When it comes to helping businesses make smart money moves, FP&A professionals are important. They’re not just crunching numbers — they’re guiding the company’s financial future.

From budgeting and forecasting to offering strategic advice, they play an important role in every major decision a business makes. And naturally, this level of responsibility comes with competitive pay.

So, what do FP&A salaries look like? What influences how much these professionals earn, and how does it vary depending on your role, location, or experience level?

What is FP&A?

FP&A stands for Financial Planning and Analysis. It is a specialized department within a company that focuses on understanding and managing the organization’s financial performance.

The main role of FP&A is to closely examine a company’s income, spending, and overall financial health. These professionals create detailed budgets, prepare financial forecasts, and analyze trends to help guide future decisions.

They play a critical role in helping business leaders understand how the company is doing financially, identify areas for improvement, and plan for growth. By using data, reports, and financial models, the FP&A team helps the company stay on track with its goals and make smarter decisions about investments, operations, and costs. In short, they turn numbers into insights that drive business success.

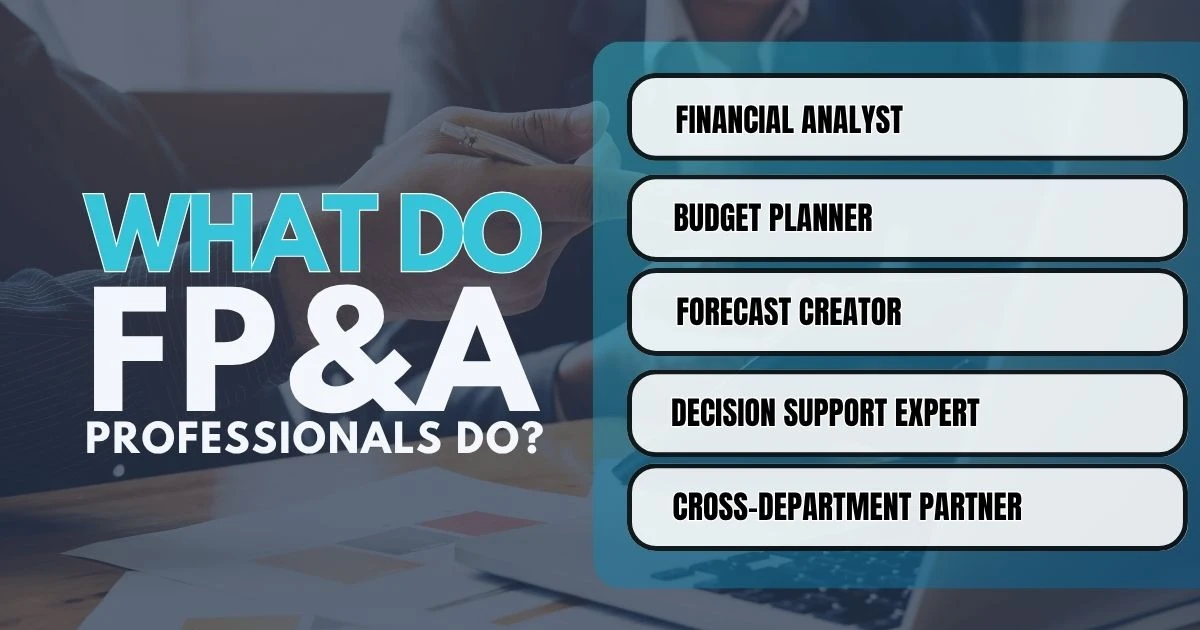

What Do FP&A Professionals Do?

FP&A professionals are the financial storytellers of a company. They take raw numbers and turn them into insights that help leaders make smart, forward-looking decisions.

- Financial Analyst – Works with financial data to understand how a company is performing and where it can improve.

- Budget Planner – Helps plan how much money the company should spend and where it should be spent.

- Forecast Creator – Predicts future income and expenses to help the company prepare for what’s ahead.

- Decision Support Expert – Provides useful financial insights to help leaders make smart business decisions.

- Cross-Department Partner – Works with teams like marketing, sales, and operations to align financial plans with company goals.

How Much Do FP&A Professionals Earn?

Salaries in Financial Planning and Analysis can vary depending on several factors, including experience level, geographic location, and specific job title. Below is a breakdown of typical salary ranges based on career stages:

1. Entry-Level FP&A Salary

If you are just beginning your career in Financial Planning and Analysis, you can expect to earn between $50,000 and $70,000 per year in the United States. Entry-level FP&A roles are typically offered to recent college graduates, especially those with degrees in finance, accounting, economics, or business administration.

In some cases, individuals with internships or part-time experience in finance may also qualify for these positions. At this stage, the main focus is on learning the basics of financial reporting, budgeting, and forecasting.

You’ll often work under the supervision of more experienced analysts or managers, helping with tasks like collecting data, preparing spreadsheets, and supporting the creation of monthly or quarterly reports.

