve. Short-term financial goals are smaller, immediate objectives like saving for a vacation or paying off a small debt within a year or two.

What is long-term financial planning?

Long-term financial planning is about setting strategies to manage your money over many years. It helps you stay on track to achieve major goals, such as retirement savings or building long-term wealth while adapting to life changes.

What are the advantages of financial education?

Financial education helps you understand how to manage money, save, and invest wisely. It reduces financial stress, improves decision-making, and increases financial security over time.

What is the main goal of becoming financially literate?

The main goal of becoming financially literate is to manage money confidently and make informed financial decisions. It helps you achieve independence and long-term financial stability.