Forecasting a company’s future can feel like guesswork, especially when everything’s changing fast. You’ve got numbers, reports, and goals… but no clear way to connect them all. Sound familiar?

That’s where many people get stuck. They build models that don’t align or miss the big picture entirely.

But what if there was a simple, structured way to tie everything together?

Something that helps you see how one decision affects the rest, without relying on scattered spreadsheets.

What Is a Three-Statement Model?

A three-statement financial model connects a company’s income statement, balance sheet, and cash flow statement. It’s the basic tool used to forecast how a business might perform. This model is also the starting point for building more advanced financial models like mergers, discounted cash flow (DCF), and leveraged buyout (LBO) models.

Why Does It Matters?

Accounting shows us how a company did in the past. But a three-statement model lets us use that information to see what might happen next. It helps predict how a business could perform in different situations.

Finance professionals—like FP&A analysts, bankers, investors, and equity researchers—use these models to understand a company’s financial health and decision-making. A well-made three-statement model shows how daily business activities affect profits, cash flow, and overall performance. It’s also useful for financial reporting and helps explain the impact of business choices clearly.

3 Core Parts of a Three-Statement Financial Model

A three-statement financial model links the income statement, balance sheet, and cash flow statement. These models are helpful because they let you change one part and see how it affects the rest. Before you start building the model, you’ll need to collect key financial data.

At a basic level, you should gather the company’s most recent SEC filings, equity research reports, and possibly press releases. For private companies, this information may be harder to find. Financial reporting rules also vary in different countries.

The three main parts of a three-statement model are explained below. Together, they show how different financial line items are connected.

1. Income Statement

The income statement shows how profitable a business is. It’s usually laid out with at least three years of historical data. This helps calculate past performance and trends that support future forecasts.

The first step in building a three-statement model is entering historical income statement data. You can do this manually using a press release or 10-K, or use an Excel plugin to pull in the data automatically.

Financial forecasting usually begins with revenue and continues with expense planning. This leads to a forecast of net income and earnings per share. Income statements usually cover a certain period, such as a quarter or a year.

2. Balance Sheet

While the income statement covers a period, the balance sheet shows the company’s financial position at a specific point in time.

The balance sheet lists what the company owns (assets), how those assets are funded (liabilities), and shareholders’ equity. You’ll enter historical balance sheet data the same way as the income statement—either manually or through a plugin.

Revenue assumptions drive the operating forecasts, which then affect the balance sheet. These include capital expenses, working capital, and other items. Think of the income statement as the driver and the balance sheet as the result.

Excel is commonly used to create these models, but more advanced tools can improve accuracy and forecasting.

3. Cash Flow Statement

The last important part of the model is the cash flow statement. You don’t need to input historical data here first, since it’s based on changes in the balance sheet.

Each line in the cash flow statement comes from elsewhere in the model. If it’s built properly, the balance sheet will balance automatically.

To forecast the cash flow, you calculate the changes between current and future balance sheet items. The final cash balance in the cash flow statement should match the forecasted cash balance on the balance sheet.

8 Steps to Create a 3 Statement Financial Model

Building a 3 statement financial model involves connecting the income statement, balance sheet, and cash flow statement into one integrated file. This allows you to see how changes in one area affect the others, helping you make smarter business decisions. Below is a detailed guide to help you build a reliable model step by step.

Step 1 – Enter Historical Financial Data

Start with collecting the company’s financial data for at least the past 3 years. You can get this information from sources like annual reports (10-K), quarterly reports (10-Q), or press releases.

Enter the data into a well-organized Excel spreadsheet. Focus on key figures such as revenue, cost of goods sold (COGS), operating expenses, assets, liabilities, and equity. This historical data is essential because it shows how the business has performed and sets the foundation for future forecasts.