2. Mid-Level FP&A Salary

Professionals with three to five years of experience in FP&A typically earn between $75,000 and $100,000 per year in the United States. At this stage, individuals usually hold titles like Senior Financial Analyst or Financial Analyst II.

They are expected to take on more responsibility than entry-level analysts, often handling independent projects, preparing detailed financial reports, and working closely with department heads or business units.

In addition to the base salary, mid-level FP&A professionals are often eligible for performance bonuses, annual incentives, and comprehensive benefits packages. These may include healthcare, retirement contributions, paid leave, and access to professional development programs.

Some companies also offer profit-sharing or equity grants, especially in competitive industries such as tech or investment banking.

3. Senior-Level and Manager Salary

At the senior level, FP&A professionals typically hold titles such as FP&A Manager, Senior Manager, or Director of FP&A, and earn $110,000 to $150,000 or more per year. These roles require not only deep financial expertise but also strong leadership skills and the ability to communicate complex data to executive leadership.

Senior-level professionals are responsible for leading teams of analysts, developing long-term financial strategies, and advising top-level executives like the CFO or CEO. Their work has a direct impact on major business decisions, including cost-cutting initiatives, investment planning, and market expansion strategies.

Salaries at this level are often enhanced with additional compensation, such as annual bonuses, stock options, executive benefits, and long-term incentive plans. In large corporations or high-growth startups, total compensation packages can exceed the base salary significantly.

Factors That Affect FP&A Salaries

Several important factors influence how much professionals in Financial Planning & Analysis (FP&A) earn. Elements such as experience, industry, and location all contribute to shaping overall compensation.

Experience Level

The more years you work in FP&A, the more you earn. Senior analysts and managers are paid more than beginners.

Location, people working in big cities usually earn more:

- New York, San Francisco, and London offer higher salaries

- Smaller towns or rural areas offer lower salaries

Industry

Some industries pay more than others. For example:

- Technology, finance, and healthcare often pay more

- Education or non-profits may pay less

Skills and Certifications

Having strong skills and certifications can boost your salary. Important skills include:

- Excel and financial modeling

- Forecasting and budgeting

- Tools like Power BI, Tableau, or SAP

Helpful certifications:

- CPA (Certified Public Accountant)

- CMA (Certified Management Accountant)

- CFP (Certified Financial Planner)

FP&A Career Path and Growth

FP&A offers a clear and rewarding career path, where both responsibilities and salary increase as you progress:

- Financial Analyst (Entry-Level) – Start your career by handling budgeting, reporting, and supporting financial planning tasks.

- Senior Financial Analyst – After gaining a few years of experience, take on more complex analysis and lead small projects.

- FP&A Manager – Oversee a team of analysts, coordinate financial planning efforts, and present insights to leadership.

- Director of FP&A – Lead the department, guide long-term strategy, and work closely with executives.

- Chief Financial Officer (CFO) – Holds the highest finance position in the company, responsible for all financial operations and strategy.

Tips to Increase Your FP&A Salary

If you want to boost your earning potential in FP&A, here are some practical tips to help you grow your salary over time:

- Keep learning new tools and software

- Get certified in finance or accounting

- Ask for feedback and improve your work

- Look for job opportunities in high-paying industries or cities

- Build a strong professional network

The Strategic Value of a Career in FP&A

Financial Planning and Analysis (FP&A) stands as a vital discipline for professionals who possess a sharp analytical mindset, attention to detail, and a dedication to driving informed business decisions. It serves as the backbone of financial strategy, enabling organizations to navigate uncertainty and chart a path toward sustainable growth with clarity and precision.

Beyond offering competitive compensation and job stability, FP&A provides a clearly defined career trajectory—from foundational analyst roles to senior leadership positions—where individuals can continuously develop their technical capabilities and strategic influence. Each progression within the field deepens one’s impact on key financial and operational outcomes.

As data-driven decision-making becomes increasingly central to modern enterprises, the demand for highly skilled FP&A professionals is on the rise. This field not only sharpens financial expertise but also positions individuals as trusted advisors at the intersection of numbers and strategy.

For those at the start of their journey—or preparing to advance further—FP&A offers a dynamic and rewarding career path grounded in both intellectual rigor and real-world impact.

FAQs

What is the Financial Planning and Analysis career path like?

The Financial Planning and Analysis career path offers structured progression from analyst roles to executive leadership positions.

What are the main FP&A professional responsibilities?

FP&A professionals are responsible for budgeting, forecasting, financial reporting, and supporting strategic business decisions.

How does the Financial Analyst career path progress over time?

The financial analyst career path typically advances through senior financial analyst, FP&A manager, and eventually to director-level roles.

What is the typical CFO career path from within FP&A?

A typical CFO career path often starts in FP&A, moving up through senior analyst, FP&A manager, director of FP&A, and then into executive leadership.