Can you envision an era devoid of spreadsheets in budgeting applications?

Long before modern finance, our ancestors had their own methods for tracking resources. From clay tablets in Mesopotamia to royal court records in ancient Egypt, the history of budgeting shows how humans have always worked to manage their money.

Budgeting is a key component of financial management, helping individuals, organizations, and governments plan and allocate resources effectively. The idea of budgeting dates back to ancient times when early civilizations recognized the need to manage their money. Over time, budgeting has grown from simple resource allocation to advanced tools for economic planning.

Understanding Budgeting

A budget is a financial plan that estimates income and expenses over a specific period for a business, organization, or individual. It involves setting financial goals, estimating future income, forecasting expenses, and setting limits for each spending category.

While a budget is often defined as a “quantitative expression of a plan for a defined period of time,” this definition doesn’t fully capture its importance and evolution in the business world. In this post, we will explore the history of budgets, their current role, and what the future might hold for them.

The Origins of Budgeting (1760-1920)

The word “budget” comes from the Latin word “bulga,” which means a leather bag used for carrying food. Over time, it came to mean both the bag and what it holds.

The idea of budgeting began in England around 1760 when the Chancellor of the Exchequer presented the national budget to Parliament each year. This was to limit the king’s power to impose high taxes and control public spending. In 1837, the Reform Act improved the budgeting process.

The Birth of Corporate Budgeting (1920-1930)

Across the Atlantic, the United States also adopted budgeting. President William Howard Taft started government budgeting in 1911, setting the stage for its use in business.

Business budgeting became important thanks to people like Donaldson Brown and J.O. McKinsey. Brown brought budgeting to DuPont and General Motors, creating flexible budgeting systems by 1923. McKinsey’s 1922 book, “Budgetary Control,” made him a key figure in business budgeting.

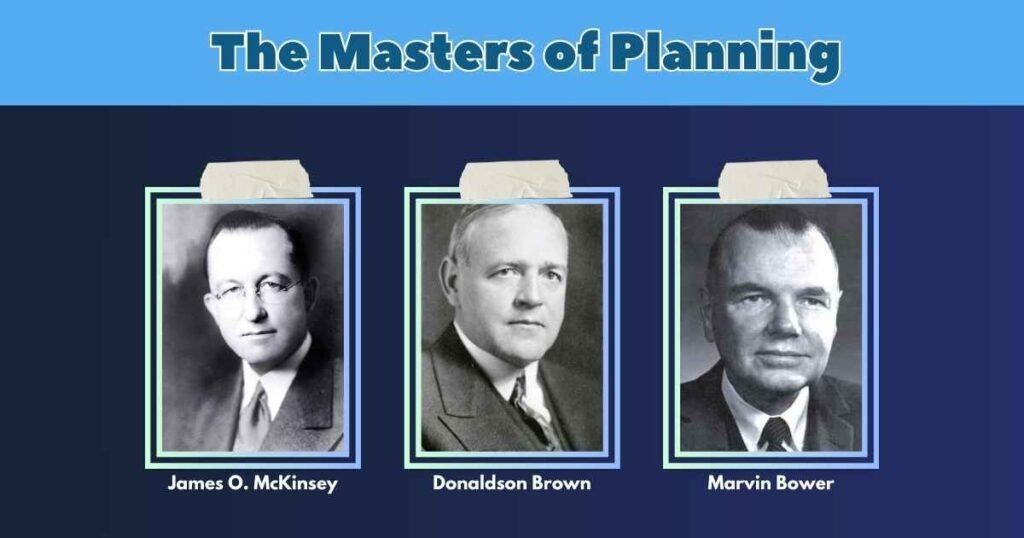

The Masters of Planning

James O. McKinsey, Donaldson Brown, Alfred Sloan, and Marvin Bower were key figures in developing modern budgeting.

Donaldson Brown created the DuPont formula, which organized investments and working capital into different categories. His work, published in 1950, stressed the importance of forecasting and planning.

In 1922, J.O. McKinsey published “Budgetary Control,” which became the basis for today’s budgeting practices. McKinsey emphasized looking toward the future instead of relying only on past data.

Marvin Bower, who studied under McKinsey, led McKinsey & Company and advised the U.S. government on budgeting. He promoted responsible spending and highlighted the difficulties of accurate forecasting.

The Influence of Excel (1987)

In the 1970s and early 1980s, financial experts spent a lot of time doing complex math by hand or with programs like Lotus 1-2-3, which started in 1983. The launch of Microsoft Excel in 1987 changed budgeting by making complex calculations and modeling easier.

Excel is known for simple math like adding, subtracting, multiplying, and dividing, but it can also handle more advanced tasks with functions like IF, VLOOKUP, INDEX-MATCH, and pivot tables. Excel quickly became an essential tool for financial analysts.

