Every entrepreneur, freelancer, or employee has faced that moment of confusion—looking at a paycheck or business revenue and wondering, Why does my bank account tell a different story?

Making money is one thing. Keeping it? That’s another. Gross income might look impressive, but net income is what truly determines financial health. If you’ve ever felt frustrated watching your hard-earned cash shrink after deductions, taxes, or expenses, you’re not alone.

Understanding the difference between gross and net income is important to smarter budgeting, better financial decisions, and long-term success. So, what exactly do these terms mean, and how do they impact your financial reality?

What is Gross Income?

Gross income is the total earnings before deductions such as taxes, employee withholdings, loan payments, and other financial obligations. It includes all revenue sources, such as sales, interest, and investments, and serves as the starting point for assessing available cash flow.

Note: Gross income does not factor in the cost of goods sold (COGS), which is subtracted from total revenue before determining net income.

Gross income appears at the top of a company’s profit and loss statement and includes revenue streams like sales, investment interest, and rental income. It shows a company’s earnings before deducting expenses such as salaries, overhead, and taxes.

This figure helps measure a company’s ability to generate revenue. Analysts use it to identify areas for cost savings and assess financial performance. Gross income also plays a role in financial forecasting, helping estimate future cash flow and profitability, which supports investment decisions and business planning.

However, to get a clearer picture of a company’s actual earnings, it’s important to look at net income—the amount remaining after all expenses and deductions.

What is Net Income?

Businesses need materials, services, and operational support to generate revenue. Net income is the amount left after deducting these costs from gross revenue. It represents the company’s actual earnings after covering all financial obligations.

Deductions from Gross Income

- Operating Expenses – Includes salaries, rent, utilities, marketing, and research and development. These are necessary costs to run the business outside of direct production.

- Interest and Taxes – Covers expenses from borrowed funds and government-imposed taxes.

- One-Time Expenses – Unexpected costs, such as losses from natural disasters or asset disposals, may also reduce net income.

Net income provides a clearer view of a company’s financial position, showing the actual funds available for reinvestment, savings, or profit distribution. But how does net income compare to gross income, and why do both figures matter?

Differences Between Gross Income and Net Income

Gross income and net income are both important financial measures, but they highlight different aspects of a company’s financial health.

- Gross income – Also called gross profit, this is the total revenue a company earns after subtracting the cost of goods sold (COGS) but before deducting other expenses like salaries, taxes, and overhead. It reflects how efficiently a company manages production and pricing.

- Net income – Known as “the bottom line,” this is the amount left after all expenses, including operational costs, interest payments, and taxes, are deducted from gross income. It provides a complete picture of overall profitability. A high net income suggests strong cost management across all areas of the business.

Both figures are useful but serve different purposes. Gross income shows how well a company generates profit from direct sales before factoring in administrative costs. Net income gives a broader view by accounting for all expenses.

Understanding the difference between these two metrics helps in evaluating a company’s financial performance. But how are they calculated, and what are common mistakes businesses make when interpreting them?

