Staying financially stable starts with managing money wisely. This means having a plan for your money allows you to spend with confidence, save for the future, and avoid unnecessary stress.

Budgeting isn’t about restriction—it’s about control. When you know where your money is going, you can make smarter choices, avoid debt, and reach your financial goals faster. Without a plan, overspending becomes easy, and unexpected expenses can throw you off track.

But what does it take to build strong budgeting skills?

Budget Management Skills

Budget management skills help you plan and control spending in a business. Handling a company’s finances or managing a small project’s budget requires careful planning to keep expenses on track.

Team leaders, department heads, and budget managers use these skills to improve profitability. Learning how to manage budgets well allows project managers to plan future costs and allocate funds efficiently.

Ways to use budget management skills:

- Communicating with stakeholders to review available funds and understand long-term financial needs

- Using budgeting software to create charts that show spending and income during meetings

- Reviewing finances and checking expenses to ensure funds are used properly and stay within budget

5 Effective Budget Management Tips

Using budget management skills effectively can improve financial planning and resource allocation. Here are five tips to help you budget better as a manager.

1. Know Your Organization’s Budget Timeline and Procedures

Understand your organization’s budgeting deadlines and guidelines from the start. Your budget may depend on financial goals set by supervisors and department heads. Being aware of key dates helps you manage time efficiently and collaborate with stakeholders who can assist with budget decisions.

2. Use Financial Data for Better Decisions

Financial data is a valuable tool for making informed decisions. Reviewing financial statements gives you a clear picture of your organization’s financial position and helps you allocate resources wisely.

“Business environments shift quickly, and relying solely on past data for your budget can affect other parts of the organization,” wrote John Wong, Senior Associate Director of Financial Planning and Analysis at Harvard Business School Online.

3. Align Budgeting with Company Goals

Understanding your organization’s goals helps you budget effectively. It ensures your team’s work supports the company’s mission and overall objectives.

For example, if the company is planning a website redesign, your team may handle tasks like writing content, creating videos, and designing graphics. Breaking down these tasks into clear budget items ensures your team has the resources to complete the project successfully.

4. Monitor Team Performance

A well-planned budget helps track progress and measure success. Setting clear financial goals and monitoring expenses allow you to assess performance and make adjustments when needed.

Regular communication with your team ensures projects stay on schedule. If something isn’t working as planned, you may need to adjust costs, deadlines, or resource allocation. Stay flexible and be prepared to shift resources to meet organizational needs.

5. Communicate Progress and Results

Regular updates keep everyone informed about budget status and financial performance. Meet with key stakeholders to share progress, highlight achievements, and identify areas that need improvement.

Keep your team informed as well. Showing employees how their work contributes to financial goals can improve motivation and engagement.

