We live in a world full of temptations, where developing unhealthy spending habits is easier than ever. Advertisements are everywhere, online shopping is just a click away, and credit cards make it simple to spend money we don’t necessarily have. This environment can lead to impulsive purchases and financial stress.

Dave Ramsey emphasizes the proactive nature of budgeting.“By planning your expenditures in advance, you can gain control over your finances rather than feeling surprised or stressed by your spending habits.”

Taking care of your money is important for your financial health. But there isn’t just one way to make a budget that fits everyone. You need to find a way that works for you. These budgeting apps can help you do just that.

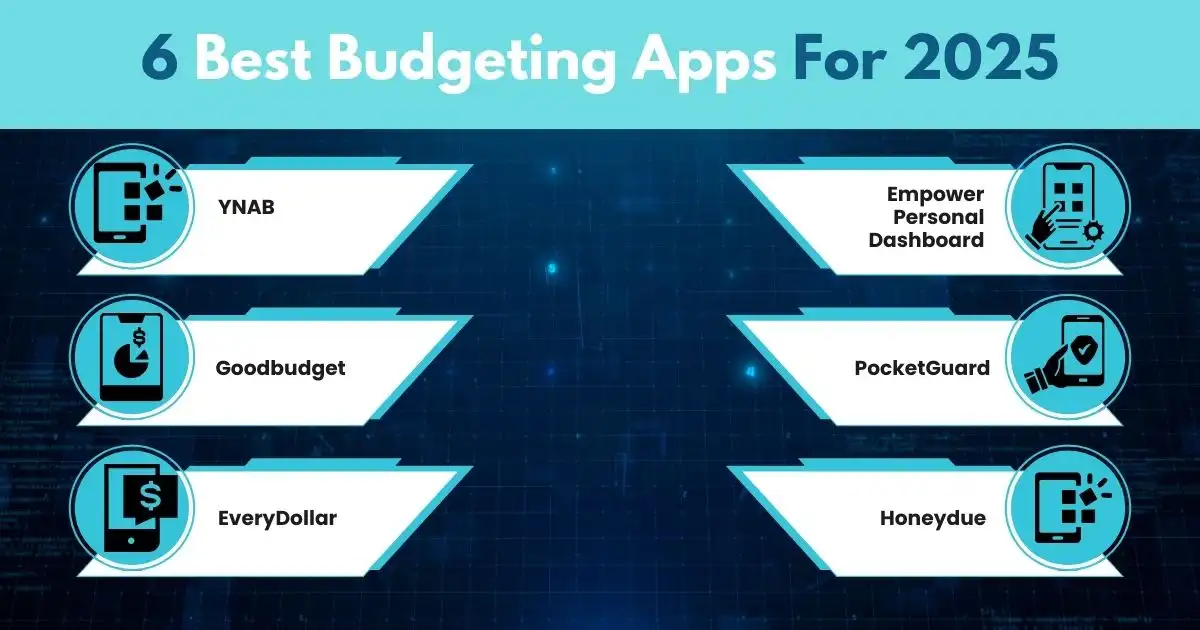

6 Best Budgeting Apps For 2025

The best budgeting apps for 2025, like Mint, YNAB, PocketGuard, GoodBudget, and EveryDollar, help track spending, set savings goals, and manage finances easily.

1.YNAB

This app helps you plan for your finances instead of just tracking past spending. It follows the zero-based budgeting system, where you assign every dollar you earn to different categories like spending, savings, and debt.

This makes you more intentional with your money. YNAB offers lots of educational resources to help you learn how to budget and use the app effectively. You can link your checking, savings, credit cards, and loans to YNAB, and it works on various devices like phones, desktops, iPads, and even Alexa.

YNAB requires commitment and active involvement in budgeting. It’s best for people who want to be hands-on with their money planning. Also, it’s pricier compared to other apps.

Cost: $14.99 per month or $99 per year, with a 34-day free trial available. College students can use it free for a year.

2. Goodbudget

Goodbudget focuses on planning your finances rather than just tracking spending. It uses the envelope budgeting method, where you allocate money to different spending categories each month.