Step 2 – Set Important Forecast Assumptions

Next, define the main assumptions that will shape your model. These are estimates about what might happen in the future. Some examples include:

- Annual revenue growth rates

- Expected changes in expenses (e.g., salaries, rent, marketing)

- Profit margins

- Inflation or interest rates

- Capital expenditure plans

- Tax rate assumptions

These assumptions should be realistic and based on research, management guidance, or industry benchmarks. Documenting these will make it easier to adjust your model later if needed.

Step 3 – Forecast the Income Statement

Now, use the assumptions from Step 2 to project the income statement. The goal is to estimate the company’s future profitability. Forecast each line item, including:

- Revenue (based on growth rate)

- Cost of Goods Sold (COGS)

- Gross Profit (Revenue – COGS)

- Operating Expenses (like salaries, rent, and marketing)

- Operating Income (EBIT)

- Interest and tax expenses

- Net Income (final profit after all costs)

This gives you an idea of how profitable the company may be in the coming months or years.

Step 4 – Forecast Capital Investments and Assets

Predict how much the company will spend on new equipment, buildings, or other long-term assets—also known as capital expenditures (CapEx). These investments affect both the balance sheet (under assets) and the income statement (through depreciation and amortization).

Depreciation and amortization should be forecasted based on the company’s past methods and expected asset usage. These non-cash expenses help match the cost of assets to the periods they benefit.

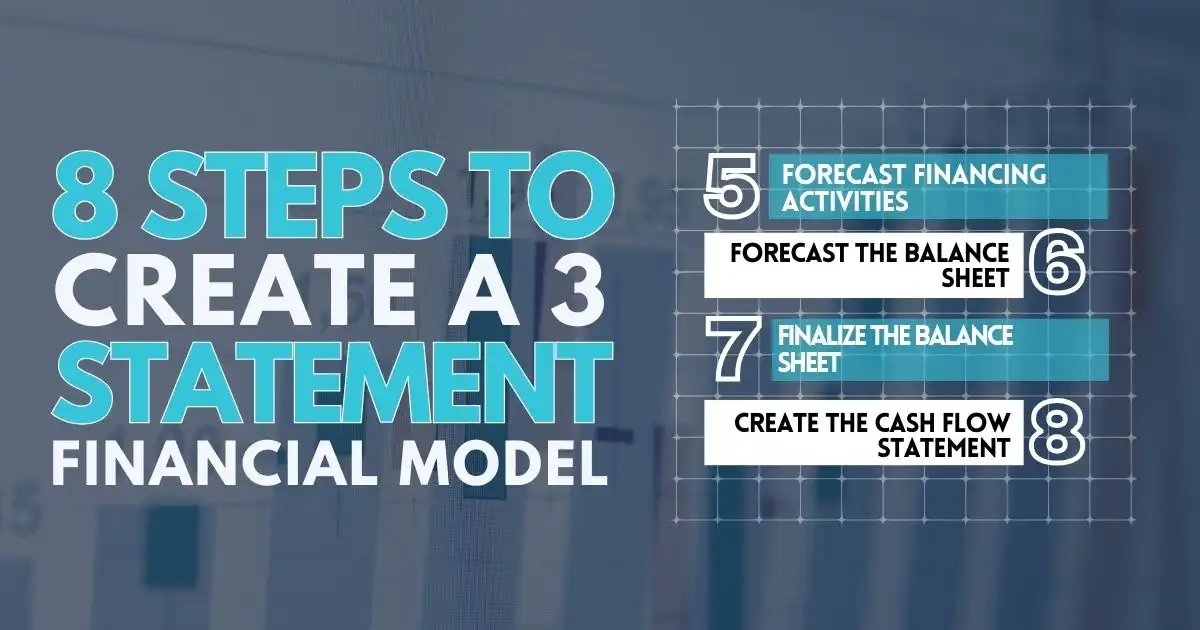

Step 5 – Forecast Financing Activities

Plan for changes in financing. This includes activities like:

- Issuing or repaying loans or bonds

- Issuing or buying back shares

- Paying dividends

- Interest payments on existing debt

These items affect both the cash flow statement and the balance sheet. Accurate forecasting here is important to understand how the company plans to fund its operations and growth.

