Technology has seamlessly woven into every facet of our existence – personal and professional – and we can’t imagine life without it.

As technology evolves, financial planning and analysis (FP&A) professionals are becoming more influential in decisions across various departments like HR, sales, and marketing. They are using technology more and more to help with their daily tasks and now need to understand both the numbers and the decisions based on them.

The demand for accurate, frequent, and integrated business planning has increased due to geopolitical tensions, global inflation, and supply chain disruptions. Given these challenges, eight key trends in FP&A technology have emerged.

Importance of FP&A

Finance is important in every part of a company’s operations. Furthermore, it greatly affects a company’s culture, growth, and future. FP&A understands the company’s short-term and long-term financial needs. They do many tasks, from regular activities like financial reporting and managing cash flow to strategic planning like budgeting and forecasting.

While other finance roles focus on keeping records and following rules, FP&A looks ahead, analyzing financial data to give valuable insights to executives and the whole company. FP&A’s success comes from its ability to provide strategic advice based on financial and operational analysis.

Top 8 FP&A Trends in 2024

This year, eight key trends are emerging, revolutionizing how companies approach financial planning and analysis. These trends are not just enhancing the efficiency and accuracy of FP&A processes but are also enabling businesses to become more agile and proactive in their strategic planning.

Here are the top 8 FP&A trends that are shaping the future of financial management in 2024.

1. Flexibility Beats Stability

Embracing change is now more important than staying the same. Instead of seeking comfort in stability, FP&A teams should focus on becoming adaptable in unpredictable situations. Technology plays an important role in helping teams adapt quickly during uncertain times.

Organizations that invest in digital transformation and train their employees to embrace new technologies are better equipped to make the most out of their tech investments. Moreover, even in uncertain times, organizations can become more adaptable by regularly predicting financial outcomes, considering different scenarios, using external data sources, and fostering strong collaboration between different departments.

2. Better Planning Boosts Teamwork

Integrated Business Planning (IBP) is an advanced way of planning that uses technology and teamwork. It combines information from various parts of a company, making it easier for people and technology to work together. When the economy changes suddenly due to global issues, companies need to adapt quickly. IBP helps by allowing teams to work together more effectively and make reliable predictions.

A survey conducted in 2023 by the Association for Financial Professionals (AFP) found that 82% of businesses report better collaboration between departments due to IBP.

3. Simple Planning Boosts Confidence

To build strong and flexible organizations, leaders need clear plans for making quick and accurate decisions. Confidence comes not just from having data but from understanding it. A straightforward plan, no matter the amount of data, encourages a culture of decisive and confident decision-making.

4. Finance Companies Will Get More AI Help

Artificial intelligence (AI) is already a big part of our daily lives. It filters spam emails, customizes social media posts, and improves our online shopping experiences on sites like Amazon. According to a 2023 survey by IBM, over 60% of business owners think AI will boost productivity. Specifically, 64% said AI would enhance business productivity, and 42% believe it will streamline job processes.

AI technology is now reliable and widely used, especially in finance. There are many FP&A AI tools available that help finance teams in various ways. AI allows CFOs to give valuable insights and data that business leaders and investors need. As businesses seek more data-driven decisions, investing in AI can boost investor confidence, improve decision-making, and enhance forecast accuracy, which is important during uncertain times.

5. Technology Attracts Talent

In a recent discussion, one out of five CFOs focused on keeping good employees and finding new talent. In a competitive job market, technology can help by attracting top talent and keeping current employees happy. A LinkedIn study showed that employees value a balance between work and personal life and opportunities to learn new skills.

Companies can keep and attract talented people by using technology to simplify tasks and support professional growth. However, many finance professionals want to succeed and become leaders in their organizations. Providing them with advanced planning tools helps them perform their best.

6. FP&A Professionals as Key Business Partners

For an organization to be strong, it must change and adapt. FP&A professionals are important in helping organizations become more flexible. During economic uncertainty, FP&A professionals should closely collaborate with the organization.

They should act as advisors and work together to plan for an unpredictable future. By shifting from isolated planning to teamwork, teams can achieve greater satisfaction and success.

7. Geopolitical Factors Still Affect Inputs and Planning

A 2023 survey by Deloitte showed that 74% of global companies faced supply chain problems because of geopolitical tensions. Additionally, 58% of businesses said these risks made them change their strategic planning and investment decisions.

Different countries’ policies and how they handle political uncertainty can really impact a company, depending on where it is located and where it does business. To prepare for these issues, companies can plan for different scenarios. Additionally, this helps them be ready for problems and changes caused by politics and allows them to make better economic predictions.