You manually input account balances, cash, debts, and income, then distribute money to envelopes. Accessible on both phone and web, the app provides helpful articles and videos.

Goodbudget offers a free version with limitations and a paid version, Goodbudget Plus, with more features.

Since it doesn’t sync with bank accounts, you need to enter every expense manually, which may not suit everyone.

Cost: Goodbudget is free, while Goodbudget Plus costs $10 per month or $80 per year.

3. EveryDollar

This app offers a simple zero-based budgeting framework that’s easier to manage than YNAB. Let’s start with EveryDollar’s free version. You manually enter your income and expenses, categorize items, and set bill reminders.

The paid version adds bank syncing, automatic transaction tracking, custom reports, and savings/investment account connections.

The free version is basic, and the paid one is pricey. Also, the app lacks pre-trial resources, and its Google Play rating has dropped.

Cost: Free basic version, 14-day free trial for premium. Afterward, $79.99/year or $17.99/month.

4. Empower Personal Dashboard

Empower Personal Dashboard, previously Personal Capital, is mainly for investing but its free app also helps budgeters track spending. You can connect checking, savings, credit cards, IRAs, 401(k)s, mortgages, and loans.

It shows spending by category and lets you customize them. It also tracks net worth and portfolios on both phones and desktops.

If you want detailed spending and saving plans, you might prefer another app. Empower focuses more on investing than budgeting, even though it offers some budgeting tools.

Cost: Free

5.PocketGuard

PocketGuard keeps things simple with its features. You can link your bank accounts, credit cards, loans, and investments to track bills and see how much you have left to spend after covering necessities, bills, and goals.

It also tracks your net worth and lets you choose if to link accounts or track finances manually. The paid version, PocketGuard Plus, offers a debt payoff plan, transaction exports, and more.

While it’s great for a hands-off experience, it might not be ideal if you prefer more control over your finances. Plus, recent Google Play reviews have decreased from 4.4 to 3.6.

Cost: PocketGuard is free, while PocketGuard Plus costs $12.99 per month or $74.99 per year.

6. Honeydue

Honeydue lets you and your partner see your finances together in one app. You can sync bank accounts, credit cards, loans, and investments, choosing how much you share. It categorizes expenses automatically and allows custom categories.

You can set monthly limits and get alerts when nearing them. It also reminds you of upcoming bills and allows chatting with emojis.

Honeydue focuses more on past transactions than on planning future expenses. Its Google Play ratings dropped from 4.1 to 3.4.

Cost: Free

Budget Smarter, Live Better

Money slips through our fingers faster than we realize. A quick coffee here, an online sale there, and suddenly, our budget is a mess. But it doesn’t have to be this way.

Think of budgeting like giving every dollar a job—no more wasted cash, no more regrets. The budgeting app best suited to your lifestyle can help you break free from financial stress. YNAB gives you full control, PocketGuard keeps it simple, and Honeydue helps couples manage money together.

Excuses won’t pay your bills, and hope won’t grow your savings. Action changes everything. Pick the budgeting app best for your needs, start today, and watch how small steps turn into big financial wins. Your future self will thank you.

FAQs

What is the best budget app?

The best budget app depends on your needs, but the best app to track spending and budget should offer expense tracking, savings goals, and bill reminders to help you stay on top of your finances. It should also sync with your bank accounts and provide real-time insights to help you make smarter financial decisions.

What is the best and easiest budget app to use?

The best and easiest budget app should have a simple interface, automated expense tracking, and clear budget categories, making it easy for users to manage their money without hassle. Look for apps with intuitive dashboards and features like bill reminders and spending alerts for seamless budgeting.

How to make a budget app?

To make a budget app, plan essential features like expense tracking and savings goals, design a user-friendly interface for easy navigation, and develop the app using coding platforms or app builders. Testing the app for accuracy and security is also important to ensure users can manage their finances safely and efficiently.

How to make money envelopes for budgeting?

To make money envelopes, label each one with a specific spending category, allocate the necessary cash for that purpose, and use only the amount inside to control expenses effectively. This method helps you visually track your spending and avoid overspending in different budget areas.