When it comes to modern financial planning, businesses today expect more than just spreadsheets and reports. They want real-time insights, automation, and powerful tools that support smarter decisions. And behind those tools? Finance leaders—especially CFOs—are stepping into roles that go far beyond crunching numbers.

These leaders don’t just manage budgets—they shape the company’s future. From managing uncertainty to driving growth strategies, CFOs rely on sophisticated software to make it happen. That’s where platforms like Vena and Planful come in.

But what makes these tools different? Which one gives CFOs the edge in today’s fast-paced business world? And how do they stack up when it comes to ease of use, speed, and value?

What Are Vena and Planful?

Vena is a cloud-based planning tool that works through Microsoft Excel, making it a natural fit for teams already familiar with spreadsheets. It enhances Excel with features for budgeting, forecasting, and reporting, offering strong reporting capabilities and smooth adoption for finance teams.

Planful, on the other hand, is also cloud-based but doesn’t rely on Excel. It has its own modern interface built for speed, automation, and team collaboration. With easy-to-use tools and strong cross-department features, Planful suits companies seeking a more streamlined planning experience.

How Easy It Is to Use Vena and Planful

Vena provides a familiar environment for teams that are used to working with spreadsheets, particularly those with experience in Excel. This makes it approachable for many organizations starting their planning and reporting journey.

However, as processes become more detailed and data sets grow, navigating complex templates may require additional time and support.

In contrast, Planful offers a more modern interface that is designed for simplicity and speed. While it removes the need for traditional spreadsheets, individuals who are used to more manual, spreadsheet-heavy workflows might need an adjustment period to become fully comfortable with the system.

Collaboration and Teamwork Across Vena and Planful

Vena is primarily tailored for finance teams, offering features that support collaboration within financial planning processes. While it does allow for shared input and workflow management, its focus remains largely within the finance function.

Planful, by contrast, is designed to support broader organizational collaboration. It encourages input from multiple departments—including marketing, sales, and operations—allowing various teams to contribute to planning and reporting in a more unified and transparent way.

- Vena supports finance-driven collaboration.

- Planful promotes cross-functional teamwork across the entire organization.

Automation and Speed in Vena and Planful

Vena provides a degree of automation, particularly in areas such as data integration and the generation of financial reports. However, its foundation in Excel places certain limitations on the extent and flexibility of these capabilities.

Planful, by comparison, is developed with automation as a central feature. Its architecture enables seamless integration with multiple systems, facilitates real-time data updates, and enhances the speed and accuracy of decision-making across various departments.

Reporting and Insights

Accurate reporting plays a vital role in business planning and performance tracking. Both Vena and Planful offer strong reporting tools, but their approaches differ.

Vena relies on Excel for advanced, customizable reports—ideal for finance teams comfortable with spreadsheets. Planful focuses on real-time dashboards and interactive visuals, making reports easier to understand and share across departments.

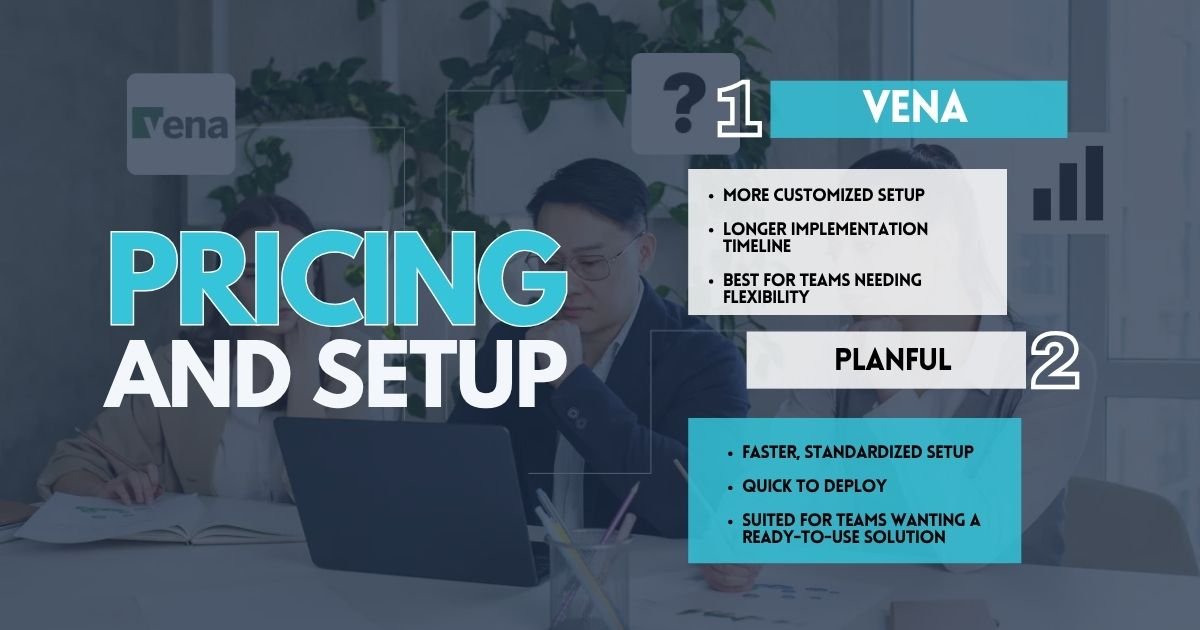

Pricing and Setup

For any financial planning software investment, setup time and pricing depend heavily on company scale and strategic requirements. The comparison below highlights the typical differences between Vena and Planful in these areas.

Vena

- More customized setup

- Longer implementation timeline

- Best for teams needing flexibility

Planful

- Faster, standardized setup

- Quick to deploy

- Suited for teams wanting a ready-to-use solution

The Value Behind the Choice

Planning software may not make headlines, but it quietly drives some of the most important decisions in a company. Tools like Vena and Planful don’t just help balance spreadsheets—they guide financial strategy, shape business growth, and influence how teams collaborate and respond to change.

In a world where timing, data, and agility can make or break success, the right platform becomes more than just software—it becomes a strategic advantage.

So, which one truly delivers that edge? Vena leans into familiarity and depth, offering finance teams precision and control. Planful moves with speed and breadth, empowering companies to act quickly and together. The better choice doesn’t always come down to features—it comes down to what kind of future your team is building.

In the end, it’s not just about planning—it’s about what your plan makes possible.

FAQs

What is financial planning software and why is it important?

Financial planning software helps businesses manage budgets, forecasts, and financial strategies. It streamlines processes and improves accuracy in decision-making.

How do business budgeting tools support growing companies?

Business budgeting tools provide structure and visibility, allowing companies to plan expenses, track performance, and adjust quickly as needs change.

What is corporate performance management in finance?

Corporate performance management (CPM) refers to the processes and tools used to monitor, manage, and improve business performance through planning, reporting, and analysis.

Why choose Excel-based planning tools over modern FP&A solutions?

Excel-based planning tools offer familiarity and flexibility, while modern FP&A solutions provide automation, scalability, and better collaboration across teams.