Your company’s sensitive information is scattered across the internet. You’re locked out of your system, and the ransom for access is staggering. Panic sets in as you try to piece together what went wrong—and then the alarm clock jolts you awake. Thankfully, it’s just a bad dream for now.

However, with cyber threats escalating, scenarios like these are becoming alarmingly real. This is why internal audits have become important for safeguarding against such risks.

What Is An Internal Audit?

An internal audit reviews a company’s internal controls, including corporate governance and accounting processes. Its purpose is to ensure compliance with laws and regulations while maintaining accurate financial reporting and data collection.

Companies employ internal auditors to work on behalf of their management. These audits also help management improve operations by identifying and addressing issues before they are detected in an external audit.

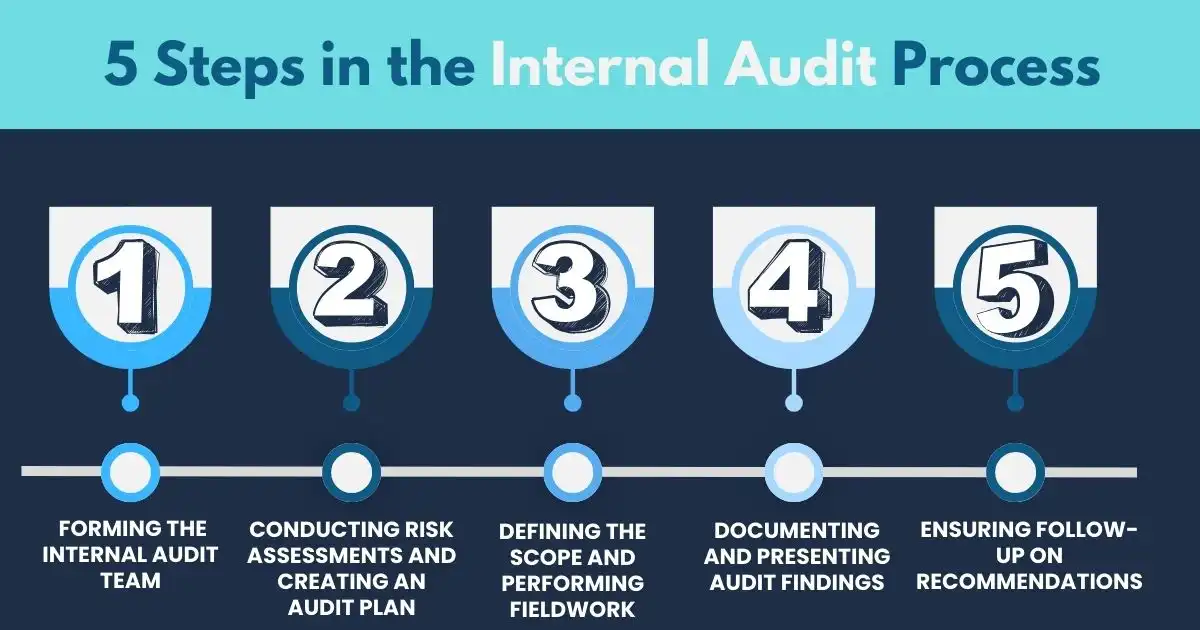

5 Steps in the Internal Audit Process

Internal audits help organizations identify and address risks effectively. The process is guided by the internal audit charter, which outlines the team’s purpose, authority, and responsibilities. Internal auditors follow the standards set by the International Professional Practices Framework (IPPF), supported by The Institute of Internal Auditors (IIA).

Here are the steps of the internal audit process:

Step 1. Forming the Internal Audit Team

The first step is assembling a team with the right skills. Team members should have strong analytical, critical thinking, and communication abilities.

Objectivity, discretion, and attention to detail are important qualities for auditors, as their work involves analyzing data and uncovering issues that others might miss. Team members must also collaborate effectively and uphold high ethical standards.

Step 2. Conducting Risk Assessments and Creating an Audit Plan

The process begins with a risk assessment, often conducted annually. This involves identifying areas of potential risk, ranking them based on priority, and selecting the focus for the audit.

The team then creates an audit plan that includes objectives, timelines, and assigned roles. A kickoff meeting starts the process, followed by regular updates to ensure progress and alignment.

Step 3. Defining the Scope and Performing Fieldwork

The scoping phase defines the purpose and boundaries of the audit. Auditors review documents, observe operations, and test transactions to assess existing controls and identify weaknesses.

New findings during this phase may lead to adjustments in the audit scope. Based on the information gathered, the team documents findings confirms them with stakeholders, and suggests solutions.

Step 4. Documenting and Presenting Audit Findings

The audit team prepares a formal report that summarizes findings, methods, and recommendations. Sometimes, an interim report is shared with management to address urgent matters.

Leadership may review a draft of the final report to provide additional input. The final report includes a summary of results, suggested improvements, and next steps, and it is often presented to the audit committee.

Step 5. Ensuring Follow-Up on Recommendations

After the audit, the team follows up to ensure that the recommended actions have been implemented. This step ensures that identified risks are addressed and improvements are in place.

By following these steps, organizations can strengthen their internal controls, improve operations, and reduce risks effectively. Internal audits provide valuable insights to help organizations address challenges and operate more efficiently.