Problems and Criticisms (1990-2009)

Using Excel for budgeting, while useful at first, has faced growing criticism as business needs became more complex. Critics say traditional budgets quickly become outdated and often lead to manipulated goals. In a notable article by Jack Sweeney in the June edition of Business Finance, he declared the ‘death of the budget,’ arguing that annual budgets, which have been used since 1922, are often obsolete soon after they are created. Some companies even stopped using budgets because of worries about goal manipulation.

\Despite these criticisms, a 2021 survey of 500 CFOs and FP&A professionals showed that none had completely stopped budgeting. In fact, 66% of finance leaders believed that having a budget is essential for both short-term and long-term planning. Critics of budgeting, however, point out the inefficiencies it causes, especially as budgeting has moved to newly formed FP&A analyst teams.

The budgeting process is time-consuming, with 42% of businesses taking up to three months and another 42% taking four to six months to complete their annual budget. These manual tasks, often done in Excel, include finding and fixing errors (64%), updating reports by hand (63%), collecting and compiling data (60%), and managing multiple versions of reports (54%). Despite these issues, many finance leaders still find budgeting a valuable tool for guiding business planning.

Moving Beyond Traditional Budgeting (2005-Present)

Beyond Budgeting aims to replace the old budgeting methods with better financial management strategies for businesses. It suggests moving away from traditional budgeting because it has some flaws. Instead, it promotes more frequent budgeting using techniques like rolling forecasts and market-based targets.

In 2008, Robert Kaplan from Harvard Business School wrote a foreword for Bjarte Bogsnes’ book on Beyond Budgeting. He questioned the usefulness of fixed annual budgets in today’s fast-changing world, noting they are expensive to prepare. As a result, businesses are searching for new ways to handle their finances.

How Businesses Adapted (2016 and Beyond)

Ivo de Brouwer, the finance director for Controlling Methodologies at Danone, a French food company, saw a big change in how companies handled budgets. In the late 1990s, the old way of budgeting worked because companies could predict and sometimes influence future events. They made an annual budget and adjusted it based on real results.

By 2016, Danone and many other companies faced a new reality of constant change, uncertainty, and complexity, known as “Vuca.” The old budgeting process no longer worked effectively. To adapt, De Brouwer and his team started using “rolling forecasts.” This meant they always planned about a year and a half in advance, predicting future events and preparing for both the best and worst scenarios. The pandemic made the challenge to traditional budgeting even greater.

Budgeting Changes During the Pandemic

COVID-19 has sped up the move from traditional yearly budgets to rolling forecasts and real-time data. Manish Gundecha, FP&A Director at HP, stresses the importance of flexible budgets, pointing out that fixed budgets quickly become outdated during unexpected events like the pandemic. He shares an example where HP had to quickly supply laptops to Japanese high schoolers during the pandemic, a situation not predicted by their past trends. This quick adaptation allowed HP and other tech companies to seize a big opportunity.

The new way of budgeting, called Rolling Forecast 2.0 by Danone, involves using more internal and external data. It allows different countries to set their own targets and focuses more on scenarios and non-financial data. This method considers important non-financial events, like social media disruptions caused by activist investors, which affected Danone’s budget in Morocco. COVID-19 has made organizations rethink their financial plans, adding flexibility to adapt to unexpected challenges, as seen with LEGO Group reinvesting travel savings and Amwell improving services in response to the pandemic.

Final Thoughts

A budget is a key financial plan estimating income and expenses over a period, helping to allocate resources, track progress, and make smart financial decisions. Despite challenges, budgeting remains important for short- and long-term planning. Modern approaches like rolling forecasts, real-time data, and AI tools improve the process. The history of budgeting highlights its lasting importance, with core principles remaining unchanged: track income and expenses, plan for the future, and make wise financial choices.

FAQs

When did people start using budgeting practices?

Budgeting practices date back to ancient civilizations, such as Mesopotamia around 3,000 BC. People used clay tablets to record their income and expenses, demonstrating early efforts to manage resources effectively.

How have budgeting tools evolved over time?

Budgeting tools have evolved significantly over time. Ancient civilizations used clay tablets and papyrus, medieval societies used ledgers and parchment, and modern times have brought paper-based accounting, spreadsheets, and advanced budgeting apps and software.

What are the core principles of budgeting that have remained constant?

Despite the evolution of tools, the core principles of budgeting have remained the same: tracking income and expenses, planning for future needs, and making informed financial decisions. These principles help individuals and organizations manage their finances effectively.

How can understanding the history of budgeting help us today?

Understanding the history of budgeting helps us appreciate the importance of financial management across different eras. By learning from past practices and mistakes, we can improve our budgeting skills and achieve our financial goals more effectively in the present and future.