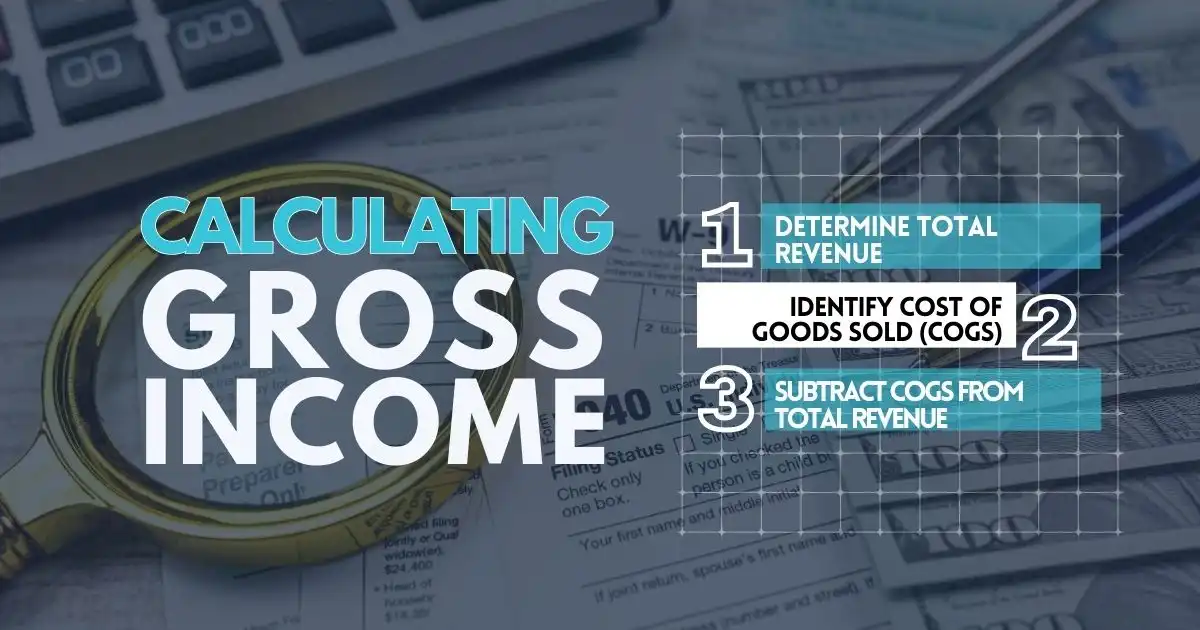

Calculating Gross Income

Gross income is an important indicator of how efficiently a company generates profit from its core operations before factoring in additional expenses. It is calculated using the following gross income formula:

Gross Income = Total Revenue – COGS

Step-by-Step Process to Calculate Gross Income

Step 1. Determine Total Revenue

Total revenue represents all the income generated from business activities before any deductions. This includes:

- Sales revenue – The total amount earned from selling products or services.

- Interest income – Earnings from interest on investments, bank accounts, or loans.

- Rental income – Any money received from renting out business-owned property.

- Other business earnings – Any additional sources of income, such as licensing fees or royalties.

To ensure accuracy, businesses should account for all revenue streams while adjusting for refunds, discounts, and product returns.

Step. Identify Cost of Goods Sold (COGS)

COGS includes all direct costs associated with producing goods or services. It typically includes:

- Raw materials – The cost of components or ingredients needed for production.

- Direct labor – Wages paid to employees involved in manufacturing.

- Manufacturing costs – Expenses for factory operations, equipment maintenance, and utilities directly related to production.

COGS does not include indirect expenses such as office rent, marketing, or administrative costs.

Step 3. Subtract COGS from Total Revenue

Once total revenue and COGS are determined, subtracting COGS from total revenue gives the gross income or gross profit.

Example Calculation:

A company sells 10,000 sensors at $50 per unit. The cost to produce each sensor is $5.

- Total Revenue = 10,000 × $50 = $500,000

- COGS = 10,000 × $5 = $50,000

- Gross Income = $500,000 – $50,000 = $450,000

Gross income provides a snapshot of profitability from primary business operations before considering other expenses.

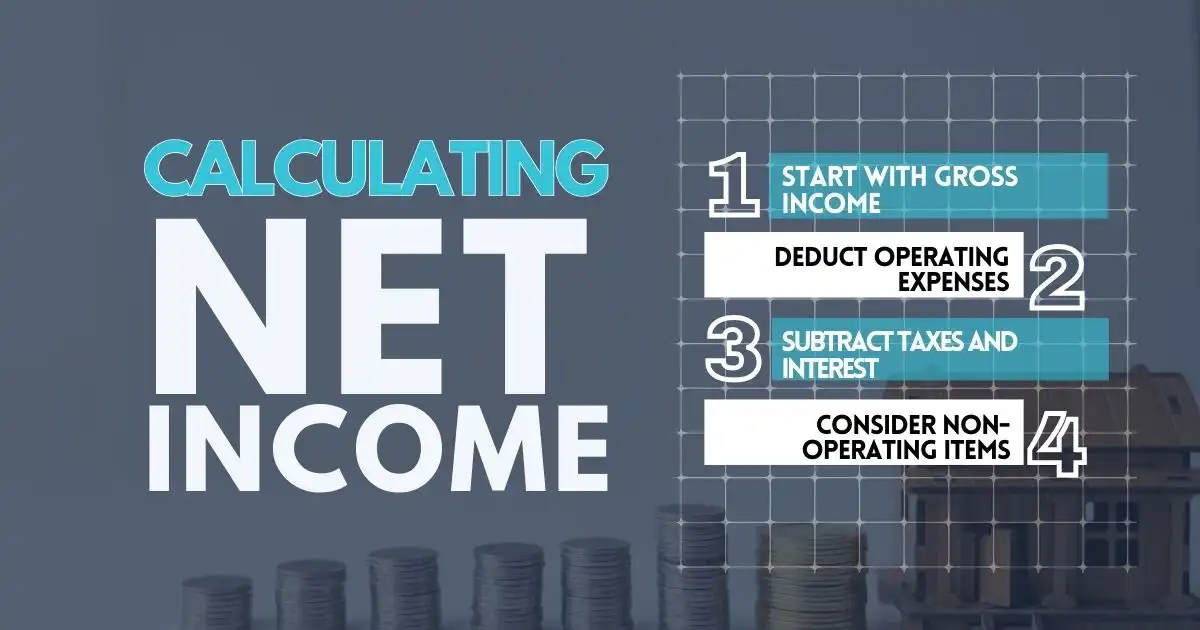

Calculating Net Income

Net income is the final profit after deducting all expenses, including operating costs, taxes, and interest. It is an important measure of a company’s overall financial health.