8. Real-time Data Boosts Fast Decision-Making in FP&A

Businesses use real-time data integration to stay flexible in uncertain times. This means FP&A teams can instantly access live data from different sources, allowing them to make fast, informed decisions.

Real-time data integration is key because it helps businesses respond quickly to market changes, world events, and supply chain problems. Furthermore, FP&A professionals can create flexible financial models, analyze various scenarios, and adjust forecasts on the spot. This not only makes predictions more accurate but also helps businesses avoid risks and seize new opportunities.

Common Challenges in Financial Planning and Analysis

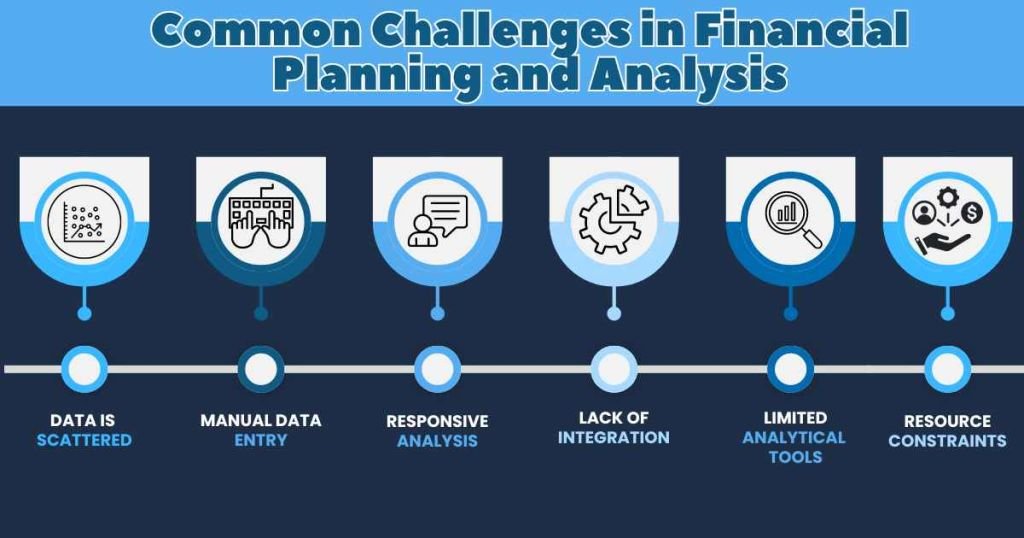

The main issue in financial planning and analysis is that 80% of your time is spent on boring tasks, leaving only 20% for strategic work. Traditional FP&A teams struggle to be strategic due to these challenges:

- Data is Scattered: Business data is scattered across different tools and systems, making it hard to access all the necessary information. This limited view hampers strategic planning.

- Manual Data Entry: Connecting different business systems is difficult, so FP&A teams spend most of their time collecting and reconciling data manually. This takes time and can lead to errors.

- Responsive Analysis: Because of data isolation and manual processes, FP&A teams can’t provide timely answers to strategic questions. By the time they gather and update data, the information is outdated, stopping them from being proactive

- Lack of Integration: Inconsistent integration between different departments and systems can lead to misaligned goals and inefficient planning.

- Limited Analytical Tools: Many FP&A teams lack advanced analytical tools, restricting their ability to perform in-depth analysis and predictive modeling.

- Resource Constraints: Insufficient resources, including both technology and skilled personnel, can hamper the effectiveness of FP&A activities.

These challenges prevent FP&A teams from becoming proactive, agile, and strategic partners in decision-making.

Final Thoughts

Financial planning and analysis teams are gaining more importance in businesses. Moreover, they are now key supporters of integrated business planning. It’s important for businesses to plan accurately and regularly, considering global challenges like geopolitical tensions, inflation, and supply chain issues. In this uncertain economic climate, organizations that use digital planning tools can adapt faster and make their planning processes simpler.

FAQs

What are the key FP&A trends in 2024?

In 2023, key FP&A trends include advanced data analytics, increased automation, real-time financial reporting, enhanced scenario planning, greater focus on ESG factors, integrated business planning, AI-driven insights, and improved collaboration tools.

How is automation impacting FP&A in 2024?

Automation in FP&A is streamlining repetitive tasks, reducing errors, and allowing finance teams to focus on strategic decision-making and analysis, thereby increasing overall efficiency and productivity.

Why is real-time financial reporting important in 2024?

Real-time financial reporting provides up-to-date insights, enabling quicker and more informed decision-making, which is important in today’s fast-paced business environment where timely responses can create a competitive advantage.

How are ESG factors influencing FP&A trends in 2024?

ESG factors are becoming integral to FP&A as companies increasingly consider environmental, social, and governance metrics in their financial planning and analysis to meet stakeholder expectations and regulatory requirements.