Finance teams dread every month-end close, this critical period demands significant time and effort for every business.

Unfinished financial documents and a disorganized FP&A team can lead to major complications during month-end book closings. An effective checklist streamlines this process, fostering teamwork and enabling focus on vital business matters.

It ensures that your team has the necessary financial information at hand and is prepared to report accurately, which is crucial for making timely decisions and aligning with long-term objectives.

What is the Month-End Close Process?

The month-end closing process is an essential accounting practice where your team reviews and records all financial activities from the preceding month.

While each business may have specific tasks, some common activities include recording missed invoices, reconciling accounts, counting inventory, comparing actual spending to the budget, managing key records, and analyzing data to generate reports for stakeholders. The primary goal is to produce accurate financial statements for the month.

Importance and Benefits of the Month-End Close Process

The month-end close process ensures that all business transactions are thoroughly tracked, which is vital for maintaining accurate and complete accounting information. Precise monthly data simplifies other accounting tasks, notably the year-end closing process, by providing reliable monthly reports for reference.

The benefits of an effective month-end close include maintaining accurate financial records, enabling informed decision-making, facilitating organized tax filing, simplifying audits, and identifying financial improvement areas.

Month-End Close Checklist

With the key steps outlined, a checklist can help gather the necessary data for successful monthly closing:

1. Keep Track of Incoming Money

Record all the money your business receives, like client payments, and make sure to check on any unpaid invoices regularly.

2. Monitor Your Spending

Use accounting software to keep an eye on all company expenses and bills. This helps you track where your money is going and ensures your records are correct.

3. Reconcile Your Accounts Regularly

Check that your financial records match those from banks and suppliers. If there are any differences, fix them right away.

4. Don’t Overlook Small Expenses

Make sure to track small cash expenses carefully. Automating these records can help avoid mistakes.

5. Gather and Review Financial Documents

Collect important documents like balance sheets and profit and loss statements. These give you a clear summary of your business’s financial health.

6. Plan and Be Proactive

Begin planning for your monthly financial close early, implement automation tools when feasible, and ensure your finance teams have the necessary resources.

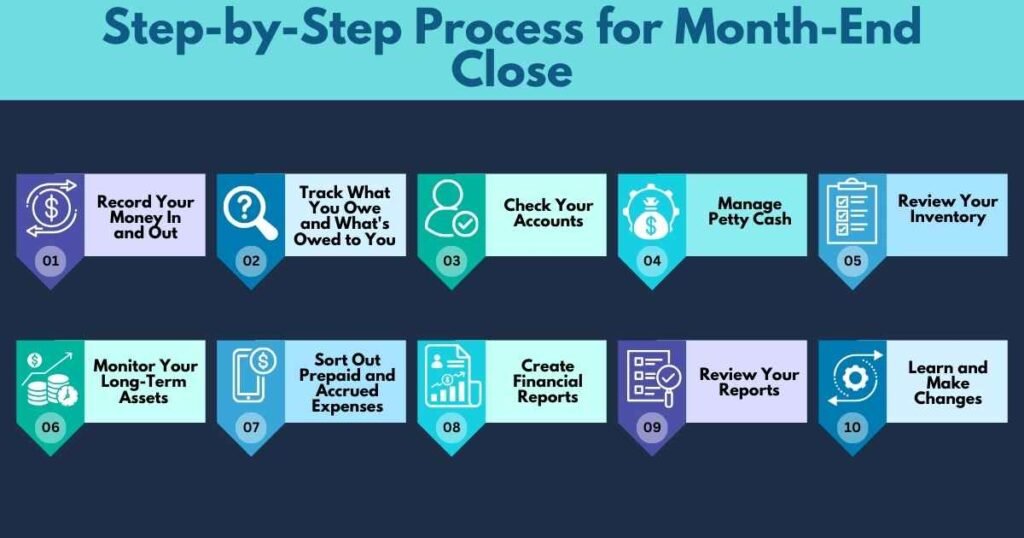

Step-by-Step Process for Month-End Close

Follow these specific steps to simplify the month-end close process:

Step 1: Record Your Money In and Out

Keep track of all the money coming in and going out. Organize income and expenses into categories to make understanding your finances easier.

Step 2: Track What You Owe and What’s Owed to You

Make sure you pay your bills on time and collect money from customers. Double-check invoices for mistakes to avoid errors in your finances.

Step 3: Check Your Accounts

Regularly compare your financial records with bank statements to catch any discrepancies or fraudulent activities.

Step 4: Manage Petty Cash

Diligently monitor small expense transactions from your petty cash fund and reconcile them to maintain financial integrity.

Step 5: Review Your Inventory

Conduct inventory counts and compare with records to identify and rectify discrepancies in stock levels.

Step 6: Monitor Your Long-Term Assets

Keep track of significant company assets, ensuring their conditions are documented and noting any related expenses and depreciation.

Step 7: Sort Out Prepaid and Accrued Expenses

Account for advance payments and any receivables, vigilantly avoiding double payments and maintaining accuracy.

Step 8: Create Financial Reports

Utilise updated records to generate financial statements reflecting your company’s worth, profitability, and cash flow, having them reviewed by a professional accountant.

Step 9: Review Your Reports

Have an independent party audit your financial statements to catch any oversights.

Step 10: Learn and Make Changes

Assess your financial reports to draw insights from successes and failures while planning for future challenges and opportunities.

Structurize Your Month- End Close

Carrying out an efficient month-end close process is essential for financial stability within any organization. By addressing incomplete financial documents and improving FP&A team coordination, businesses can navigate this critical time smoothly.

Implementing a structured approach, such as following a checklist and specific steps, will enhance accuracy and facilitate better decision-making. Regular reviews and adaptive strategies pave the way for informed financial management, positioning companies to achieve their long-term ambitions effectively.

FAQs

What is a month-end close checklist?

A month-end close checklist is a step-by-step guide that helps businesses complete important accounting tasks at the end of each month. It ensures all financial records are accurate and ready for reporting.

Why is the month-end close process important?

The month-end close process helps ensure that all financial data is correct, so businesses can make good decisions based on accurate reports. It also helps catch and fix any mistakes.

What are common tasks on a month-end close checklist?

Typical tasks include reconciling bank accounts, reviewing expenses, updating financial statements, and preparing invoices and payments.

How can I make the month-end close faster?

Organizing your records throughout the month, using accounting software, and following the checklist can help speed up the month-end close process.