Formula:

Net Income = Total Revenue – Total Expenses

Step-by-Step Process to Calculate Net Income

Step 1. Start with Gross Income

Begin with the gross income calculation from the previous steps. Gross income represents revenue after subtracting the direct costs of production but before deducting other business expenses.

Step 2. Deduct Operating Expenses

Operating expenses cover the costs of running the business, excluding production costs. These may include:

- Salaries and wages – Payments to employees, excluding direct production labor.

- Rent and utilities – Costs for office space, warehouses, electricity, and internet.

- Marketing and advertising – Expenses for promoting products and services.

- Research and development (R&D) – Investments in new product development and innovation.

- Office supplies and software – Business-related purchases like computers, software, and furniture.

These expenses must be subtracted from gross income to determine operating profit or EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Step 3. Subtract Taxes and Interest

After calculating the operating profit, the next step is to deduct:

- Interest on loans – Payments for borrowed funds used to finance business operations.

- Taxes – Corporate taxes imposed by the government, including state and federal taxes.

Once these deductions are applied, the remaining amount is the company’s pre-tax income.

Step 4. Consider Non-Operating Items

Some businesses may have additional gains or losses that are not directly related to their core operations. These include:

- Investment income – Earnings from stocks, bonds, or other financial instruments.

- Asset sales – Profits or losses from selling business-owned assets, such as buildings or equipment.

- Legal settlements – Compensation received or paid due to lawsuits.

These amounts should be added or subtracted accordingly to get the final net income.

Example Calculation:

Using the previous example where gross income is $450,000, assume the following additional costs:

- Operating Expenses = $382,500 (85% of revenue)

- $450,000 – $382,500 = $67,500 (EBITDA)

- Taxes and Interest = $22,500 (5% of revenue)

- $67,500 – $22,500 = $45,000 Net Income

This means the company has $45,000 left as a final profit after covering all expenses.

Net income provides a clear picture of a company’s profitability after all financial obligations are met. But how do gross and net income differ when analyzing financial performance?

Use in Financial Analysis and Decision-Making

Calculating gross and net revenue helps finance leaders identify important factors affecting profitability, such as:

- Raw material costs

- Labor expenses

- Overhead costs

- Equipment maintenance and replacement

- Pricing strategies

- Production efficiency

- Supplier relationships

By analyzing these expenses, businesses can improve profit margins and increase net income. Understanding cost structures allows finance leaders to develop strategies for managing and reducing expenses, leading to higher profitability.

For example, reviewing raw material costs may highlight opportunities for bulk purchasing or negotiating better supplier rates. Analyzing labor costs can reveal areas for efficiency improvements or outsourcing.

Evaluating overhead expenses might uncover potential savings in rent or utilities. A thorough review of costs and production processes can lead to significant savings, helping to maximize revenue.

The Money You Keep Matters More

It’s not just about what you earn—it’s about what you keep. A flashy paycheck or impressive revenue means nothing if expenses eat it all up. Think of gross income as the big fish you catch, but net income is what’s left after gutting, cleaning, and cooking. That’s the meal that truly feeds you.

Many businesses and individuals focus only on gross income, chasing higher numbers while ignoring what’s slipping through the cracks. But a high income with poor financial management is like carrying water in a leaky bucket. Want to build wealth? Focus on the bottom line. Cut waste, track expenses, and make smarter decisions.

Your financial success isn’t just about making money—it’s about managing it wisely. The sooner you start thinking this way, the sooner you take control of your financial future. So, are you tracking the right numbers?

FAQs

What is the difference between gross income and net income?

The difference between gross income and net income can best be described as the deductions applied. Gross income is the total revenue earned before any expenses, while net income is what remains after subtracting taxes, operating costs, and other deductions. Net income gives a more accurate picture of actual earnings.

Is net income and gross profit the same?

No, net income and gross profit are not the same. Gross profit is the revenue left after subtracting the cost of goods sold (COGS), but before deducting operating expenses, taxes, and interest. Net income accounts for all these deductions, making it the final profit a business or individual keeps.

Which of the following is true about gross income and net income?

- Gross income is calculated before deducting expenses.

- Net income is the actual profit after all deductions.

- Businesses use net income to assess overall profitability.

- Gross income helps determine a company’s revenue-generating efficiency.

Why do you think it is important to use net income, not gross income, when creating a budget?

Net income is what you have available to spend after taxes and expenses. Using gross income in a budget can create unrealistic financial plans, leading to overspending. A budget based on net income ensures better financial management and prevents unnecessary debt.