Did you know 72% of CFOs have increased their hiring of FP&A professionals to meet the rising demand for strategic financial insights?

The global FP&A training and technology market has surged to $18.3 billion, highlighting a major shift in how businesses approach financial planning. Today, 48% of finance job listings require FP&A skills—a significant jump from just three years ago.

Finance teams are shifting focus to professionals who can analyze trends, create solid forecasts, and drive business decisions. If you’re in finance, growing your FP&A skills is essential for making an impact and moving your career forward.

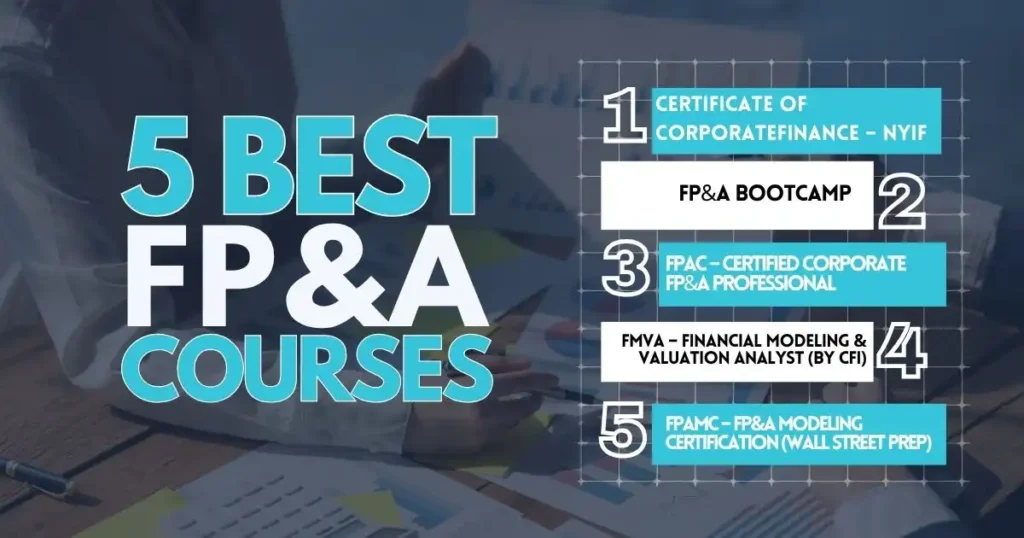

Below are 5 top-rated FP&A courses that deliver practical knowledge and real-world value. Each one gives you tools you can apply right away in your current role—or your next one.

1) Certificate of Corporate Finance – NYIF

Duration: 60 Hours

Format: Self-paced, Online

Cost: $1,545

This FP&A course from the New York Institute of Finance covers advanced finance topics in great detail. You’ll learn about:

- Credit analysis for companies

- Forecasting for industries and businesses

- Valuing projects and deals

- Managing risk and cash

- Finding short and long-term funding

- Handling day-to-day cash needs

It’s best for people with solid experience in finance, like analysts, bankers, and traders, but anyone working in corporate finance can benefit from the wide range of topics. NYIF has been around for over 100 years, and its programs are trusted by finance professionals worldwide.

This certificate helps you improve your financial knowledge or start strong in the field.

2) FP&A Bootcamp

Duration: 4 Weeks

Format: Live Zoom Workshops

Cost: $1,497

This 4-week live FP&A course is designed for people already working in finance. It teaches you how to:

- Create clear reports and presentations

- Work well with other teams

- Manage budgets without being too strict

- Improve Excel and modeling skills

- Build forecasts from both high-level and detailed data

- Use advanced methods for planning and budgeting

What makes this course different is how it teaches both technical skills and people skills. You’ll learn how to explain numbers clearly and work closely with others in your company. The sessions are led by Christian Wattig, who has held finance roles at big companies like P&G and Unilever.

You’ll learn by doing, with group work and real-time feedback. If you attend, take part, and finish the work, but still don’t find value, you can ask for a full refund.

3) FPAC – Certified Corporate FP&A Professional

Duration: 12 Weeks (36 Hours)

Format: Self-paced, Online

Cost: $1,025 – $1,520 (depending on membership/early bird)

This FP&A course is offered by the Association for Financial Professionals (AFP). It focuses on planning, analysis, and working with other teams. People with the FPAC certification often earn more, up to 16%, than those without it.

The exam has two parts: one with 140 questions and another with 55 questions. You might be able to skip the first part if you meet certain conditions.

While this program doesn’t have as many hours of course material as some others, almost all participants say it helps them in their jobs. Once certified, you can also join AFP’s online community and attend one of the largest finance conferences each year.

4) FMVA – Financial Modeling & Valuation Analyst (by CFI)

Duration: 4–6 Months (courses range from 2–10 hours each)

Format: Self-paced, Online

Cost: $298.20 (Self-Study) or $508.20 (Full Program, with 40% discount)

CFI’s FMVA certification is well-known among finance pros around the world. This is an excellent FP&A course for learning modeling and valuation. You can start with optional prep courses if you need a refresher or skip them if you already know the basics.

There are many topics to choose from, including real estate, startups, and mergers. This helps you focus on the areas that fit your goals. One course in the program—Budgeting and Forecasting—is just 7 hours long but gives you a full walk-through of how to build budgets and analyze results. With over 50 courses to pick from, this program is flexible and helpful for career growth.

5) FPAMC – FP&A Modeling Certification (Wall Street Prep)

Duration: 30 Hours

Format: Self-paced, Online

Cost: $499

Wall Street Prep’s FP&A course is built for working finance professionals. It’s a 30-hour program with a strong focus on practical skills. Designed for a wide group of people, from analysts and managers to CFOs and accountants, the course includes 8 modules.

You’ll learn to build full financial models (income statements, balance sheets, and cash flow), create long-term plans, and design dashboards.

Many large companies use this course to train their teams, so it’s also useful if you’re onboarding new staff or changing roles.

Your Next Move Starts Now

The demand is real. The numbers speak for themselves. FP&A isn’t just another skill—it’s now a pillar of modern finance. As hiring increases and expectations rise, standing still isn’t an option.

Each FP&A course above gives you tools that employers actively look for—skills that translate directly into better decisions, stronger partnerships, and more responsibility. This is your opportunity to take control of your path. Build sharper insights. Lead conversations with confidence. Make your voice count in the boardroom.

Pick the course that fits your career stage and learning style—and commit. You don’t need permission to grow. Just the right resources and the decision to start.

Your future in finance isn’t waiting. It’s ready when you are.

FAQs

What is the best FP&A certification course for advancing my career?

The Certified Corporate FP&A Professional (FPAC) by AFP is widely recognized as the top credential for experienced finance professionals. It demonstrates advanced skills in forecasting, budgeting, and business analysis.

Are there beginner-friendly FP&A courses for those new to finance?

Yes, platforms like Coursera, Udemy, and LinkedIn Learning offer beginner-level FP&A courses that cover budgeting, forecasting, and Excel modeling. These are ideal for early-career professionals looking to build foundational financial planning and analysis skills.

What topics are typically covered in an FP&A certification course?

Courses typically include modules on financial modeling, variance analysis, forecasting, and budgeting. Advanced certifications also cover data analytics, strategic planning, and performance management.

How long does it take to complete a financial planning and analysis course or certification?

Short online FP&A courses can be completed in 2 to 8 weeks, depending on your schedule. Professional certifications like FPAC may require 3 to 6 months of study and exam preparation.