Step 6 – Forecast the Balance Sheet

Use the earlier forecasts to predict future values for key balance sheet items, including:

- Current and fixed assets

- Liabilities such as accounts payable, long-term debt, and taxes payable

- Shareholders’ equity

Make sure all relationships between the statements are logical. For example, net income from the income statement flows into retained earnings on the balance sheet. Working capital items (like accounts receivable and payable) should also reflect how the business operates.

Step 7 – Finalize the Balance Sheet

Now, ensure the balance sheet follows the basic accounting rule:

Assets = Liabilities + Shareholders’ Equity

If the two sides don’t match, check your calculations and links across the model. Any mismatches may indicate errors in your assumptions or formulas. A balanced sheet shows the model is built correctly.

Step 8 – Create the Cash Flow Statement

The last step is building the cash flow statement. This report shows how money moves in and out of the business. It is divided into three parts:

- Cash from Operating Activities – Uses net income and adjusts for non-cash items like depreciation and changes in working capital.

- Cash from Investing Activities – Includes capital expenditures, investments, or asset sales.

- Cash from Financing Activities – Shows inflows and outflows from debt, equity, and dividends.

Rather than entering historical data manually, you can create the forecasted cash flow by referencing other parts of your model. A well-linked cash flow statement ensures the ending cash balance matches the cash figure in the balance sheet.

By following these steps, you can create a complete 3 statement financial model that supports smart business planning and decision-making.

Important Points to Consider Before Building a Financial Model

Before starting your 3 statement financial model in Excel, keep these key points in mind to ensure accuracy and reliability:

1. Stay Objective and Avoid Bias – Personal opinions or overly optimistic views can lead to unrealistic forecasts. Try to keep your assumptions neutral and data-driven. This helps you avoid common behavioral biases that can distort your model’s accuracy.

2. Build Strong, Realistic Assumptions – Your model depends on assumptions about things like revenue growth, expenses, and market trends. These assumptions should be reasonable and based on historical performance and sound forecasts. Well-grounded assumptions make your model more reliable.

3. Watch for Errors as You Learn – Financial modeling takes practice, and making mistakes is part of the process, especially when you’re just starting. Review your formulas carefully, test your logic, and consider learning through a financial modeling course to sharpen your skills and reduce errors.

Think Beyond the Numbers

Most people treat financial models like static spreadsheets—fill in some cells, and that’s it. But that mindset could cost you big. A well-built 3 statement model isn’t just for finance pros or big-shot investors. It’s a map. And if you’re running a business or making decisions, flying without it is like driving blindfolded.

Every dollar you plan to spend, every risk you take, and every growth goal you set—weaves into this one tool. It’s more than math. It’s how you connect the dots and spot the trouble before it hits. Don’t wait for a cash flow crunch or a missed forecast to realize the value.

Roll up your sleeves. Build your model. Test your ideas.

You don’t need to be a genius to do this, but you do need to start. Because when money talks, the model shows you what it’s really saying.

FAQs

How do you model an income statement in a three statement model?

To model an income statement, start by projecting revenue and expenses based on historical data and assumptions. This forms the top of your three statement model, which then links to the balance sheet and cash flow statement.

How does a three statement model work in financial modeling?

A three statement model is a financial tool that integrates a company’s income statement, balance sheet, and cash flow statement into a single, connected Excel file. It’s commonly used in financial analysis and forecasting.

What is Excel for Finance: Building a Three-Statement Operating Model?

Excel for Finance: Building a Three-Statement Operating Model is a course or training resource that teaches how to create a fully integrated financial model using Excel, combining the income statement, balance sheet, and cash flow statement.

How to build a three statement model from scratch?

To build a three statement model, begin with historical data, project the income statement, link it to the balance sheet, and complete the model with a cash flow statement. Excel is the preferred tool for this due to its flexibility and calculation features.