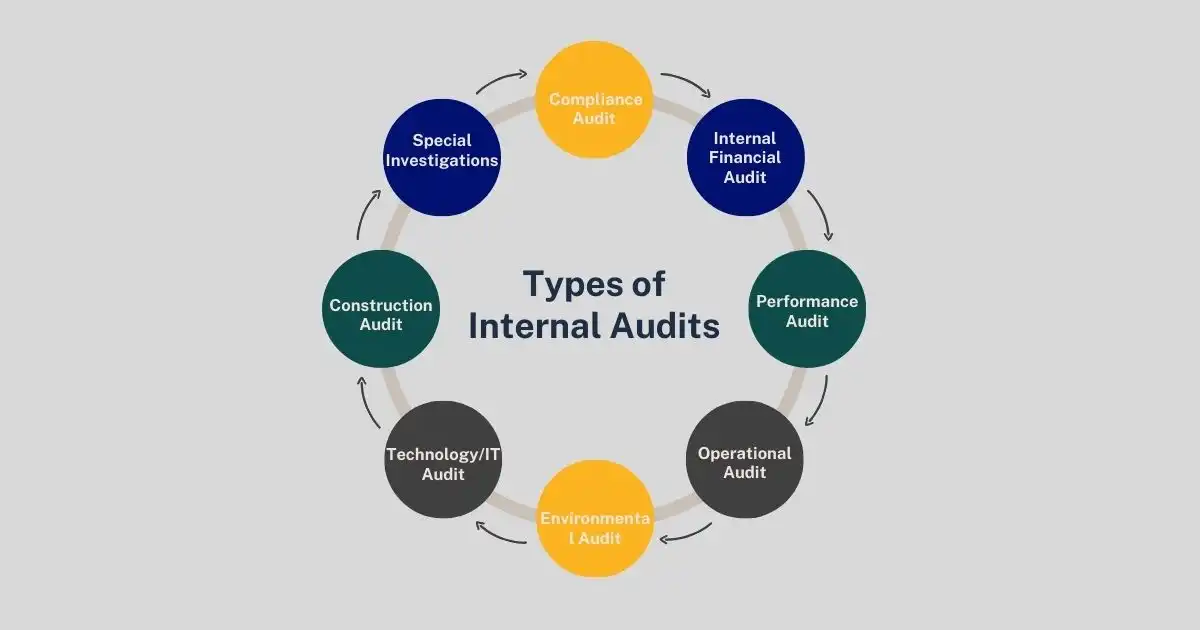

Types of Internal Audits

Internal audits help companies manage risks, follow rules, and improve operations. Each type focuses on a specific area like compliance, performance, or technology.

1. Compliance Audit

A compliance audit ensures that a company follows applicable laws, regulations, policies, or other requirements. An internal audit team reviews and compiles relevant information to assess whether the company meets these obligations and provides an opinion on its compliance status.

2. Internal Financial Audit

Public companies are often required to undergo external financial audits by independent third parties. To prepare for these or to further investigate audit findings, companies may conduct internal financial audits. While the tests performed by internal and external auditors can be similar, the key difference is the independence of external auditors.

3. Performance Audit

A performance audit focuses on the results of specific objectives or metrics, rather than the processes. Companies may use these audits to evaluate whether goals, such as expanding diverse supplier use, have been met. The internal auditor independently reviews outcomes to measure progress toward such objectives.

4. Operational Audit

Operational audits assess how well an organization’s staff and processes align with its mission, values, and goals. These audits often occur when key personnel leave or new management takes over. The aim is to evaluate resource efficiency and ensure the organization operates effectively.

5. Environmental Audit

As businesses focus more on environmental responsibility, some conduct internal audits to assess their impact on the planet.

These audits evaluate how the company sources materials, minimizes greenhouse gas emissions, adopts eco-friendly distribution methods, and reduces energy usage. Companies committed to sustainability or using triple-bottom-line reporting may include environmental audits in their annual evaluations.

6. Technology/IT Audit

An IT audit evaluates the company’s technological systems, including hardware, software, security, documentation, and backup/recovery processes. This type of audit may result from a lawsuit, a complaint, or the goal of improving efficiency. The audit aims to assess the accuracy, security, and overall effectiveness of IT systems.

7. Construction Audit

Construction audits are common in real estate, development, or construction-related companies. These audits review project progress, billing accuracy, and contract compliance with contractors and vendors. They also verify that payments made and received align with project agreements and that internal project reports are accurate.

8. Special Investigations

Special investigations address one-time situations, such as evaluating the success of a recent merger, reviewing the hiring of a key employee, or addressing staff complaints. When conducting such audits, it is important to select auditors with the right expertise and independence to ensure a thorough and unbiased evaluation.

Why Internal Audits Are Your Best Defense

Think of your business as a well-built structure. Even the strongest buildings can have hidden weaknesses. Internal audits act as inspections, identifying risks before they cause serious damage.

Cyber threats and regulatory issues often strike where controls are weakest. By conducting regular audits, you can uncover these risks and address them before they escalate.

Audits are not just about finding faults; they are about ensuring long-term security. They encourage questions like, “Are our processes effective? Are we prepared for unexpected challenges?” These steps protect your business from costly mistakes.

Take action now by organizing a skilled team to handle internal audits effectively. Their work will not only highlight issues but also create solutions that last. A solid audit plan ensures your business remains strong and secure in an uncertain world.

FAQs

What are internal audit requirements?

Internal audit requirements refer to the standards and processes organizations must follow to assess risks, compliance, and operational efficiency. These typically include a risk-based audit plan, qualified auditors, and clear reporting procedures.

What are internal audit best practices?

Internal audit best practices include conducting regular risk assessments, maintaining auditor independence, and using technology for efficient evaluations. Clear communication and follow-up on recommendations are also essential for effective audits.

How to conduct an internal audit effectively?

To conduct an internal audit effectively, start with a thorough risk assessment, define the audit scope, and create a clear plan. Ensure auditors gather evidence, document findings, and present actionable recommendations to management.

Who should perform an internal audit?

Qualified professionals, such as internal auditors with expertise in risk management and compliance, should perform an internal audit. They must be independent, ethical, and skilled in analyzing business operations and controls.