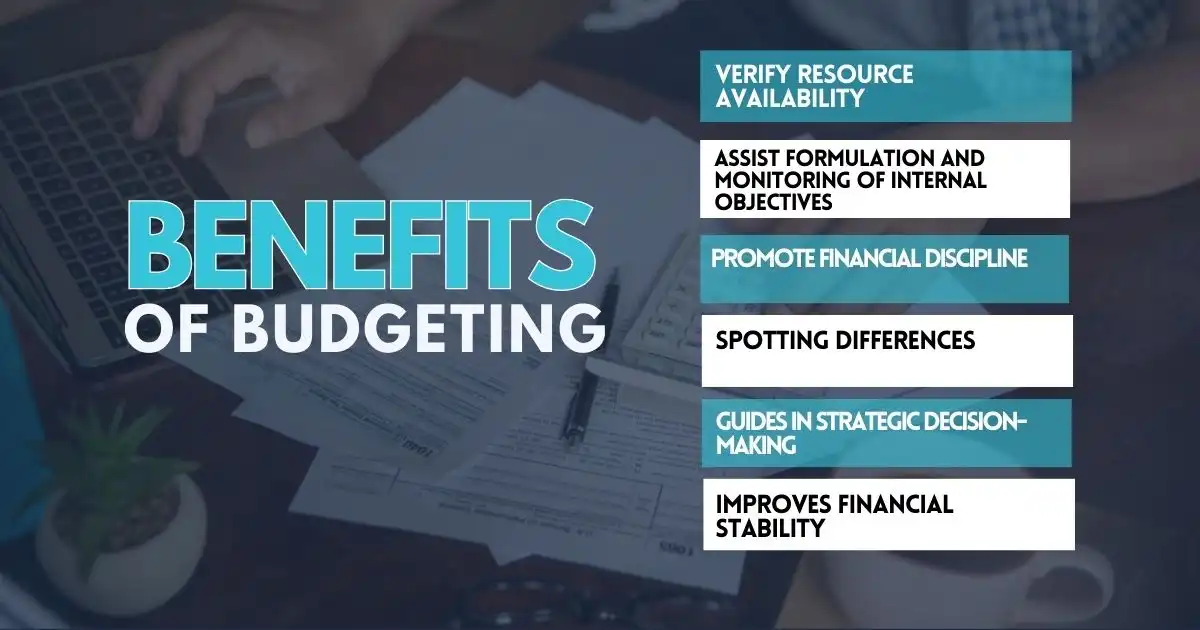

Benefits of Budgeting

Budgeting helps you manage money wisely, avoid unnecessary debt, and work toward financial stability. Here are the benefits of budgeting and how it can improve your financial well-being.

Verify Resource Availability

The main purpose of budgeting is to guarantee that an organization has sufficient resources to achieve its objectives. By planning finances ahead of time, you can identify which teams and projects need additional resources and where you might be able to reduce spending.

Assist Formulation and Monitoring of Internal Objectives

Budgeting for the upcoming period goes beyond just allocating funds; it also involves figuring out how much revenue is necessary to meet company objectives.

Financial goals should be realistic enough that you can rely on them to guide your budget allocations. Your goals dictate the expenses required to achieve them and vice versa.

Promote Financial Discipline

Budgetary control enforces financial discipline by ensuring that spending stays within the planned budget. It helps organizations set clear financial limits, monitor expenses, and prevent unnecessary costs. By following a structured budget, businesses can allocate resources effectively and avoid financial mismanagement.

Spotting Differences

Comparing budgeted and actual figures helps organizations detect discrepancies and take timely corrective action. Regular financial reviews allow managers to adjust spending, reallocate funds, and address potential financial risks before they escalate. This ensures better financial accuracy and stability.

Guides in Strategic Decision-Making

Budgetary control helps organizations make informed financial decisions by providing a clear view of income, expenses, and resource allocation. With accurate financial data, managers can assess spending patterns, identify cost-saving opportunities, and adjust budgets to support business goals.

A well-planned budget also promotes long-term growth by prioritizing investments, planning for future expenses, and adapting to economic changes. Expanding operations, hiring staff, and launching new projects become more manageable when financial decisions align with organizational objectives, ensuring stability and success.

Improves Financial Stability

Effective budgetary planning prevents overspending and ensures funds are used wisely. Tracking expenses and setting financial limits help maintain cash flow and avoid debt.

A well-managed budget allows organizations to handle unexpected costs and invest in growth. Strong financial control builds long-term stability and supports business sustainability.

Control Your Budget, Control Your Future

Money can slip through your fingers like sand if you don’t have a plan. Budgeting isn’t just about numbers—it’s about making sure your hard work pays off and your future stays secure. Without a budget, you’re driving blind, hoping you won’t hit a dead end. But when you take control, you decide where your money goes, not the other way around.

Think about it—what could you do with more financial freedom? Pay off debt faster? Save for a dream home? Grow a business? Every dollar has a job, and it’s up to you to assign it wisely. A solid budget doesn’t just keep you afloat; it builds a strong foundation for the future.

So, will you let money control you, or will you step up and take charge?

FAQs

What are some strategies for driving budget efficiency?

To improve budget efficiency, track expenses regularly, set clear financial goals, and adjust spending as needed. Use budgeting and forecasting tools to analyze financial data and make informed decisions.

How can you increase the budget without overspending?

To increase the budget, look for ways to boost revenue, cut unnecessary expenses, or reallocate funds wisely. Reviewing financial reports and adjusting priorities can help ensure responsible budget growth.

What are budgeting and forecasting tools, and how do they help?

Budgeting and forecasting tools help track income and expenses, predict future financial needs, and create detailed financial plans. These tools assist in making accurate financial decisions and avoiding budget shortfalls.

How can you ensure you don’t go over your budget?

Monitor spending regularly, set spending limits, and use budgeting software to track expenses in real-time. Reviewing your budget often and making adjustments can prevent overspending.